The standard variable OH rate per DLH is $0.80 (calculated previously), and the actual variable overhead for the month was $1,395 for 2,325 actual direct labor hours, giving an actual rate of $0.60. The standard variable overhead rate is typically expressed in terms of the number of machine hours or labor hours depending on whether the production process is predominantly carried out manually or by automation. A company may even use both machine and labor hours as a basis for the standard (budgeted) rate if the use both manual and automated processes in their operations.

Accounting Ratios

- Specifically, fixed overhead variance is defined as the difference between standard cost and fixed overhead allowed for the actual output achieved and the actual fixed overhead cost incurred.

- Variable overhead efficiency variance is one of the two components of total variable overhead variance, the other being variable overhead spending variance.

- In this case, the variance is favorable because the actual costs are lower than the standard costs.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. The controller of a small, closely heldmanufacturing company embezzled close to $1,000,000 over a 3-yearperiod. With annual revenues of $30,000,000 and less than 100employees, the company certainly felt the impact of losing$1,000,000. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Fixed Overhead Variance

Suppose Connie’s Candy budgets capacity of production at 100% and determines expected overhead at this capacity. Connie’s Candy also wants to understand what overhead cost outcomes will be at 90% capacity and 110% capacity. The following information is the flexible budget Connie’s Candy prepared to show expected overhead at each capacity level. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction.

Why You Can Trust Finance Strategists

An adverse variable overhead efficiency variance suggests that more manufacturing hours were expended during the period than the standard hours required for the level of actual production. Therefore, these variances reflect the difference between the standard cost of overheads allowed for the actual output achieved and the actual overhead cost incurred. An overhead cost variance is the difference between how much overhead was applied to the production process and how much actual overhead costs were incurred during the period. In conclusion, the variable overhead variance is an important tool for measuring and controlling indirect costs, and is used to evaluate the efficiency of overhead spending. Consequently by analyzing the variance, management can identify areas for improvement and take steps to reduce the cost of variable overhead, thereby increasing profitability and competitiveness. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction.

Ask Any Financial Question

Figure 8.5 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. The standard overhead rate is calculated by dividing budgeted overhead at a given breakeven point bep definition level of production (known as normal capacity) by the level of activity required for that particular level of production. Variable overhead spending variance is favorable if the actual costs of indirect materials — for example, paint and consumables such as oil and grease—are lower than the standard or budgeted variable overheads.

Often, explanation of this variance will need clarification from the production supervisor. Another variable overhead variance to consider is the variable overhead efficiency variance. Using the flexible budget, we can determine the standard variable cost per unit at each level of production by taking the total expected variable overhead divided by the level of activity, which can still be direct labor hours or machine hours. The variable overhead efficiency variance calculation presentedpreviously shows that 18,900 in actual hours worked is lower thanthe 21,000 budgeted hours.

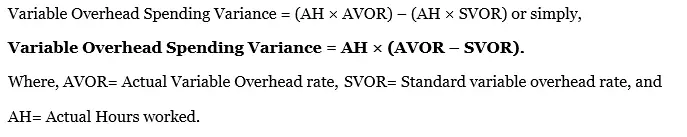

(c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to make production changes. An unfavorable variance may occur if the cost of indirect labor increases, cost controls are ineffective, or there are errors in budgetary planning. Variable Overhead Spending Variance is essentially the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. Using the information given below, compute the fixed overhead cost, expenditure, and volume variances.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.