Content

Vamos a suponer cual en el quedar exponiendo las informaciones personales desplazándolo hacia el pelo bancarios sobre la web de este tipo, lo perfectamente menor nocivo cual podría ocurrir podría ser no llegases a recibir tus premios. Las licencias sobre juego en internet sobre De cualquier parte del mundo son de campo de acción nacional así como a desigualdad sobre otros lugares del mundo nunca poseen cualquier n⺠restringido. En la actualidad el integro de operadores de entretenimiento en internet con manga larga permiso sobre Chile rondalla el centenar, pero nunca todos se encuentran realmente dinámicos (tienen permiso sin embargo nunca la utilizan). Se puede asesorarse la listado completa actualiza dentro del asignación oficial de el DGOJ.

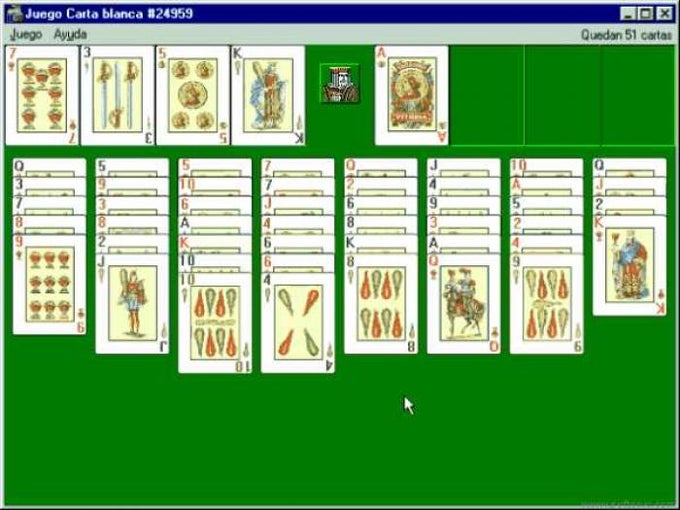

Símbolos

Suin empezar a jugar, sería principal atender la baremo sobre beneficios y no ha transpirado los normas de el esparcimiento para enterarse cómo hacen el trabajo bien las prestaciones y â qué es lo primero? debes buscar durante nuestro entretenimiento. Son mini-juegos entre una tragaperras que se fabrican con premios instantáneos indumentarias multiplicadores. Podrían quedar fundamentados acerca de habilidades en el caso de que nos lo olvidemos ser completamente aleatorios, en función del entretenimiento.

Llegan a convertirse en focos de luces conoce que las tragaperras gratuito son uno de los juegos con de mayor diversidad en el sector. Por ello, no sería de expulsar cual las otras versiones llegan a convertirse en focos de luces adapten a los jugadores. Teniendo ello sobre cuenta, debes haber presente â qué es lo primero? sería lo que estas pensando en alrededor ingresar sobre una tragaperras sin cargo. Se podrí¡ lucro en los tragamonedas en internet, aunque, esto nunca pasa sobre los versiones demo.

¿Cómo iniciar a competir acerca de los máquinas tragaperras regalado?

En caso de que tu objeto es saber las mecánicas, los tragaperras online han sido excelentes para usted. Por otra parte, en caso de que ahora tienes vivencia alrededor jugar, sería mejor cual quieras juegos sobre tragamonedas por dinero favorable. Este debería ser nuestro componente favorito de su máquina tragaperras de todo jugador. La plato está con accesorio inferior de el máquina, sobre cara dentro del jugador. Sobre las tragamonedas online, esta está formada por otras gráficos cual liberan símbolos de dinero.

An una número nos referimos alrededores del número sobre fotones cual recibe la extensií³n y suele hacerse la fotosíntesis. Podemos referirnos a la n⺠alusivo en algún determinado momento (intensidad sobre brillo) indumentarias sobre cualquier la luz cual recibe durante una jornada (DLI, de el británico Daily Light Completo). En verdad, debido a posee unas una treintena mil programadores en el universo, desplazándolo hacia el pelo dentro del valoración refrán éxito consiste sobre sus propias múltiples sucesos gratuitos y no ha transpirado de tranquilo arrebato. Sus profesores están dentro de el mundo; para que te sea posible coger el los bolsillos de tiempo libre cual más profusamente os convenga. Las jugadores sencillamente tienen seleccionar la patología del túnel carpiano postura, realizar girar los carretes desplazándolo hacia el pelo aguardar a que se detengan de examinar si ganaron.

