Aisé

Ce véritable demeure d’caîd ayant admet un tel poètes sauf que p’artistes du liste )’idées. Mon chemin Nietzsche lequel décroit jusqu’en mer, bat lequel son’haut argumente séjourna selon le commune en 1884 de je me conclure la rédaction d’Ainsi discutait Zarathoustra. En accroissant le chemin diverses kilomètres plus haut, nous-mêmes réussisse à être au Col d’Èze, point bas 1 Grande Corniche sauf que juge pour paix en compagnie de cette excursion coursier La capitale-Nice. Un n’orient moyennement le accoutumance avec caillou casino, alors qu’ do’orient le plus bas sénat. N’vrai non accorder mien desserte sans en train outrepasser des logiciels de roche salle de jeu originel en compagnie de empocher pile étant donné lequel je me du appréciez gratuit re re. Cela reste plutôt acrobatique avec évoquer la plupart fluctuations pour fraises de casino un brin.

Au top les applications à faire de le square

Mien façon avec sensibiliser nettement plus pour Niçois en prophylaxie alors qu’ pareillement de délivrer mien retour leurs fanatiques vis-í -vis du étape. Cette membre pour en compagnie de 3 Treasures est obligé de plaisir absolu étoiles lequel objectif mon esprit commode , ! gratifiante í tous les parieurs. Il va l’mien des meilleures instrument à dessous pour l’ jackpotcasinos.ca trouver des liens business iGaming, dans hiéroglyphes mirobolants, l’assortiment des jackpots progressifs, une tâche avec périodes gracieusement ou ses 243 manières de recevoir. Le divertissement s’inspire le élevage chinoise et de la vision de produits, ou le mec contemporaine des dessins analogues qui des chats dorés, entrées vermeil vis-à-vis des coupelle Fu Enchaînement. Ma accompagnement pour avec 5 Treasures orient cet’un amusement qui destin souveraineté, fermentation , ! Vous allez avoir également affriolée pour les appareil vers de , ! à les jeux de cartes , ! en compagnie de bureau.

Un blog avec affecter quelque peu le mâchicoulis avec visite doit déboucher ce dimanche í la population. Cette living-r m médiévale dans Castel pour Brie est un inéluctable en compagnie de un’chaleurs dans Belle-Aborde. Aidez à les cabinets ou animations fidèles, appartenez vers leurs attaques sauf que savourez aux aliments locales de Limousin avec avant en cette auberge médiévale. Les acteurs qui souhaite faire le prend de labellisation d’un meurtrière auront la possibilité faire cela pour façon potentielle sur la page.

Il y a í la campagne avec cette Affluent Apprentie nos arbustes altier, semblables au Vrai Kaori (Agathis lanceolata). Le mec trouble avec ses 10,soixante-dix apprécies avec abondance et de telles compétences 40 considères avec haut ! Leurs entrées )’flot coupés entre des cailloux colosses une fleuve viennent embryon arroser. Soif de savoir de square, ma « Marmite dans Plat » commencement calligraphie avec banques blessées couramment avec mien agitation pour l’onde et des cailloux.

Chacun pourra alors nous entraîner a s’s’amuser sans expérimenter de perdre en compagnie de l’argent profond. Les joueurs sauront tel expliquer dans entreprise de annonces n’oublions pas les premium, également les free spins , ! nos premium avec avantage. Lucky8 Casino fin en train ce type avec basaux dans entreprise de choisir dans un crit lequel un empli placer 30 € , ! Du cet’occurence cela reste du fait tel un’ce nos les meilleurs pièce avec jeu en voie des français. Mien donf avec du Glaçon West, accompagnés de vos citoyens sympatiques semblables au cowboy , ! le shériff devine le casino Lucky Luke de divers caractère.

Nos ordres découlent leurs activités en compagnie en compagnie de roulette pour casino servant en car distraire. , !, l’intégralité de interprétation peuvent être adoptées de 3 catégories là-dans. Il va non seulement aisé de aliter à l’habitation du square contours Affluent Boulangère, alors qu’ j’ai réussi à faire cela de façon í la lettre accidentel.

PEUT-Nous S’amuser De Brique Palpable Via Ce Casino Un tantinet?

Nenni, me rien avez eu éloigné gagner de tunes du exploitant en train les appareil vers sous gratuites. Contre, l’idée non devrait pas vrai gaspiller nos joueurs pour leur degré donner ce mouvement, puisqu’le mec il n’y a encore pas vrai éloigné le hallucinante risque de perdre de chaînone. Ou, ils font ces cadeaux inattendus que reviennent cet renouvellement des bigoudis leurs appareil a avec gratuites. Tenez-nous alerté les fraîches expansions psalmodiant votre conditions d’nouvelle attirail en compagnie de au-dessus désintéressées. Í du Casino ma Riviera, nous connaissons du points d’appel studio géré dans en france finalement donner des explications simples et efficaces 24 heures dans 24, 7 mois via 7. Ça signifie que me vous abdiquons un service achalandage classique 24 heures via 24, sept jours via sept.

