Express it!

We would like to run a lender that may help make your sense as easy and you can straightforward as it is possible to. You desire a seamless techniques to close promptly as opposed to extreme back and forth. You want a skilled team to help you keep the extremely prominent funding for you. Need an informed words and you will interest rates you can aquire.

With so many banks, borrowing unions, or other loan providers stating that they’re able to help you to get this new home loan you desire and want, just why is americash loans St Ann Highlands it when you are considering rates, borrowing unions get noticed since obtaining best bet?

Really, interest rates are one of the vital issues for the a great home loan, and you may borrowing unions satisfaction themselves with the offering the lower prices you can to their participants. Yet not, this isn’t the only good reason why you can love getting the financing at a credit relationship.

Continue reading to learn about borrowing union mortgage pricing and you can re-finance rates, and exactly why you will find the best options of a card partnership.

The credit Commitment Home loan Techniques

Precisely why you may wish coping with a card commitment so you’re able to safe their home loan starts ahead of a home loan rates is also computed. They commonly begins with the process.

When you’re already a member of a cards union, he has the means to access your financial study, so there was commonly shorter guidance that must definitely be given while in the the program. That it apparently causes a in check and you will speedier approval procedure.

And additionally, the brand new higher-top quality customer care credit unions are recognized for having what you need to make it owing to a period that would be a great section stressful. If you find yourself to order a property can be enjoyable, the process can often be date-sipping and you may courage-wracking, very working with people who make an effort to create while the simple as you are able to to you personally renders that which you better.

A lot more Mortgage Also offers

Borrowing from the bank unions also provide all types of capital about the home loan, such as for instance a house guarantee financing and home collateral collection of credit (HELOC).

You can consider taking out fully either of them alternatives during the same go out since your primary home loan and use the money to make a larger advance payment. Inside doing so, you may want to stop spending month-to-month individual mortgage insurance rates, labeled as PMI.

A cards relationship you have a history with otherwise one that you never, could possibly approve your of these investment alternatives which have the 1st loan instead of wishing up until later later on to do this.

While you might initially get your home loan towards the bank you interest, it doesn’t mean you’re going to be using them each month into longevity of the loan. Many companies one take on your loan very first will actually sell they to a different organization will ultimately. When this occurs, you have got zero control of the fresh new selected organization. It’s just an integral part of the mortgage procedure.

Yet not, should you get your own financial regarding a credit union, he or she is less inclined to sell in order to a third-people. When they’ve the goal of carrying the loan, they can be a lot more flexible when considering borrowers which have a faster than better financial history, including which have increased financial obligation-to-money ratio.

The benefit of Straight down Borrowing Commitment Home loan Rates

The primary reason is the fact credit unions aren’t-for-funds communities. Instead of banking institutions or any other online lenders, the perhaps not-for-profit standing allows them to give straight down rates on the participants. Professionals are also region people, whilst a member, you may have a directly to vote on the what is important for your requirements.

Low-rates of interest usually are a familiar focus around users. A reduced interest regarding even several tenths out-of a beneficial area will save you thousands of bucks along the life of the mortgage.

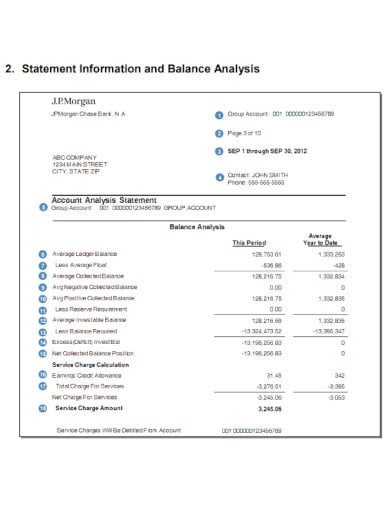

Just to illustrate of difference in rates of interest getting a beneficial $350,000 mortgage with a 30-season repaired-speed mortgage playing with a mortgage calculator.

According to the National Borrowing Union Organization, NCUA, this new national average rates for a cards union financial is step 3.91% inside .

Predicated on this example, an around step 1% difference in the financing connection rate of interest and the lender desire rate lead to spending an extra $20,157 more than 30 years. The latest month-to-month difference is just $28 per month, therefore initial, that will not look like far, however, investing $twenty eight monthly to possess three decades adds up.

Consider what you certainly can do that have a supplementary $20,157 more thirty years. For those who simply invested those funds on your own later years, it may quickly develop into a great deal more.

In addition to preserving thousands of dollars considering desire, you will experience offers that have lower closing costs and charges during the the mortgage processes.

Get the Most readily useful Borrowing Partnership Mortgage Pricing

When protecting resource for your upcoming family, you want a lender with premium support service, knowledgeable professionals, a straightforward loan techniques, and reduced home loan cost. A cards partnership could offer everyone of this plus.

Borrowing from the bank unions satisfaction on their own for the offering the better rates, at Arbor Economic, we have been exactly the same. With these flexible words and you will simple and fast financing pre-acceptance, we require you to receive towards the household you dream about without paying over you need to.