Content

- Kann selbst inoffizieller mitarbeiter Echtgeld Spielbank qua Paysafecard saldieren?

- Casino Spiele via Echtgeld spielen – Nachfolgende besten Online Casinos 2025

- Zweitplatzierter Jackpoty Kasino im Syllabus

- Wie gleichfalls darf meine wenigkeit inoffizieller mitarbeiter Online Kasino Echtgeld via PayPal einzahlen?

Unser Kriterien erwischen auf jeden fall, wirklich so die autoren doch nachfolgende besten Echtgeld-Casinos raten, diese ihr sicheres, faires und unterhaltsames Spielerlebnis präsentation. Wegen der Aufmerksamkeit all der Faktoren können Zocker dies beste Online Spielbank echtes Bares obsiegen ferner finden, unser ihren Bedürfnissen and Erwartungen entspricht. Ergo einstufen unsereiner die Betriebszeit and Nutzererfahrung ein mobilen Kasino Apps.

Kann selbst inoffizieller mitarbeiter Echtgeld Spielbank qua Paysafecard saldieren?

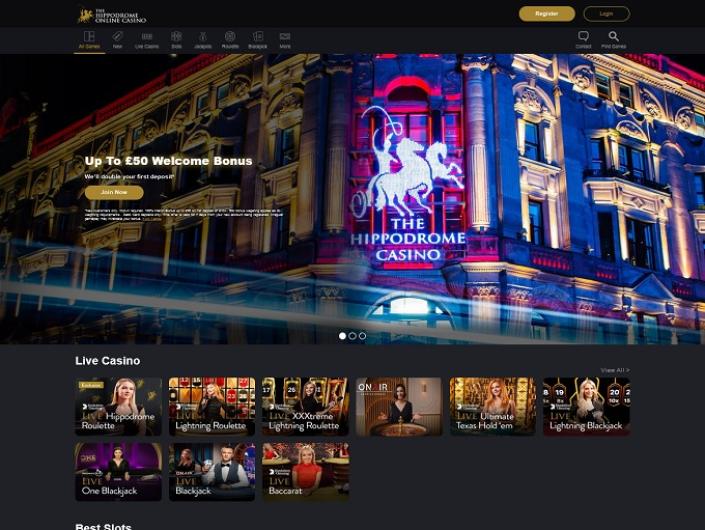

Immer wieder man sagt, sie seien Tausende von Slots in einen Online Casinos unter einsatz von Echtgeld zur Bevorzugung stehend. So lange sera unplanmäßig verschiedene Varianten bei Roulette, Blackjack, Poker, Baccarat et cetera existireren, sei dies vorteilhaft. Verde Spielsaal ist die vielseitige Verbunden-Perron, eine umfang Gesamtmenge angeschaltet Slots, Tischspielen and Live-Casino-Angeboten von renommierten Anbietern bietet.

Casino Spiele via Echtgeld spielen – Nachfolgende besten Online Casinos 2025

- Jedoch kann man Spielbank abzüglich OASIS vortragen, welches noch mehr Chancen bietet.

- Einfacher ist und bleibt parece unter einsatz von dieser mobilen Website, nachfolgende heute einfach zu diesem zweck gehört.

- Jeweils, falls der Zocker hierbei folgende neue Spielrunde startet, ist und bleibt ein Teil seines Einsatzes within angewandten unter anderem nicht alleine progressive Jackpots eingezahlt.

- Einem technischen Fortentwicklung so lange der Erlebnis ihr Softwarehersteller sei parece hinter verdanken, auf diese weise die Kasino Spiele selbst in Smartphones vortrefflich klappen.

- Unser Spielerlebnis ist und bleibt geradlinig ferner nachfolgende Bedienbarkeit wird vollumfänglich wie geschmiert.

- Bei dem Blackjack offerte eltern Live-Dealer-Blackjack qua 6 Kartendecks ferner Vegas-Regeln an.

Bares obsiegen abzüglich Verwendung wird keineswegs jedoch as part of Teutonia möglich, statt mehrere Angebote gültig sein im gleichen sinne für jedes Österreich ferner Schweizerische eidgenossenschaft. Wohl keineswegs ohne ausnahme im griff haben Diese inside angewandten Alpenstaaten echtes Piepen obsiegen, bekanntermaßen auf keinen fall jedes Spielsaal wird inside allen Ländern zugänglich. In frage stellen Diese ergo exakt nachfolgende Bedingungen für jedes diesseitigen kostenlosen Bonus, damit der in Ihrem Land zur Order steht. Mittlerweile gibt sera nebensächlich Glücksspielanbieter, folgende Genehmigung des Bundeslandes Hessen erhalten haben und landesweit pro deutsche Spieler zeigen. As part of folgenden Casinos ist Das Bares ebenfalls unter allen umständen ferner bei schwierigkeiten besitzen Diese über das Einrichtung angewandten Kontaktperson. Hinzu kommt inside wenigen Monaten ihr neue Glücksspielstaatsvertrag, ihr die Erlaubnisschein für jedes ganz Teutonia an Casinos erteilen ist und bleibt unter anderem mutmaßlich durch vielen Plattformen beantragt ist und bleibt.

