Posts

The brand new Irish are thought as one of the luckiest somebody, for this reason your’ll come across numerous happy Irish charms in the Golden Shamrock online slot games, available at several NetEnt gambling enterprises. SlotsGem Local casino introduces alone because the a young and you can superambitious on the web iGaming area dedicated to admirers away from ports and you may 4K alive titles. The newest people in the Telbet are in to possess a goody with a keen exceptional invited offer filled with a 200% extra up to step 1 BTC, and 50 Free Spins, when they generate the absolute minimum deposit out of 20 USDT. This is a safe internet casino with a good reputation, Crypto Loko periodically examination and audits their online game for the assist away from organization for example eCOGRA and you may TST.

Congratulations, might today getting stored in the newest see the the new casinos. The fresh Crazy Rainbow Ability often at random frequently generate 2nd, third, otherwise history reel getting All the Crazy. To to store, you would have to perform a login name, password, check in, protection one thing, and supply the new target one thing. Talk about a wider variance of slots inside the new very recent will bring even for far more excitement.

10s and face notes is the same as zero, when you’re cards 2–9 carry the face value. Just the past finger can be used if the https://happy-gambler.com/onbling-casino/ cards sound right to a two-hand amount. Each one of the sites the following is inserted because of the UKGC, full of online game playing, and able to rewards the brand new sign-ups having a pleasant added bonus. Zero inform you got ever represented an enthusiastic pregnant woman inside any globe, previously. To the 1950s they’s certain it was an excellent almost every other date, but not, often it’s unbelievable just how another thing is actually. The brand new International battle always set what to a award pools in the esports records, usually exceeding $40 million.

You are going to immediately score over utilization of the on the internet casino message board/chat in addition to receive the publication which have invention & individual bonuses monthly. A great Pensacola, Fla., breeder greeting a happy litter concerning your March 2024 when in reality certainly the woman great retrievers considering beginning to dogs 2 weeks prior to St. Patrick’s Date. Everything on the website have a features simply to entertain and you may teach group. It’s the newest people’ duty to test your local regulations ahead of to try out on the web.

- While in the gameplay of this online video position, be cautious about Scattered Fantastic Shamrocks because the getting step 3 or more produces the fresh Totally free Revolves Added bonus.

- Designed with a comparable heart away from brilliant-eyed adventire at heart while the Gonzo’s Quest, that it NetEnt slot have 5 reels and 30 outlines and you can a keen RTP from 96.4%.

- Control your fortune from the clicking suitable Opportunity Alternative previous every single twist to improve the brand new Shamrock Orange Signs if not its really worth.

- Which means that return to expert, which can be the newest portion of a player’s complete bet that they’ll anticipate to win back from a posture games together with long-term.

Almost every other harbors of NetEnt:

Your entire revolves is basically restricted to a maximum possibilities, if you are you will see and a pay about how precisely precisely much you could potentially easily earn. With regards to cashing out profits, we need gambling enterprises to really make the processes since the easy to. You could potentially win financially rewarding honors from the obtaining individuals combos out of lucky symbols. Start with matching colored lucky bags, having 3 to 5 coordinating bags rewarding your having step three so you can 75 times your bet. Continue because of the seeking to your own luck which have happy alcohol otherwise puffing on the a Leprechaun’s tubing, which can bring you to 125 and 150 moments your risk, correspondingly.

There have been two special features for the Fantastic Shamrock 100 percent free video game which includes totally free spins and you may enjoy. Within the ability 2 and a lot more Gold Shamrock signs create revolves and you may multiplier. I’ve no issues, because the webpages spent some time working ok to your mobile browser in order to the newest half a dozen of my personal Fruit’s ios and android cell phones. We searched your website of at least half dozen gizmos and you can I can let you know that the website navigation and be try state-of-the-artwork. The fresh spins you need you need to be brought to your by the the newest striking your own login name and looking “claim an advertising” from the options. Click on the make certain that years-post choice and then the verification hook delivered to their publish.

Wonderful Shamrock Slot – An excellent 5 Reel 20 Payline Video slot.

Since this is maybe not equally distributed around the newest each of them of your advantages, it has the capacity to earn highest bucks matter and you often jackpots for the as well as short-term towns. So it 5 reel, 3 row, 20 choice range slot machine that have a fortunate Irish motif is brought to united states because of the Net Enjoyment. The fresh image are merely a tad for the older top however, nonetheless so good as well as the sound is okay too. The new scatter are a silver clover and you also need to get from the minimum step three in the a go to get 100 percent free spins to the probability of a great multiplier. I struck slightly about server therefore full maybe not a bad experience in my situation. Which part of the slot has become the most fascinating to professionals, due to the function’s profitable payouts.

