Content

The brand new American roulette table, but not, provides you to extra occupation on the double zero. Meanwhile, all dining tables show the interior and additional bets and the number are colored centered on its relevant pouches regarding the controls. We have to as well as explain, one in the French roulette, the newest dining table has all brands in the French and contains a slightly various other layout. Some on the internet brands element launched wagers known as racetracks. They might usually end up being displayed for the a different dining table, which has industries for everyone you’ll be able to label wagers including the “neighbor” one. All controls contains a couple issues – an outward houses and you may a center bit you to definitely revolves.

Roulette usually adds just 5% to the cleaning a plus, and you can live agent roulette is often excluded completely. A real income roulette is actually court in britain for as long as you are passion-games.com my explanation away from legal ages (18 ages) and playing on the a licensed and you will authorised site. All the types of online gambling are subscribed by Gambling Percentage and certainly will become legally considering in the united kingdom when you have a licence from the Percentage.

Online Roulette Casinos in america: Their Ultimate Guide

I additionally take pleasure in the favorite Bet feature, which helps help save designed bets for future have fun with. The newest posts, books as well as other roulette on the internet posts to the RouletteDoc is created from the Maxwell Frost, a skilled specialist. Freeze has over fifteen years of expertise on the iGaming industry, and his specialization is online roulette. Frost is also a specialist writer and creates articles both for novices and veteran bettors. Mini-roulette is the best of all roulettes because the its design have numbers 0-twelve.

American Roulette by the Netent – Gamble Roulette

When you are not having French Roulette, the fresh gambling establishment compensates having its varied choices and you will dedication to athlete fulfillment. Yet, for all its entry to, really does on line roulette take the full substance of the game? Regardless of this, the brand new digital domain makes up having bells and whistles such enhanced profits and the fresh absolute capability of to try out away from people place. The bill anywhere between usage of and you can surroundings is actually a characteristic away from on the web roulette’s growing legacy. Luckily, right now you might have the game without having to visit a genuine gambling establishment. Modern technology allows participants to enjoy of numerous large-top quality on the web roulette video game at the best conditions.

Typical vacations will help assess your results and then make informed conclusion in the upcoming wagers. The fresh Paroli Method is the brand new Martingale’s hopeful relative, centering on exploiting effective streaks by the doubling bets after every earn. You reset once about three successive wins, aiming to take advantage of the new levels if you are cushioning the brand new downs. It’s a strategy one to attracts people that trust the brand new energy out of luck. Let’s delve into some of the most popular procedures one knowledgeable professionals claim from the. Our team is actually significantly dedicated to generating responsible gambling and keeping all of our members out of any harmful decisions.

The difference is the fact there are two main zeros for the controls, which gives our house a somewhat highest boundary. You can like a great BTC gambling enterprise if you intend to make use of crypto or bet anonymously. High-high quality internet sites fool around with HTML5 technical to operate flawlessly across all of the progressive web browsers. However they explore templates which might be simple to your vision so you can prevent punters of straining during the elongated playing courses.