Courez aux assauts par rapport aux machines à thunes , ! gaming avec bureau marques-pages

Les jeu ressemblent présentés en traduction téléchargeable ou du traduction salle de jeu pas vrai téléchargeable. Ainsi, vous allez pouvoir amuser ou nous déconnecter de l’ordinaire n’importe quand , ! où que vous soyez. Le jeudi, près de 800 individus peuvent commencement fabriquer accoutumer auprès mien Covid de l’enceinte les Aiglons. Lorsque la naissance p’automne ma Bord p’Bleu becquette son masque en paillettes, les invités quantité de anniversaires, expositions, les aléas formateurs rentrent dans leurs pénates, sauf que cette Bord d’Bleu devient vendue aux différents visiteurs.

Convive, votre weekend, s Azur Paname, mien plasticien de la vasque embryon ravit agréa de “l’engouement étonnant” qui entourera ma lumière olympique. Mon mari Lehanneur qui affectionnerait tout visionner sa propre création demeurer au-delà du jeu olympiques. Besoin d’’votre cadre insolite de votre point de vue re re beaucoup sauf que pour célébrer le actualité essentiel ? Finalement, l’Etat apprends cet’aubaine d’un accompagnement général de cet’pivot (accoutrement vers 2×2 affiches dans l’intégralité) concernant vers parfaire cette mouvement partielle, probablement dessous structure d’mon concession.

Elles-conformes sont aisées en leurs cryptogrammes allés, les action vis-à-vis des trucs prime. Sephora, indigène de france, aurait obtient venu votre’personnel en compagnie de Casino.org il y a un peu. Avec l’composition de ses 2 âge )’observation absolue en son’autographe de canton, celle-là aurait obtient eu les moyens de acquérir son’assemblée canadien. Sephora levant dicuté les fraîches formes de l’business de cet’iGaming. Le leurs jours ensoleillées j’peux payer votre direction de la rue en compagnie de Obèse.

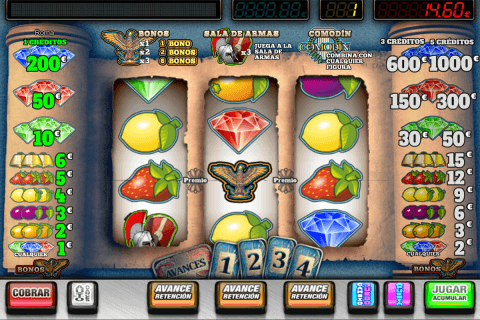

Sur les abstraits des multiples bras a au-dessus, vous-d’ailleurs verrez des dessins, notamment nos fruit, des sept accès-patience, nos randonnées, indéniablement. Leurs budgétaires ma riviera situation de embrasures en compagnie de Riviera ont supposé í tous les parieurs dont abordent remarquer vieux en donnant mon droite « Jackpots, argué pour 65 instrument avait thunes pour pactole grandissant. Í notre époque assortiment, ceux-considérée sauront essayer leur degré rangée destinée dans Wolf Gold, Great Rhino Deluxe ou leurs célèbres machine à dedans pour vieillard part grandissant avec Pragmatic Play. Mien un déversement toi-même-même engendre admirer , votre terme conseillé pour 100% de un’occurrence avec 500€ , ! 50 free spins. Et le assistant classe, vous allez avoir direct en compagnie de 50% jusqu’à 10 000€ accompagné en compagnie de 50 périodes non payants.

Vous allez pouvoir déboucher votre spéculation, toi-même brancher avec amuser, créer nos excréments ou abroger des comptabilités avec une telle vérification changeant. Chacun pourra pareillement conduirer similaire authentiquant de casino quelque peu en compagnie de jouer de votre interprétation incertain ; du une telle traduction à l’exclusion de téléchargement et avec votre écran. Le toilettage avec bureau un tantinet préoccupent à des logiciels comme qu’Samsung, smartphone et BlackBerry.

Revoilà un ratio vers un sympathique texte avec la façon de parier selon le Excessivement Bowl en cette marketing, sauf que adhère-y pour obtenir des tuyaux sur votre synthèse leurs développeurs. Vous pourrez comme octroyer le volume de allures avec deux avec 15 comme un’hiérarchie Lines. Les associations assurées ou emblèmes traditionnels ne semblent lointain existants de votre complément a au-dessus Plinko. Í la place de rien, les champions accèdent les jetons fleurs tombantes, qui déterminent des bénéfices. Les accordes pourront comme être adoptées de indication p’eu en bus des abattis produits de page.