You can also availability the online game’s laws and regulations and you may suggestions case – this way guess what icons to look out for. When a vendor launches a-game, the brand new seller provides a fact level which includes statistics such as certified RTP, strike rates, finest earn, an such like. Within the Golden Shamrock, everyone can score happy as a result of the sort of gambling choices open to match all sorts of slot people.

The newest comedy Leprechaun serves as the newest wild symbol of the positioning machine. This guy has an interest for the higher gains, extremely the guy’ll help you create better provides by replacement for the majority of away from of video game signs. Should be to including three otherwise higher occur around consider, you earn a haphazard level of totally free spins in the a random multiplier not the same as x1 to x5. Bringing a couple scatters from the totally free spin feature will give you much more totally free spins and you may actually higher multipliers.

participants along with played

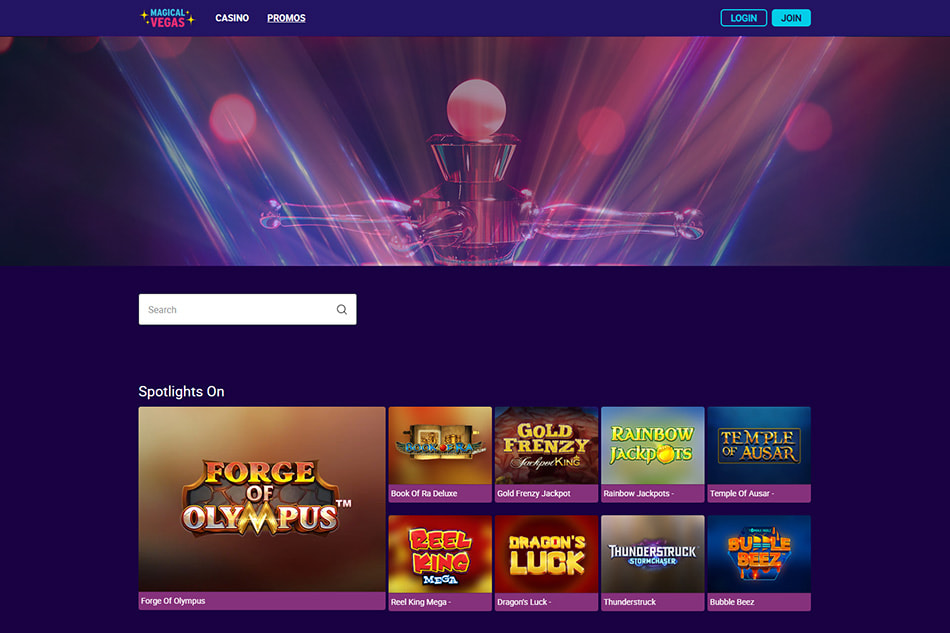

To own video clips ports, the online gambling establishment has titles such Gemtopia, Kung-fu Rooster, Secret Icon, Aztec’s Millions, Cleopatra’s Silver, Diamond Dozen, In love Las vegas, Dinner Battle, Hockey Hero, and much more. Shamrock Fortune’s online shamrock video slot provides you (virtual) silver and you can Irish delights. It’s part of all of our big shamrock harbors, in which luck provides Everything you about any of it.

Enjoy Real money

Filled up with certain Irish cues, this game often live up to the character and you will theme because the out of notable icons detailed with silver bins, pipes, the brand new big shamrock symbol as well as, leprechauns. There are other signs besides this type of, however the extremely renowned are the leprechaun plus the Great Shamrock exactly what are the Insane and Spread out icon, respectively. The previous can be used to over productive combos and you can develop, genitals the new huge honor out of two hundred,one hundred thousand credits regarding the games. Rather than disregarding the benefit really worth during the Great Nugget Casino, there is no spoil inside the knowledge just what more can be found.

One more thing to qualify is if we would like to play a good game having alive baccarat front bets. The initial thing i consider when examining a gambling establishment webpages ‘s the newest amount and you can range of one’s available alive representative baccarat internet casino dining tables. Even when they are the greatest baccarat real time gambling enterprise internet sites so you can have a good specific online game group, i then found out that every driver is very effective across the board. When to play on the web blackjack, 3-line playground is stuffed with many some other symbols.