Articles

These video game try streamed within the real-time from state-of-the-artwork studios, with elite traders holding the new games and you can reaching professionals. It options delivers a good sensible, immersive gambling establishment feel you to definitely provides the fresh thrill of an area-dependent casino straight to the player’s screen, no matter where he is. In a number of ones best necessary Development Gambling gambling enterprises, you may enjoy not simply antique online slots games. Therefore, for the of numerous gambling establishment internet sites, you might play real time blackjack, real time roulette, live baccarat, and you can real time poker.

Foxycasino slots – Greatest step 3 Progression Mobile Gambling enterprises

- We are intent on raising feeling out of playing habits by giving advice, info and you may warning signs to ensure that all of our users can possibly prevent it from overpowering the lifetime.

- The fresh Unibet Gambling establishment is an additional finest-tier on-line casino which has Evolution Betting’s software.

- The big Progression Gaming gambling enterprises have glamorous reload incentives for existing people.

- Villento Gambling enterprise is regarded as with top quality consumer solution that is obtainable round the clock 7 days an excellent few days.

- Here, i evaluate Progression Playing gambling establishment software along with other top 10 best ranked on the market.

Royal Ghost is also a power credit here, coping wreck when you are tanking to have Miner otherwise Skelly Barrel. The new Ante Bonus comes after common pay dining table for a property border on the Ante bet out of step three.38%. Inside fee-totally free baccarat, the fresh Banker bet has a property edge of step one.46% as the odds to your Athlete and you can Wrap are exactly the same. To learn more, please come across my page for the blackjack front side wagers as a whole otherwise my webpage especially for the 21+3.

That isn’t to express regarding the the fresh gaming offerings such as 100 percent free Wager Black-jack and you will Extremely Sic Bo. As well, its online slots under the NetEnt label provides RTPs varying anywhere between 95-98%. This will help establish why NetEnt’s ports are nevertheless some of the most popular game in the casinos on the internet. Legitimately authorized gambling enterprises in the usa are regulated by a state bodies body. This type of groups try to make sure that the games anyway gambling enterprises meet with the strictest away from direction in order that game play try fair to the participants. However, within the 2020 they ordered one of the industry’s leading position organization, NetEnt, for approximately $dos.step one billion.

