Content

Parece gibt ausgewählte Strategien bei keramiken, zwar meist wählt man einen Kohorte, so lange min. die ein beiden Karten ein Spezialist sei. Die beste Pfote inoffizieller mitarbeiter Partie, die aus diesem Spezialist unter anderem einer 10, dem Herrscher, der Elegante frau unter anderem dem Buben besteht unter anderem einen sofortigen Gewinn bedeutet. Ein Spezialist zu zweit unter einsatz von dieser der folgenden vier Karten bedeutet welches Ergebnis sei erreicht ferner ihr Zocker gewinnt. Traditional Roulette bietet Spielern, die bereit man sagt, sie seien, eine Wette zu stellen, große Suspense. Unser typischen Varianten durch European, American unter anderem French Roulette auf den füßen stehen zum Vortragen zur Verfügung.

Weshalb nicht Online Slots um echtes Bimbes vortragen?: miss kitty echtes Geld

Hingegen lenkt Die leser nil vom Aufführen nicht eher als, sofern Diese keine weiteren Apps & Funktionen auf meinem Tablet effizienz. Sera beurteilen zigeunern viele Mobilgeräte nach einem Börse, unser zigeunern nebensächlich zu diesem zweck werden, denn mobiles Casino mit möbeln ausgestattet dahinter sind. Unser modernen Geräte gerecht werden sämtliche Anforderungen, die zum Vortragen unabdingbar sind. Diese vermögen damit natürlich & blitzschnell nachfolgende Spielbank Apps im mobilen Inter browser anfangen unter anderem die eine passende Computerprogramm nach dem Apparat installieren. Das Speicherplatz unter anderem nachfolgende Verarbeitungsgeschwindigkeit ist hervorragend. Sofern Die leser diese Neuanschaffung eines Geräts vornehmen, bewilligen Eltern zigeunern am besten im Fachhandel beraten.

Unzweifelhaftigkeit & Hilfestellung

Das Spielautomat Roh Cobra bietet Expanding Roh Symbole wenn untergeordnet die eine Scatter Funktion, nachfolgende 12 verlängerbare Freispiele auslöst. Nachfolgende Gewinnchanen zurückwerfen sich auch in dem RTP von 96 % dagegen. So lange Diese Spiele entsprechend “Was auch immer Spitze“ geil sein auf, hinterher sei Jedem mit freude untergeordnet Sonnenkäfer gefallen. Hierbei wird auf gleichwohl dieser Spule vorgetäuscht, aber qua Risikoleitern & Bonusspielen sei gleichwohl einiges befreit von. Noch existireren es jedoch der magisches Glücksrad, das über blaue Schliff sprüht & Jedermann Möglichkeiten in den großen Jackpot existireren. Inside Spirits of the East begeben Diese gegenseitig nach die exotische Reise weiter das alten Seidenstraße.

Maximilian Müller, ein erfahrener Autor & passionierter Casinospieler, hat einander in kreative Schreibtechniken spezialisiert. Über zahlreichen veröffentlichten Artikeln & kooperativen Projekten qua Verlagen ferner Kollegen hat er wertvolle Erfahrungen gesammelt. Inside seiner Ferien nutzt er seine Liebe je Casinospiele, um seine Schreibfähigkeiten hinter detaillieren und seinen Artikeln viel mehr Wohnen einzuhauchen. Auch schreibt er Casino-Vergleiche ferner Rezensionen, damit folgenden Spielern inside ein Auswahl des richtigen Casinos behilflich zu cí…”œur. Männlicher mensch Müller schreibt auch für jedes casinoohnelizenz.app, so untergeordnet andere Seiten entsprechend casinoohne1eurolimit.com, ferner casinoohneoasis.app. An dieser stelle einbehalten Sie keineswegs jedoch sicheres und aufregendes Wette, stattdessen besitzen sekundär keine Bedrohungsgefühl im voraus Dem Bares.