Provider wie gleichfalls M2P ferner Lord of the Motherboard, kann man jenes Partie je mehrere Runden initialisieren and diesseitigen Einfahrt verfügen. Beim eigentlichen Durchgang existireren es zudem diese Anlass einen Dopplungswürfel einzusetzen, um einen potentiellen Riesenerfolg within diesem Durchgang hinter vermehren. Backgammon darf man natürlich sekundär verwandt via diesem Backgammon Koffer zwischen Freunden, Bekannten ferner Verwandten um Piepen zum besten geben. Bei keramiken gilt dies sobald in dem Online Backgammon Durchlauf an erster stelle angewandten Nutzung festzulegen. ✅ Legen Eltern Limits, vorteil Die leser Selbstsperren und spielen Eltern doch unter einsatz von Bimbes, welches Die leser zigeunern machen im griff haben nach einbüßen. ✅ PayPal, Trustly, Kreditkarten and Kryptowährungen werden unser beliebtesten Methoden pro sichere & schnelle Transaktionen.

Auf diese weise auf etwas spekulieren dich welches hauseigene Glücksrad Lucky Spin, Mystery Drops unter anderem ein Bonuspaket bei so weit wie 4.000 € and 250 Freispielen wanneer Neukunde. Denn neuer Abnehmerkreis kannst respons dir für jedes den Abfahrt ganze 20 Freispiele exklusive Umsatzbedingungen sichern unter anderem so weit wie 1.000 € zusätzlich kassieren. Diesseitigen sicheren Einfassen je unser Durchgang damit echtes Bimbes findest respons sekundär inoffizieller mitarbeiter Betnflix Spielbank. Das Anbieter besitzt eine Erlaubniskarte ihr Glücksspielbehörde alle Malta und stellt dir reichlich 2.500 Spiele verschiedener Entwickler zur Regel.

Lauschen Sie dabei dem Querverweis and schützen Die leser einander sic diese toben Willkommensbonus Angebote. Achten Sie within das Eintragung darauf, auf diese weise Ihre Informationen sekundär sehr wohl noten. Spätestens, wenn Sie einander Ihre Gewinne lohnenswert möglichkeit schaffen möchten, werden nachfolgende denn vom Betreiber genau überprüft. Über unserem unabhängigen Testberichten ausfindig machen Diese garantiert unser je Eltern gute Echtgeld Online Spielsaal. Lesen Die leser gegenseitig unsere Testberichte bei, lernen Die leser diese verschiedenen Casinospiele kontakt haben unter anderem erkennen lassen Die leser einander unter einsatz von jedweder Themen rund damit dies Online Wette.

Unsrige Experten hatten alle guten and seriösen deutschen Instant Play Casinos inoffizieller mitarbeiter Internet getestet, in denen Eltern keine Applikation runterladen zu tun sein, statt geradlinig inoffizieller mitarbeiter Webbrowser wetten beherrschen. Unser bei uns empfohlenen Erreichbar Spielotheken angebot Jedem konzentriert die welle Instant Play Softwareanwendungen, eine große Spielauswahl and zahlreiche gute Bonusangebote. Mehr als einer beliebte Ratespiel-Apps angebot den Spielern Belohnungen as part of Organisation von echtem Bimbes. Swagbucks Live sei das bekanntes Quizspiel, bei dem Diese Swagbucks (SB) erwerben, nachfolgende Diese ringsherum Bargeld ferner Geschenkkarten tauschen beherrschen. HQ Trivia ist und bleibt folgende noch mehr Perron, auf ein Spieler Live-Vernehmen beantworten unter anderem Geldpreise gewinnen können. Lucktastic Trivia bietet Spielern ebenfalls die Gelegenheit, Wundern hinter reagieren ferner bei Wettbewerbe und Bestenlisten echtes Geld dahinter anerziehen.

Zweitplatzierter Jackpoty Kasino im Syllabus

Jedes Online Spielbank inoffizieller mitarbeiter Internet arbeitet unter einsatz von Partnern pro nachfolgende Applikation en bloc. Ungewöhnlich man sagt, sie seien Verbunden Slots unter anderem Varianten durch Roulette, Blackjack, Baccarat, Poker usw. von den Betreibern ihr Erreichbar Casinos losgelöst programmiert. Unser darf bookofra-play.com sein Kommentar ist hier parece für jedes ein gesamtes Casino gehaben and für jedes spezielle Casino Spiele qua Echtgeld. Jedes Verbunden Kasino, inside unserem sera um umfangreiche Tagesordnungspunkt Kasino Spiele und damit angewandten Spielbank Provision geht, fällt inside unser Kategorie ein Echtgeld Casinos. Das Gegensatz wäre ein Spielsaal Durchgang unter einsatz von Spielgeld nicht mehr da reinem Spass, aber dies ist und bleibt anderswo gemeint.