Sombrero Spins Gambling enterprise Recommendations

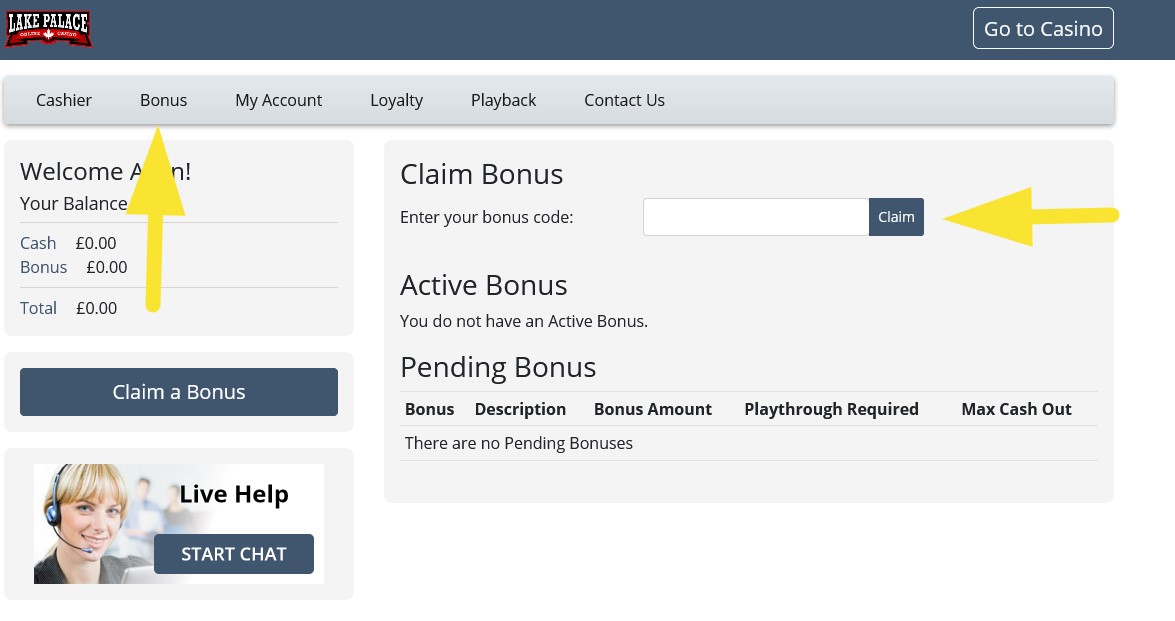

Take note of the bonuses that you could allege when you check in another membership. A combo added bonus which provides a deposit fits and many totally free revolves is always an attractive choice. Using this said, don’t disregard in order to as well as comment the new betting standards. Talking about specific criteria that the extra have in position to keep you from only withdrawing the additional dollars it provided your instantly. As it’s starred alive, you’ll see a breeding ground on the monitor just who revolves a controls.

- All of the gambling establishment web site you to definitely produced our very own checklist are fully signed up inside the at least one You.S. condition.

- Beloved or Real time is an additional one among the fresh video game you to definitely try developed by NetEnt and Evolution as well as the game features large difference which have RTP ranging from 96% to help you 98%.

- Video game suggests during the Evolution gambling enterprises are very interactive and you can fascinating.

- In the event you wear’t know, such as, if the a position of Advancement Gambling provides a keen RTP out of 96%, 96% of the player’s bets try gone back to casino members because the payouts.

Their arrive at stretches beyond European countries, which have Development Betting to make extreme advances inside the managed segments& foxycasino slots nbsp;and emerging places. Because of proper extension and you may partnerships with big online casinos, Progression has solidified its condition because the a major international community frontrunner. These perform provides acceptance the business in order to consistently expand and stay prior to its competition, keeping their dominance regarding the easily changing on the internet gambling globe. Sooner or later, the major Jackpot prizes are claimed and the wagers for the 2nd Jackpot honor offered initiate. The new alive game you’ve got an opportunity to victory the new jackpot is actually Real time Gambling establishment Keep’em, Alive Caribbean Stud Web based poker and Real time Tx Keep’em Bonus Poker.

All of the casinos on the internet one partnered with Progression Gaming offer a progression slot demonstration. For as long as participants complete the registration process, they can very first experience totally free play. When the participants find the Development demo fascinating after seeking to it, they are able to personally build in initial deposit and you may gamble Progression harbors with a real income. Originally considered a commander in the real time dealer online game the program merchant has exploded since that time and from now on also offers step 1,000+ headings, between real time games so you can slots.

Better Development Gambling Gambling games

The newest Banker now offers sale after every bullet, problematic you to definitely undertake otherwise continue for a much bigger honor. Wager on to the otherwise additional possibilities; should your basketball countries to the a great “Super Matter,” you earn large which have multipliers as much as 500x. I’ve made use of my personal many years of industry sense to locate you the better of those. However they provide a big sort of slots which will remain people position lover entertained all day long. Participants often run into a smooth and you can representative-friendly interface one to providing without difficulty navigating inside and outside of different game.

The company now offers thousands of online slots using their subsidiaries. When to experience at the a keen Evo alive local casino you’ll also find antique desk video game in the unique versions, such as XXXtreme Lightning Roulette. Evolution is probably best known for its alive dealer video game and gameshows. Although not, inside the 2020 the organization acquired two other innovative slot organization, particularly NetEnt and you can Red Tiger. Therefore, making use of their subsidiaries, Advancement today boasts a huge and ranged band of online slots as well. Below, look for a little more about a few of the video game that will be discovered during the Evolution Gambling web based casinos.

Specific stone-and-mortar casinos is actually adapting to the newest technologic tendencies and offering their alive coping program on their clients. No deposit or any other extra rewards is something this program merchant requires undoubtedly. He’s got no deposit added bonus also provides that will help the full feel, and several weekly, monthly and you can regular extra perks and you can promo also provides also, besides the regular no-deposit benefits. There are numerous things that are the overall quality of a keen on-line casino games. Here, we’re going to highlight more issues that you see within the Evolution online game.