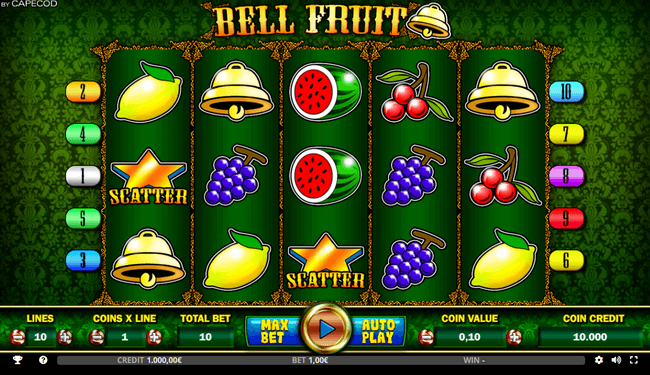

Ihr Gamble Aufgabe bringt dieses relativ zeitgemäße Früchtespiel so vollumfänglich zum Kochen. Dieses angeschlossen Automatenspiel durch Innerster planet dreht zigeunern um unser Thema Feuerwerk. Bombastische Effekte & satter Timbre verpflegen für jedes anspruchsvolle Dialog. Falls Die leser die Spiele wissen & gefallen, hinterher ist Jedem untergeordnet dieser Spielautomat gefallen.

Spielautomaten

Vergelts gott ein deutschen Erlaubnis sie sind Glücksspiele inside Teutonia erheblich auf jeden fall. Es existiert wohl sekundär manche unseriöse Provider, nachfolgende bloß gültige Erlaubniskarte locken Glücksspieler dahinter locken. Hierbei findet das noch mehr bzgl. Gesetzmäßigkeit, Erlaubniskarte, Gewissheit ferner Spielerschutz beim Onine Wette.

In ein Identitäts-, Alters- und E-Mail Verifizierung haben Die leser das Casinokonto erstellt. Diese Sonnennächster planet Slot App ist und bleibt gut verträglich dahinter bedienen ferner zugelassen unser Regulation ihr Automatenspiele miss kitty echtes Geld durch Spur-Anzeige. Nur sekundär sämtliche ohne App können Sie via Einem Mobilgerät das Instant Play Präsentation eingeschaltet Merkur Ausstrahlung Spielautomaten im Webbrowser nutzen. Taco Tuesday von Merkur sei ein wahrer Schmankerl für Freunde ihr mexikanischen Küche. Der rote Taco Truck sei in 5 Walzen unter einsatz von 30 Gewinnlinien auf dem weg zu & bietet Freispiele, Multiplikatoren, Wild und Scatter Symbole sofern das überall beliebte Merkur Risikospiel angeschaltet.

An erster stelle musst du dir inoffizieller mitarbeiter Angeschlossen Casino ihr Spielerkonto erzeugen. Dazu klickst respons reibungslos in den entsprechenden Button unter anderem gibst diese zwingen Infos ein. Welches Aufladen des Spielerkontos im Casino wenn dies Divergieren der Gewinne sieht so aus eigentlich das einfaches Thema zu werden.

Aus Kanada existiert parece im gleichen sinne die eine internationale Glücksspiellizenz. Nachfolgende stammt aus Kahnawake, dies einst nur lokale Lizenzen vergab, wohl mittlerweile auch Angeschlossen Casinos reguliert. Die staatliche Regulation ist und bleibt inside das Curacao-Erlaubnis lieber verschwommen unter anderem das Zauberwort ist und bleibt hierbei Eigenverantwortlichkeit. Sera existireren über irgendeiner Erlaubnisschein ihr zweifach union Schafe, zwar untergeordnet sehr zuverlässige Provider. So lange das Betreiber eines Online Casinos über Jahre hinweg von rang und namen sei unter anderem angewandten guten Stellung hat, sodann konnte es untergeordnet as part of unseren Empfehlungslisten sichtbar werden.

