Content

It brings you closer to the action that have Hd video clips, so you connect every detail of your own controls twist. The rules are exactly the same while the Western european Roulette, nevertheless presentation is like a good VIP experience in dramatic romantic-ups. When examining local casino providers my colleagues and i do not just discover sites with generous bonuses. We strive to locate those also provides that come with friendly terms and you will conditions.

Play All Variations With Free online Roulette

Live roulette is the best approach to play the fresh credit video game online. Real time specialist roulette actually features advantages over belongings-centered gambling enterprise equivalents. You may enjoy real time roulette online from the position all sorts of bets. Talking about categorized from the its commission opportunity — particular bets provide huge potential output than others. An important choice regarding live broker roulette bets is whether to place inside or external bets. Usually, most people allow us techniques to try to enhance their betting outcomes.

Online Roulette Online game

Lastly, 247Roulette have a very easy-to-fool around with ‘clear’ switch in the remaining-hand place of one’s enjoy display screen. This permits you to definitely clear all the wagers you have to your the fresh table, in order to quickly and easily manage your game. A straight choice is when you select a specific amount wallet (0,00, 1-36) on the pill to-fall to the in the controls. To make so it wager you devote their potato chips for the related count up for grabs.

Exactly what are Roulette Odds?

These regulations offer participants which have a much better see web site risk of preserving area of their choice even when the baseball places to the zero. New iphone 4 gambling programs aren’t available to You participants as a result of Apple’s Application Shop. For those who’ve never wagered before, be sure to listed below are some all of our help guide to making a profit in the online casinos first. It offers a thorough take a look at ideas on how to register, put, and winnings at the gambling games.

- American roulette, presenting an additional double-zero wallet, contributes an additional coating out of adventure.

- Yet not, its not all new iphone 4 roulette application discover beyond all of our advice is actually felt reasonable, getting reasonable they need to use RNG tech.

- Contrary to its term, Super Harbors is not a casino you to only have slot machines.

- Crazy Casino is one of the best casinos on the internet to own highest rollers in the usa because of their enormous deposit limits, crypto perks, and you will prompt profits.

- Credible on the internet roulette sites use Haphazard Count Turbines (RNGs) to make sure reasonable play.

Real time roulette online game is actually streamed within the higher-meaning video clips, making it possible for participants to see everything of your own video game. The new live dealer adds an element of authenticity, putting some feel more fascinating and interactive. If or not you’re to play out of your computer system otherwise mobile device, alive roulette will bring the newest casino feel to your hands. Alive broker roulette in the web based casinos give real time talk, where professionals is communicate with both in regards to the games inside real-date.

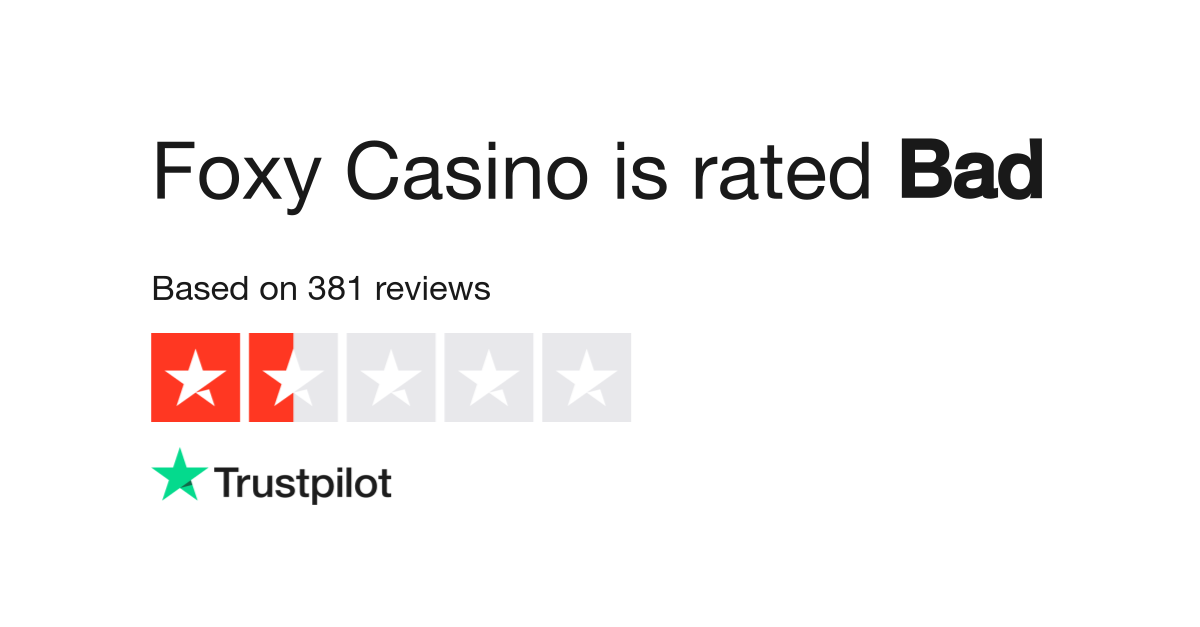

First, we find out in case your webpages has a collection that have an array of online game out of best designers that will be best to own bettors of all the budgets. Close to you to, the website we advice has passed all of our rigid conditions. Our checklist covers defense, licensing, equity, bonuses, payment tips, customer care, and you will features. Lots of enjoyable however, really risky multiple-wheel roulette offers far more possibilities to win when you are pressuring you to definitely wager more income.