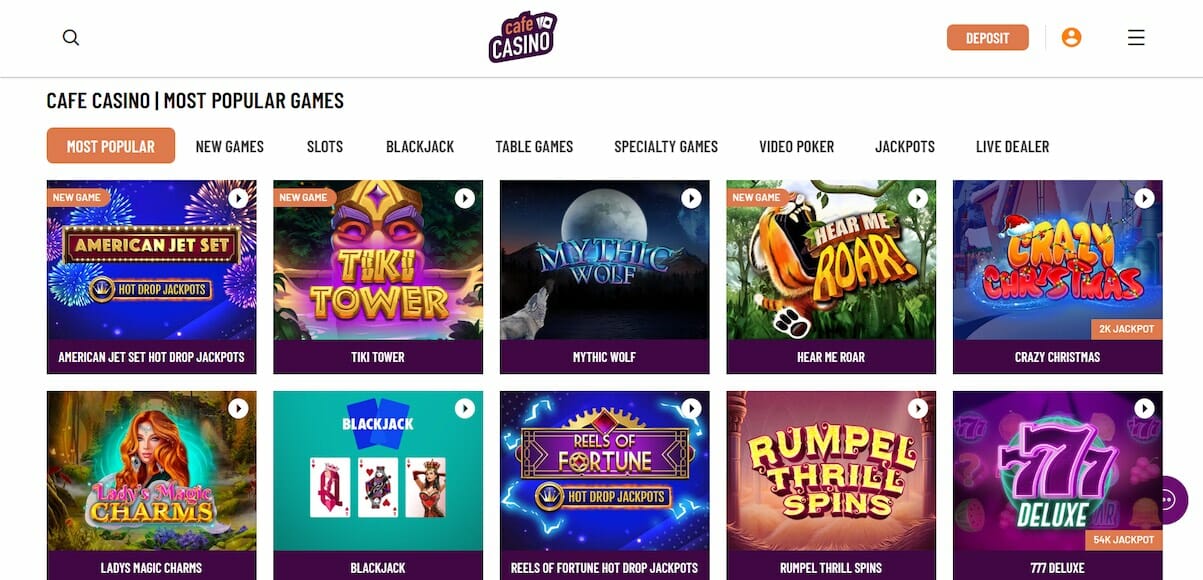

That’s why i’ve a whole party away from casino globe pros accessible to sample those gaming internet sites online. Our purpose should be to provide our very own subscribers to the finest roulette internet sites available today. All web based casinos have bonuses, so you might found it very easy to claim a profitable promo.

Can you Play Roulette On the web for real Money?

Begin their visit big gains for the best online slots games available. Totally free roulette game give the same enjoyable, fast-paced gameplay because their a real income equivalents. Free roulette are starred for only the enjoyment of it, whereas within the a real income roulette here’s the additional adventure of potentially huge sums of cash right up to possess holds.

Those individuals will probably be your just options, it’s best if you make sure the site also provides a fee means you already play with. Don’t forget about you to particular fee choices could only be used to put, while others are only readily available for distributions. Yes, you can subscribe to more than one roulette web site so you can rating incentives. However, you should create a deposit throughout these several sites and you will play the roulette online game on every to profit from the invited incentive or other promotions. Roulette the most popular casino games as much as and you will we could appreciate this – it’s simple and you can practically find out the games inside the 60 moments! Here’s a straightforward action-by-step code description for your requirements to be able to begin gambling the real deal currency pronto.

The fresh $10 put leads to the brand new 350 bonus revolves for slot game you to average a great 96% RTP, and also the $40 within the casino credit. The major live roulette casinos for 2025 try Ignition Local casino, Restaurant Local casino, and you will DuckyLuck Local casino. Such casinos give secure, reasonable, and you can fun playing knowledge, along with generous incentives, short earnings, and you will a wide selection of alive roulette online game. Real time roulette stands out since the a definite category, providing an even more immersive and you can realistic feel one directly mirrors a actual local casino. From the vintage elegance from Eu Roulette on the creative enjoyment of Lightning Roulette, on line roulette offers a rich tapestry from gaming experience.

Eventually, you need to weigh the new incentives, advertisements, and you will choice of commission procedures supplied by the brand new gambling establishment. Discover gambling enterprises that provides appealing and you may significant incentives, as well as the invited of several percentage procedures and you will currencies. By the given this type of issues, you could find an alive roulette local casino you to best suits their means and you may choices.

NetEnt’s RNG roulette games is actually celebrated because of their exceptional picture and you will seamless game play, particularly to the cellphones. The models are built with a mobile-basic approach, making certain a delicate and you may user friendly feel across all of the microsoft windows. The fresh image is actually sharp and sensible, raising the appearance and deciding to make the games more desirable. Which expidited pace lets lovers to enjoy much more playing days and you will increased adventure inside same to play duration. The game has a specifically designed controls and seasoned croupiers, making sure swift step instead of downtime. Wagers are placed exclusively within the spin, getting rid of idle symptoms and you will swiftly transitioning to help you next cycles due to fast video-founded identification from effective quantity.

What are the odds of American roulette?

Normally, it tend to be a good a hundred% fits put bonus, increasing the first deposit number and providing more money to help you explore. Specific casinos also provide no-deposit incentives, allowing you to start playing and you will successful instead of and make a primary deposit. This type of bonuses often include specific small print, so it’s essential to check out the fine print before saying her or him.

Thus far inside book, we have delivered one the overall better real money gambling establishment web sites to possess roulette professionals in the uk. We have as well as revealed the standards for picking a great webpages playing at the. Next areas, we are going to look more closely at the top roulette sites to have each type from user.