Blogs

Electronic poker spends a fundamental 52-cards platform, like antique casino poker. For each and every round begins with a give worked, along with the choice to store otherwise exchange notes so you can function a far greater hand. Most electronic poker alternatives do not pay for anything below A couple Partners. The brand new exclusion being a good ‘Jacks or Greatest’ online game that can shell out for the a couple of Jacks (or even more).

Options that come with gaming rules for all of us web based poker sites

In order to trigger the largest winnings, a royal Flush must be gotten. A regal Flush is made up of the five higher cards of 1 fit. Just remember that , as the joker is also replace inside video game, it cannot option to the new Adept in this hand. It’s not difficult to find strategists in the casinos, and you may bettors will get rewarding information while playing to the free type.

The best All of us Web based casinos playing Video poker inside the June, 2025

Beginners’ area for first concerns, standard strategy and you will anything regarding learning poker.

- Sure, really gambling enterprises aren’t relevant, so you can sign up to several workers instead of breaking the law.

- Below are a few of the very preferred terms you will tune in to from the video poker terminals.

- Such, inside “Jacks otherwise Greatest,” usually hold any partners otherwise finest give, during “Deuces Wild,” support the deuces as they improve winning combinations.

- Even if this can be one of the mythology that people have understood thus far from the casino poker online game, this is a fascinating games that you should learn how to play.

Should i gamble most other games for real currency?

Observe that extremely gambling enterprises merely make it bettors to withdraw using the payment gateway which had been familiar with add financing. You can put a big otherwise brief blind just before to experience https://happy-gambler.com/all-irish-casino/ the brand new notes. Game team allow us those poker versions and you will real time choices. Yet not, discovering Texas Keep’em is a great initiate while the their laws and regulations are similar to Omaha or any other variations.

Very little court action have ever before started drawn facing People in america only for to play on-line poker. Very on-line poker sites functioning for real money to help you Usa professionals have been in a good “gray” court urban area. Free video poker games on the net give you the thrill away from local casino play without having any risk of losing money. Perfect for newbies and you will educated participants exactly the same, such game render an excellent solution to discover procedures, behavior hands options, and enjoy casino poker when, everywhere.

Real money Electronic poker Game

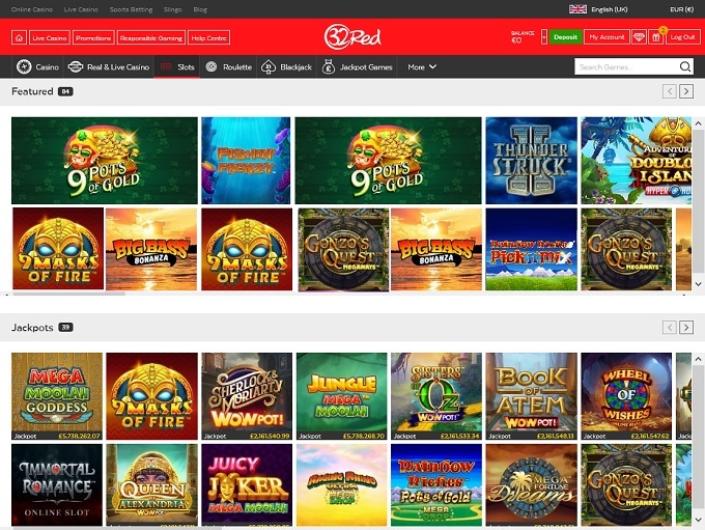

You might immediately gamble 32,178+ Vegas-build slots instead paying a cent. Choice fast and remove quicker, definition the fresh local casino makes a quick profit. Play as the slow you could; this will help to do away with the loss. Deuces Insane is much like the fresh Joker Poker, apart from as opposed to incorporating a lot more joker notes, all 2 cards following grow to be swappable Wilds for your cards to create an educated give you are able to. Nearly all Video poker today are distinctions of casino poker one to mark four notes out of a randomly shuffled 52-card platform (53 cards to possess Joker’s Crazy) instead of a distributor.

Visas given because of the big United states of america banking institutions, debit notes, as well as prepaid service Visa notes cannot have the normal declines seen somewhere else. They should only have finest exclusive chip connectivity, and therefore usually have the history inside gaming it’ve had. Bovada Web based poker could be high inside achievement cost having on line betting handling sources returning to the brand new ’90s.

Within its gameplay, a person sales two gap notes deal with off and four community cards face up. The overall game have three stages – the initial phase have about three cards while the almost every other a few features one to credit for each and every. High-end mobiles include far control power that they competitors some legacy desktops. Therefore, you can use such gadgets to operate poker games as opposed to sense one lags. Mention and you will/otherwise post hand records out of bucks games and ask for research from other professionals. Here are some our very own exciting writeup on Western Web based poker V slot because of the Wazdan!