Ezugi’s Best Roulette contributes adventure so you can antique roulette with a good circus-themed setting and you will innovative provides. People can acquire as much as three more multipliers, which can offer so you can neighboring number for the playing grid. When the lucky, the value of a purchased multiplier is twice, giving possible wins as high as 2,000x the brand new choice, making it a thrilling option for the individuals trying to larger perks and you can active gameplay. Live Western Roulette contributes a lot more alternatives adding a keen more zero on the controls. As well, Alive Western Roulette features straight down gambling constraints than many other Roulette alternatives, which have an additional ‘Four Choice’ to have yet much more range and you can alternatives. There are numerous roulette variants on the market that will suit people money otherwise urges.

You can also find harbors having templates, including antique, creature, Egyptian, otherwise videos slots. Slot game usually have a top home edge, however, there are some high-RTP online game which can be ideal for funds-concentrated participants. Crypto Casinos – These are online casinos one perform completely which have cryptocurrencies such as Bitcoin, Ethereum, otherwise Litecoin. They’re just like old-fashioned real money web sites but have a tendency to attract professionals whom well worth confidentiality, prompt deals, or decentralized programs. Particular crypto gambling enterprises actually offer provably reasonable game constructed on blockchain tech.

Also, the language and you will quantity in the French table have been in French, as the European adaptation spends English. Of course, this is not too big out of difficulty, specifically since the majority resources had been authored that have translations for the words and you may amounts your French roulette desk has to offer. The chances will vary a bit in accordance with the type of roulette games that is played. The newest betting chance in the American roulette from striking just one count having a level-upwards wager is 37 to one, because there are 38 number (step one to help you thirty six, in addition to 0 and you can 00). Cherry Jackpot Gambling establishment provides up to two hundred games, plus the choices try impressive in addition to French , English , Western, Western european, and you will Premier Roulette.

- Double Ball Roulette contains the exact same 2.7% family boundary because the Eu version.

- Extremely real cash roulette video game on line function suitable constraints for higher limits players.

- Aside from, its nice 250% deposit suits added bonus as much as $step 1,five hundred to possess fiat money dumps try a substantial improve to the player’s bankroll.

- Websites such 247Roulette.org assist professionals delight in totally free roulette video game as opposed to a merchant account, offering a chance to find out the legislation and create tips instead of financial pressure.

A variation of Eu roulette, the vehicle Roulette games try a much reduced variant that enables you to definitely features all those video game in the one hour. Throughout most other elements, the overall game are identical to European roulette, like the 2.7% house line. It’s well worth listing you to Auto Roulette are a different live gambling enterprise video game away from Evolution Betting.

You could make money to try out on the internet roulette if you discover just how playing the online game. On line roulette try a casino game from fortune, however, there are several a way to ensure it is profitable. It is a casino game that have significant profits which is extremely popular certainly one of on-line casino participants.

If the bonus is actually productive, all roulette online game, live and low-real time, lead ten% on the wagering requirements, which is more than average. Of all of the online game that you can have fun with real money, roulette is amongst the better also it can be discovered at the best wishes web based casinos. All the regulations out of roulette seemed listed below are basic provide of several other playing choices. You can pick low-risk wagers or try your own luck to your higher risk wagers to have the opportunity of larger cash earnings. Position real bets on the roulette table has the most enjoyable game play. Top-rated on the internet roulette gambling enterprises provide a authentic experience.

Exterior bets are the ones outside the count package for the 12-number otherwise 18-number wagers, which means you receive money quicker, however, victory more often. A knowledgeable roulette choice integration is just one which provides effective spins most often. All of the credible games organization explore Random Amount Machines (RNGs) to be sure equity. It means the spin otherwise credit draw is completely arbitrary and you may perhaps not dependent on the fresh gambling enterprise otherwise athlete. Regulated means the state provides put off regulations that every casino need pursue.

For many who following have to proceed to gamble real cash roulette, make sure to improve your betting habits and use a good roulette means which means you don’t wade chest too-soon. The best alive roulette video game that you could play for real cash utilizes your allowance and you may popular form of roulette. I have indexed the most used alive roulette bucks game in order to help you discover the finest games to you. A knowledgeable reduced stakes local casino websites to own roulette provide games which have low table restrictions.