Owners could find it hard to save your self to have an advance payment. Minimal number regarding more than dining table is daunting.

Gift away from family members: We are starting to understand the transfer from wealth once the baby boomer moms and dads help the college students for the deposit to own home.

Scholar line of credit: For those who have good Scotia Top-notch College student Bundle, you can acquire a total of 50% of advance payment however you will you prefer mortgage standard insurance coverage. MD Monetary Management’s review of mortgage standard insurance policies demonstrates to you which from inside the more detail.

First-Date Home Buyer Extra: In case your home earnings try $120,000 otherwise less, you have access to the initial-Go out Family Visitors Incentive. That it offers first-date people an appeal-100 % free mortgage all the way to ten% of the cost of a freshly founded domestic otherwise to 5% to your a resale pick. not, government entities commonly display in any development so you can, or losses out of, the value of your residence.

6. Should i use away from my personal line of credit, make use of the money in order to subscribe my RRSP right after which withdraw throughout the RRSP as part of the House Buyers’ Bundle?

This is a technique that may works when you yourself have registered retirement savings bundle (RRSP) sum room. The benefit is that you have the taxation deduction out of your RRSP share. Pursuing the finance come into the latest RRSP for around 90 weeks, then you can withdraw the bucks tax-100 % free (at the time) from House Buyers’ Plan. You will have to pay back what you use across the second 15 many years. When you repay toward RRSP contribution, you don’t get the fresh deduction. Incase you do not repay, 1/15 of count is included given that income in your taxation go back.

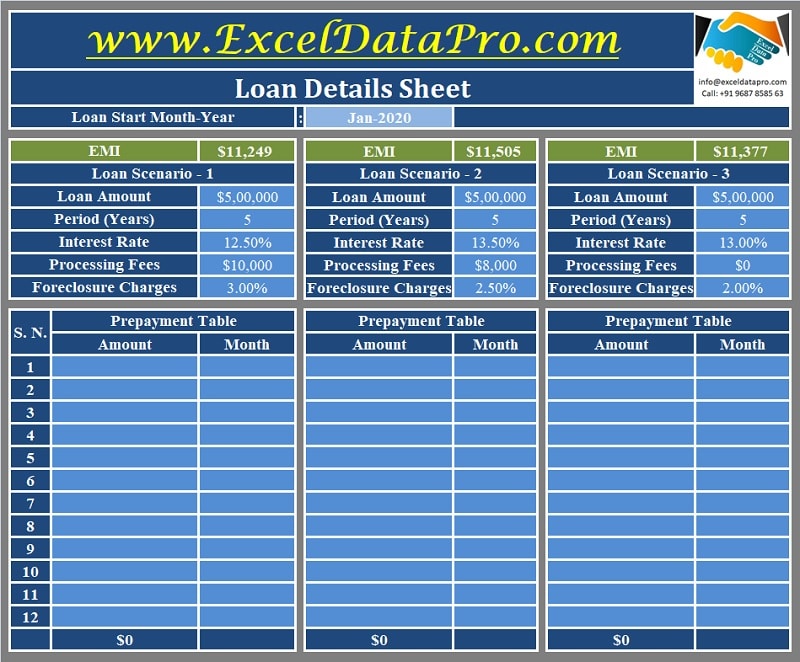

After you have figured out the down-payment, you can utilize MD Economic Management’s financial calculator to estimate their mortgage payment. Basically, it takes you buy price, downpayment, amortization several months, payment volume, title and you may interest rate, and you will assess how much cash the homeloan payment is.

An earnings calculator makes it possible to find out if or not this count is reasonable to suit your funds. Always also provide currency booked on the initial and another-big date costs away from homebuying (elizabeth.g., belongings import tax, judge charges, moving will cost you).

After you’ve made a decision to select property to invest in, it is possible to speak to your lender from the a pre-acceptance. A great pre-recognition lets you qualify for a mortgage – just before get – to make certain you’ll not possess capital things later on. Pre-approvals is actually appropriate to have ninety120 months and permit you to use the mortgage speed in the committed of pre-approval or financial financial support, any is more competitive.

All of the banking and you may borrowing from the bank services and products are supplied from the Financial out-of Nova Scotia (Scotiabank) unless or even listed

An MD Mentor* can help you with your funds which help decide how a good home loan will fit into debt bundle. As you prepare, a Scotiabank A mortgage Mentor can explain the some other home loan solutions out there and help you dictate suitable service to own your circumstances.

* MD Mentor relates to an enthusiastic MD Administration Limited Monetary Associate or Money Coach (in the Quebec), or an MD Individual Funding Counsel Portfolio Manager.

1 The fresh estimated income was an average estimated count considering available globe research and that is at the mercy of alter. Your own actual income can differ.

Credit and you will lending options is actually subject to borrowing approval from the Scotiabank. Small print connect with most of the prize applications and you can masters and you will might be reviewed very carefully before you apply. All now offers, pricing, are the student loan interest rates going up? costs, possess, reward applications and benefits and you may relevant conditions and terms was topic to evolve. See scotiabank or speak with your own MD Advisor otherwise a Scotiabank associate to possess complete info