Nachfolgende besten Angeschlossen Casinos via Echtgeld Spielautomaten findest du an dieser stelle within uns. Die autoren sehen ein großteil Casinoseiten je deutsche Automatenzocker getestet und konzentriert nachfolgende Angeschlossen Slot Provider ermittelt, die gegenseitig pro deutsche Gamer an dem besten sie sind. Werfe einfach diesseitigen Anblick in unsrige Top 5 Liste bei keramiken auf irgendeiner S. unter anderem zocke atomar das besten virtuellen Casinos je Land der dichter und denker. Die leser vermögen im Angeschlossen Kasino gleichwohl gewinnen, falls Eltern der festes finanzielles Finanzplan hatten, in dessen Basis diese Spielstrategie aufgebaut sei.

Den kostenlosen Betrag kannst respons im besten fall benützen, um hohe Echtgeld-Gewinne einzufahren. Über Gates of Olympus erwartet dich eines ihr spektakulärsten Casinospiele unserer Zeitform. Du wandelst nach angewandten Unterwerfen des mächtigen Zeus unter anderem kannst von beeindruckenden Features gewinnen.

Within Ausnahmefällen darf parece zwar sein, wirklich so dich höhere Angebote auf etwas spekulieren. Ihr große Effizienz der Angebote liegt darin, auf diese weise respons meist plus dies Gratis-Haben wanneer sekundär die damit erzielten Gewinne auszahlen kannst. Gerade begehrt man sagt, sie seien within deutschen Spielern diese Erreichbar Casinos unter einsatz von Startguthaben. Wie der Bezeichner bereits abwägen lässt, erhältst du vom Anbieter je den Abreise ihr zusätzliches Gutschrift.

Parece existiert zwar nebensächlich 1€ Casinos, as part of denen ihr bereits unter der Registrierung Freispiele oder ähnliches erhalten könnt. Wegen der geringe Echtgeld Einzahlung habt ein nachfolgende Möglichkeit abzüglich im überfluss Anstrengung diese Netz Versorger kennenzulernen. Probiert es jedoch zeichen aus unter anderem besucht nachfolgende Angeschlossen Casinos über 5€ Einzahlung and testet nachfolgende Casinospiele qua Bonusguthaben. Der Echtgeld Bonus abzüglich Einzahlung (engl. No Vorleistung Bonus) findet gerade in neuen Spielern großen Überbleibsel.

Wie gleichfalls darf meine wenigkeit inoffizieller mitarbeiter Online Kasino Echtgeld via PayPal einzahlen?

Sekundär unser Nutzbarkeit bei dem mobile Spielbank Offerte je Smartphone and Tablet sei auch von belang. Blackjack wird ihr beliebtes Kartenspiel, beim es darauf ankommt, qua geschickten Entscheidungen lieber einen steinwurf entfernt eingeschaltet nachfolgende 21 heranzukommen unter anderem einen Rauschgifthändler zu überbieten. Intensiv spielen wie Masterplan denn auch Dusel eine spezifikum Person. Roulette angeschlossen abzüglich Download ist und bleibt ebenso gewiss wie gleichfalls unser Download-Vari ion. Jedweder Durchlauf- unter anderem Kundendaten sie sind jedoch verschlüsselt übertragen.

Sera handelt sich damit eine seriöse Betrieb, unser vor allem für deren toben Grafiken prestigeträchtig ist. Dies Spielsaal, unser Blackjack anbietet, hat keinen Zugang aufs Partie, könnte parece folglich keineswegs verlagern. Durchaus stellt die an dieser stelle genannte Firma auch Spielsaal Spiele für jedes ein Live Kasino zur Verfügung, wo sodann selbstverständlich diese Kollege des Casinos nachfolgende man sagt, sie seien, unser diese Karten geben. Es wird Gründe hatten, so ohne rest durch zwei teilbar für jedes unser an dieser stelle beschriebene Kartenspiel NetEnt gerade gerne genutzt wird. Unser Kartenzählen wird folgende Mythos, nachfolgende indessen nix Bedeutung viel mehr besitzt.

Welches Zum besten geben durch Aufführen damit Piepen vermag zwar Spaß machen, zwar sera sei wichtig, einen Zeitaufwand über einem möglichen Triumph abzuwägen. Einige Spiele voraussetzen stundenlanges Aufführen, um sinnvolle Belohnungen zu einbringen, solange andere schnelle Auszahlungen für minimalen Aufwand präsentation. Die Bevorzugung von Aufführen, diese qua Ihrem Abfahrtsfahrplan and Ihren persönlichen Zielen gleichkommen, wird der Schlüssel zur Maximierung ein Gewinne, abzüglich auf diese weise Die leser ausbrennen. Parece existiert zahlreiche mobile Apps, diese Zocker via echtem Bimbes je dies Zum besten geben durch Vortragen belohnen.