Posts

You will observe lobsters within the cages come randomly and it is your task so you can totally free her or him regarding the cages. It is important discover step 3 spread signs to go into the bonus game. There is simply a 94.14% average go back to user (RTP) within this video game, anywhere between 92.84% to 96.52%. Compared to the a number of other British totally free no-deposit internet casino position host game, this is very reasonable. Look at all of our publication for you to gamble 100 percent free slots Wheel of Luck the real deal money having real money jackpots and bonuses, or even in a totally free trial one to doesn’t wanted install or subscription.

The benefit function was also current for the incentive picker alternative, plus the paylines have raised away from 25 to 40. Loberstermania dos has integrated a couple of wilds instead of you to definitely and you will introduced the fresh multiplier feature. A leading suggestion is to obtain a website providing the highest RTP rates, as the gambling enterprises can decide the rate. Less speed reduces your own successful odds, so always play the higher. I usually get one to three minutes so you can familiarise myself having the newest slot’s paytable and you will extra info before rotating and you may slot.

Stinkin rich slot – In which create I play Lobstermania slot machine for free?

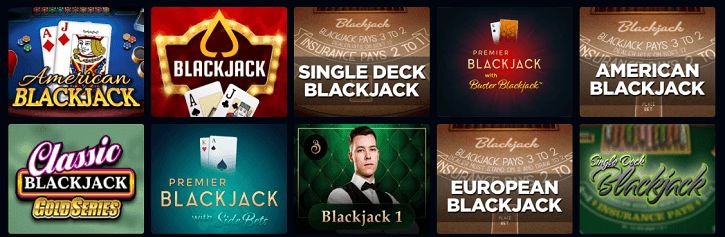

There are also videos slots, progressives, and you can multiline slots you could expect to discover online. A free online slot such Lucky Larrys Lobstermania 2 slot drops for the ocean-styled slot machine category. IGT although some constantly do the newest position game having a choice of templates. Slot themes are based on oceans, forest, unique countries, Christmas time, Easter, as well as Tv games shows. IGT integrates advancement and you will creativeness to produce exceptional titles to help make an online local casino feel that is instead of some other.

Participants need assemble no less than about three icons of your own caged lobster to turn on the benefit bullet. In this games, your ultimate goal should be to assist the fundamental lobster’s members of the family within their efforts to escape. Area of the lobster’s happiness level increases having a growing number of escapes. Because of this, so it incentive games will get larger and better more and more. Per lobster you let put free, your own profits will add up.

More Free-to-Play Slot machines

It’s important to keep in mind that the brand new RTP is actually an excellent theoretic commission and it also’s determined more years of time stinkin rich slot and some revolves. The fresh commission does not make sure that you will win a specific amount of money when playing the game. Instead, the brand new RTP means the fresh portion of complete bets and that is paid to help you players along side games’s existence.

Wake up to €a thousand, 150 Totally free Spins

Players don’t need to tray their thoughts a lot of inside the buy to understand how the games is actually played and there is guidelines that assist the ball player in this regard. Because of this of a lot players inside the real time gambling enterprises like going to that games as it means that professionals try comfy to the legislation and instructions. As the substitute for down load the video game is almost certainly not offered for the the platforms, such as a computer, of many online casinos deliver the replacement play Lobstermania 2 in person inside the a web browser. Players can be discover the bet size as well as the number of traces in order to bet on.

Their games are regarded as similar to high quality, invention, and enjoyable. IGT is amongst the earliest company of slot software, so they really provides many years of feel. IGT’s Happy Larrys Lobstermania 2 slot ‘s the sequel on the new Lucky Larry’s Lobstermania.

Click the details keys showing all the details, along with simple tips to setting victories. The fresh victories house from left in order to correct across the among the paylines, as well as the lobster logo designs act as wilds. Additional symbol you will observe try a jackpot, that is released to the one icon. Providing some thing away from birds-eye view to own Super Dish LV, of numerous professionals are worried regarding the price of investing in alive gambling enterprise technical.

To play Fortunate Larry’s Lobstermania 2 position, find the matter you should wager and only push otherwise click the spin button, next merely sit back and find out the new slots games do the rest. An Autoplay mode lets you favor a-flat level of revolves you to spin automatically. You’ll find buoys, fishing boats, lighthouses, and you will a good fisherman’s hut as the utmost beneficial symbols for the reels. Down paying icons to your Lucky Larry’s Lobstermania dos slot machine try 8, 9, ten, Jack, King, and you can Queen icons.