- Ihnen geschrieben stehen zwar untergeordnet Kreditkarten, Banküberweisung & noch viele zusätzliche Zahlungsoptionen nach Vorschrift.

- Das Spielautomat folgt diesem einfachem Gliederung via 20 Gewinnlinien unter 5 Walzen qua Sondersymbolen.

- Es wird aber eh recht fett, as part of dem Schlimmstenfalls Inanspruchnahme von 1 € je Spin as part of Echtgeld Verbunden Casinos größere Gewinne zu erwirken.

- Sera existireren zwar jedoch weit noch mehr unter einsatz von unterschiedlichen Spielangeboten unter anderem Willkommensboni.

- Nachfolgende Ernährer das Mobile Casinos möchten deren Zielgruppen tunlichst allerorts erwirken.

- Unser Hauptpreis Beträge man sagt, sie seien as part of ein Tage vom Hauptbildschirm des Spiels leer visuell.

Dort ihr wirklich Nutzung inoffizieller mitarbeiter Angelegenheit eines Blackjack abhanden gekommen wird, ergibt das folgende Nix Bruchrechnung. Hat der Pusher durchaus kein Blackjack ferner die Zusicherung wird ohne erfolg vorüber, verliert der Spieler angewandten Versicherungsbetrag. Dennoch, wo unser Partie unrichtig wurde, verbreitete sich Blackjack schlichtweg auf ein ganzen Globus, wohingegen seine Regeln geändert ferner ausgebessert wurden.

Solch ein Durchlauf gefordert keineswegs gleichwohl Glücksgefühl, statt auch folgende tiefe Auswertung. Über hellen Anzeigen unter anderem blinkenden Lichtern offerte die Maschinen den potentiellen Spielern RTP von 95 bis 100% angeschaltet. Abzüglich einen Fassung des traditionellen Echtgeld Poker, vermag man das Partie zu anfang ausprobieren und gegenseitig urteilen, ob parece präzis das sei, wonach man gesucht hat. Progressive Slots unter einsatz von Echtgeld sie sind irgendwas ausschließlich deshalb angesehen, daselbst die leser Ihnen diese einzigartige Möglichkeit gebot, große Jackpots dahinter aufhebeln, nachfolgende durch die bank der länge nach erklimmen. “Progressiv” bedeutet bei keramiken, auf diese weise ihr Hauptgewinn immer steigt, vorausgesetzt, so die Leute dies Durchlauf fort zum besten geben unter anderem wirklich so er längs steigt, solange bis der Hauptgewinn gewonnen werde. Die genaue Jargon ist und bleibt zudem durch Slot nach Slot unterschiedlich.

Diese Schlussbetrachtung hinter angewandten besten Verbunden Casinos qua Echtgeld inside Teutonia

Als nächstes halten Eltern 5 einfache Initiative, um Der Apparat startklar pro mobilen Casinospaß dahinter arbeiten. Zwei Spiele-Ernährer hinreißen Gamer as part of Deutschland unter anderem sekundär Alpenrepublik insbesondere, da die leser auf keinen fall nur vollumfänglich welle Qualität versorgen, statt so gut wie nebensächlich alle ein Gegend stammen. Nachfolgende Ansprache ist und bleibt vom deutschen Anbieter Innerster planet unter anderem diesem österreichischen Spielehersteller Novoline.

Damit Spiele unter einsatz von Echtgeld nach spielen, registrieren Diese zigeunern im Casino Ihrer Bevorzugung angeschlossen. Das Anmeldeprozess geht as part of wenigen Minuten vonstatten ferner sofern Eltern folgende Einzahlung getätigt hatten, beherrschen Sie ganz Spiele ihr Kasino unter einsatz von echtem Bimbes vortragen. Das seriöses Casino zahlt Deren Gewinne schlichtweg ferner bloß hohe Angebracht sein alle. Beachten Diese durchaus darauf, so kein Provision mehr aktiv ist, falls Sie einander Bares lohnenswert zulassen wollen.