This is also true for an individual applying for a small business loan or a line of credit. Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes. This means that for every $1 invested into the company by investors, lenders provide $0.5.

Calculate Debt Equity Ratio In Excel

Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop. The cost of debt and a company’s ability to service it can vary with market conditions.

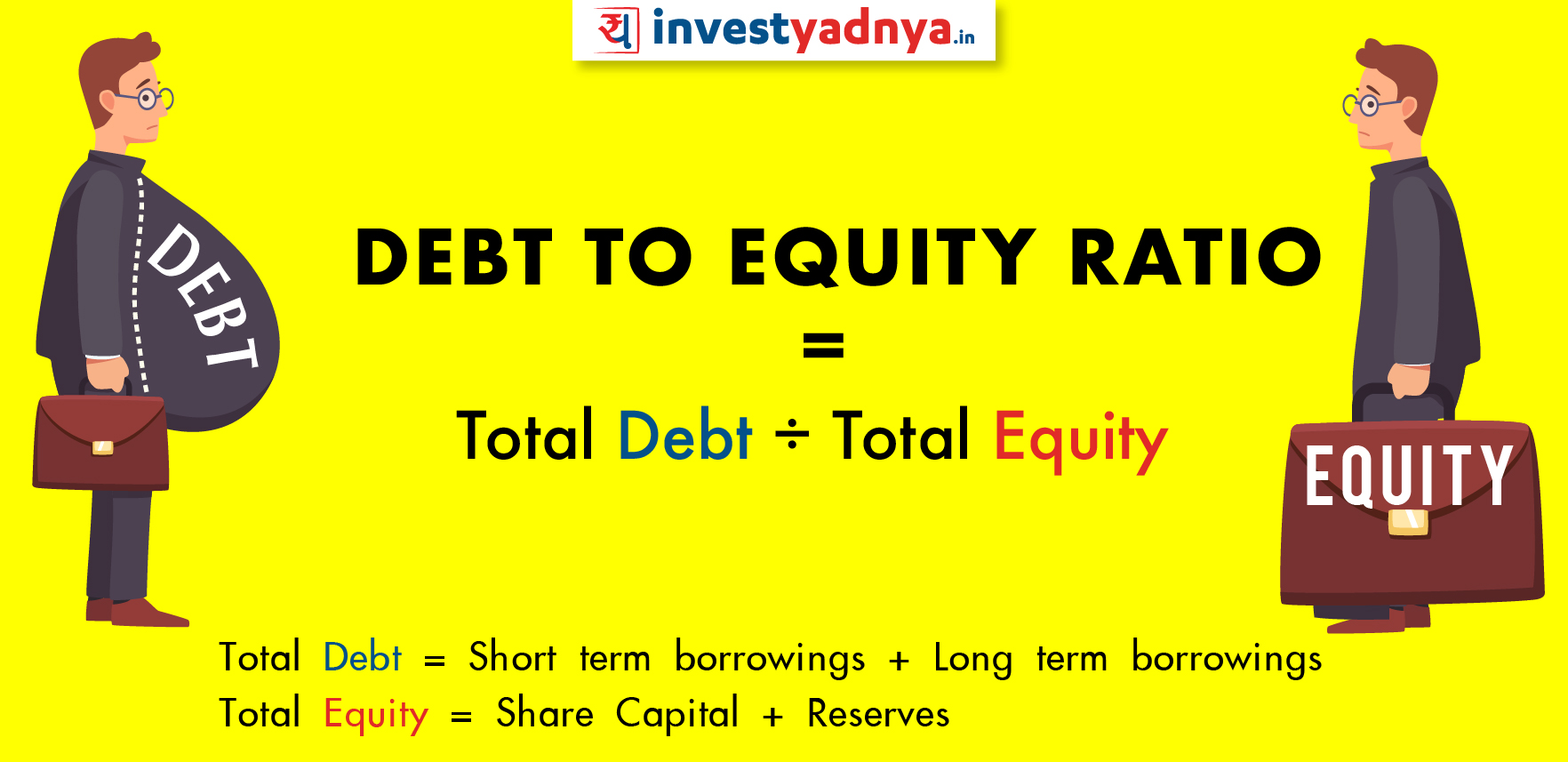

Debt-To-Equity Ratio Formula:

Current liabilities are the debts that a company will typically pay off within the year, including accounts payable. Long-term liabilities are debts whose maturity extends longer than a year. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply.

Trading Services

For instance, capital-intensive industries such as utilities or manufacturing might naturally have higher debt ratios due to significant infrastructure and machinery investments. The purpose of calculating the debt ratio of a company is to give investors an idea of the company’s financial situation. Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day. She has ghostwritten financial guidebooks for industry professionals and even a personal memoir.

- Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18.

- All we need to do is find out the total liabilities and the total shareholders’ equity.

- At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt.

- Upon plugging those figures into our formula, the implied D/E ratio is 2.0x.

For example, if a company takes on a lot of debt and then grows very quickly, its earnings could rise quickly as well. If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations. In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities.

A company’s total liabilities are the aggregate of all its financial obligations to creditors over a specific period of time, and typically include short term and long term liabilities and other liabilities. The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity. The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks. At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt. The Company’s quarterly Debt to Equity Ratio (D/E ratio) is Total Long Term Debt divided by total shareholder equity.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies.

This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). These balance sheet categories may include items that would not normally be considered debt or equity risk response plan in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt.