Content

You could play the Snowy Fortune position at no cost because of the to try out inside the demo setting. Within this totally free-enjoy type of the new slot, the fresh gambling enterprise provides you with free digital coins which can be used so you can wager on game. To help make the position more interesting, per reel icon displays an alternative cartoon. For instance, the fresh ship sails collectively on the reels because the white wolf releases a breath out of condensation since it strolls to the screen. Snowy Fortune even offers a dramatic music soundtrack to play on the records, with sound clips to enhance the brand new position’s epic ambiance.

The new motif in the game is the mythical Viking globe and its smart of in every method, it is dated but still provides me pleasure to give all of us specific twist I would recommend happy-gambler.com browse around these guys they. A playing company that has more than half a century of the past trailing it already, Paf Gambling establishment demonstrates that they know very well what it needs to be successful and you can liked by professionals. The fresh Arctic Luck image, apply better out of a shield, is in charge of the newest substitution incidents you to happen. Whether it countries where it is needed, it does its job and it may be part of a typical combination, as one of its icons. Betting needs to be fun, not a supply of be concerned or damage.

The most valuable symbol is a woman warrior followed by a larger old Viking helmet. The least rewarding symbols is actually a treasure chest, a longboat, a light wolf and you will a wines filled horn. The newest casino slot games features a predetermined jackpot of 1,024 means, which is each other a great and you can an adverse topic. Snowy Luck try an excellent 5-reel slot machine game video game who has zero repaired paylines.

Best casinos on the internet by complete winnings to the Cold Luck.

- It Cold Luck slot comment can give certain user-generated stats from our spin-record equipment.

- Whenever you have found a winning combination, it does light and begin depending down.

- The overall game comes with the wild symbols, 100 percent free spins, and fascinating added bonus has.

- The complete choice shows the expense of one twist of the reels.

Inside the Cold Fortune demonstration mode, your have fun with virtual coins provided by the brand new casino rather than transferring dollars in the casino account. This really is a risk-100 percent free way to get to know the online game’s technicians featuring. I really like the bonus round to your totally free spins and you may capturing the brand new spiders, as well as the whole become of your slot. It offers repaid me personally a decent victory now and then, however, nothing magnificent.

You might double or quadruple your bank account because of the correctly speculating the fresh color or match of a credit. People out of Cold Luck obtained 1328 times to have a total of the same out of $13,334,722 having the average single win from $ten,041. At the time of composing it opinion, Snowy Luck RTP is actually 96.58%. Yet not, the application merchant was at liberty to improve that it RTP value any time, very check to your most recent RTP before you enjoy. We video game similar to this need at the least step 3 different features, the newest picture are indeed terrible and the online game is not inviting one stand set. In reality we want to disappear rapidly which is a crappy signal to have a game title.

It position has a good 97% return commission, which means that you can find great opportunities to earn. The platform lets users to sign up and receive a pleasant extra. The brand new Enchanted Meadow position aligns to the game’s main theme. Excel, miracle, and fantasy is the main layouts of this online game.

Two additional signs mix something up a while whenever they look regarding the proper metropolitan areas, both of which is pretty familiar to pokie players. The fresh wild takes the form of the new Snowy Fortune symbolization, and you may works within the a normal method from the replacement most other icons if the they completes a fantastic integration in so doing. Cold Fortunes try played for the a five-by-four reel configurations which have step one,024 successful means. For each twist in this position online game will set you back a minimum of 0.5 gold coins for each and every spin.

Far more Game

A slot you to rarely pays aside however, can deliver massive wins is recognized as being a high volatility video game. Providers affix volatility ratings on their items, nonetheless it’s not always clear-slash. All of our tool consistently monitors ports and offer for every game to your our device a real time investigation volatility rating. The reason why Arctic Luck functions very well to your mobile phones is basically because there are not any down load minutes or lengthy set up processes.

- Cold Fortune crazy icons often choice to people icon except the fresh spread out.

- Snowy Chance try a deeply fascinating Microgaming slot starting having five reels and you may 1,024 solutions to-win.

- These may do their particular winning combinations from the obtaining a couple of her or him to the reels to possess a level currency payment.

You’re planning to feel one of the most creative slot servers because of the Microgaming app developers. So it 5-reel video slots games have a great Viking tale that offers participants 1,024 opportunities to win. Which unbelievable thrill seems like it might render particular reward.Professionals will meet effective and you can noble Viking characters in the process to your value hoard. To ascertain, you’ll must gamble.Even though this games can be known as an advanced position machine, it actually features an easy gameplay.

In the world of slots, we frequently make use of the term volatility to spell it out a game title’s efficiency. RTP, Struck Speed, and you will Finest Earn is actually factored to your so it metric, and that identifies how often a position pays out and exactly how sizable the individuals wins is actually. Slots makers discharge statistics for each and every tool it create. They base their statistics to the millions of simulated revolves.

Did you know that is the greatest app of your Microgaming which gives you the chance to getting fortunate having 1024 different ways from play? You are wandering to understand that I found know about it whenever i try checking out the documentary film relevant to your gambling enterprises. Just after watching one, I went on the search of the identical through the services from on line pokies and discovered many options strongly related you to. When you’re inside practice of betting following Cold Chance often excite your from the its motif as well as the has provided with her or him.

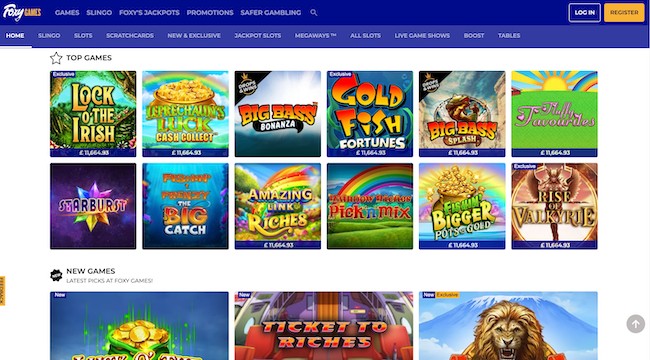

Listing of gambling enterprises providing to play Snowy Chance position

Along with, the brand new position crafted by Microgaming has got the Nuts icons and an excellent Spread out available. The result associated with the is actually for there to be a lot of profitable spins, however, smaller prize membership with every and you may a maximum jackpot one to are somewhat restricted, at the 6000 coins. When you’re aesthetically attractive, including design possibilities gets narrow the online game’s attention, to add potential entry to challenges.

+ 180 100 percent free revolves

Yet not , which means very combinations don’t spend far. One which just play, you’ll need prefer how many coins in order to choice together with to your worthiness of those gold coins. This can make it easier to lay a share for every spin. You get around three free spins for a few spread out signs, just five to own five signs and you may five for five symbols respectively. It’s a life threatening lower really worth while the certain pokies out there would offer fifty to a hundred totally free revolves for a good four spread icon blend. Essentially, Cold Luck room try doubtlessly worth a try, regardless of the opportunity so it’s simply for the way that it’s more than 1,one hundred thousand ways to earn.