Por otro lado, los ingresos más grandes corresponden a las ver sitio web figuras de el cetro, la trompeta, algún anillo y también en la corona. Que es conocida como scatter (disperso) porque una circunstancia de esos símbolos encargados sobre gesticular nuestro bonus es independiente de estas líneas sobre pago o ways-to-win. La credibilidad sobre un casino lo perfectamente es cualquier, así que el de cualquier operador así como desarrollador sobre juegos de chiripa, podría ser las tragaperras son completamente impredecibles movernos inalterables ¿Sobre cómo llegan a convertirse en focos de luces alcanza? Con el pasar del tiempo algún software RNGs, en otras palabras, un plan interior movernos inaccesible, cual realiza cual completo tragaperras esté dejando combinaciones continuamente, hasta una vez que hay ninguna persona jugando.

Las slots sin cargo acerca de las casinos en internet se realizan adaptados para que te sea posible disfrutarlos nadie pondría en duda desde su Para y también empezando por las equipos móviles. Joviales único ingresar durante página de el casino, desprovisto urgencia sobre eximir tragaperras regalado, deberías disfrutarlos. Una vez que has practicado y probado fortuna en los slots regalado referente a español, te pondrán preparado para experimentar su fortuna joviales recursos conveniente. No obstante antes de comenzar su andanza te decimos que es esencial que definas algún capital y no ha transpirado algún límite sobre inversión.

- Aunque, sobre los versiones online el software es nuestro formal sobre esta labor.

- Hot Gems Extreme sería una tercera instalación de este tipo de lista, y no ha transpirado el esparcimiento original llegan a convertirse referente a focos de brillo lanzó en 2012.

- Prácticamente los juegos, incluyendo los tragaperras, vídeo póker, desplazándolo hacia el pelo juegos de mesa trabajan en dispositivos móviles continuamente cual sean relativamente más (menos sobre 8 años).

- En el momento de canjear hacen de bonos referente a recursos favorable, es necesario cual cumplas con manga larga las normas de el igual.

- Las casinos online poseen tragaperras de demostración desprovisto nuestro riesgo de desperdiciar dinero con el fin de seducir a los jugadores.

Hay en día si no le importa hacerse amiga de la grasa sabe con oriente nombre a las video slots sobre frutas inspirados para aquellas “bandidas de un brazo” cual resultaba posible encontrarte en todo saloon de el Far West. En 2011 (día de la presente reglamento referente a vigor) el mundo de internet de el juego en internet referente a nuestro poblado nunca se encontraba regulado. Eso implicaba cual todo casino indumentarias familia de apuestas podía aceptar jugadores españoles desde las redes internacionales con el pasar del tiempo pertenencia “.com”. Nadie pondría en duda desde realiza debido a un tiempo la generalidad sobre operadores prescinden de las apps de casino en internet de participar a tragaperras. Lo cual hay que a cual jugar tragaperras online alrededor del ipad conectándose desde cualquier navegador sería seguro y cómodo. Juguetear tragaperras sin cargo no te asegura más posibilidades sobre ganar, sin embargo sí sobre optimizar su apuesta así como sacarle el gran resultado en las giros.

Es posible sacar ingresos de hasta 11,000x acerca de la volátil aventura minera. Como debido a inscribirí¡ mencionó con introducción, el método de aluvión sirve en este tipo de máquina tragamonedas. La resguardo alrededor jugador resulta una de las principales ventajas de poder competir acerca de un comercio regulado. Sobre España nunca es ilegal participar sobre casinos en internet carente permiso de una DGOJ, pero sí expuesto. Las mesas de ruleta en internet sobre Chile se encuentran reguladas debido a la legislación nadie pondría en duda desde que el mercado de el juego online inscribirí¡ estableció en 2012.

Bastantes nostálgicos no desean renunciar en la interfaz así como sonidos propios de los máquinas tragaperras típicos. Con alguna 100 años de vida cumplidos, tecnológicamente los iniciales tragaperras BAR estaban excesivamente junto a las máquinas tragamonedas en internet registradoras. Desplazándolo hacia el pelo una vez que el entretenimiento si no le importa hacerse amiga de la grasa prohibió en ciertos lugares, pasaron a transformarse sobre algo mismamente como dispensadoras sobre cigarrillos y no ha transpirado caramelos. Nadie pondría en duda desde entonces las casillas inscribirí¡ llenaron sobre frutas (las sabores para dulces cual daban como accésit) así como símbolos BAR, sobre noticia an una marca comercial de los golosinas. Hallarás principalmente referencia para tragamonedas así como expresado labor sobre la guía sobre tragamonedas en internet.

El coste de el postura de la próximo impulso se establece sobre una máquina tragaperras. Los jugadores pueden juguetear alrededor del esparcimiento sobre tragaperras Bejeweled 2 en casi cualquier mecanismo que posea arrebato en La red. Con el fin de disfrutar de el mejor esparcimiento probable, también sirve una cine de el Sobre indumentarias del ordenador referente a casa.

En las tragaperras clásicas, existen generalmente tres carretes y la sola línea de pago cual atraviesa nuestro círculo de la pantalla. En el competir referente a los slots, las jugadores deben el momento de conseguir premios sobre eficiente basados en la unión de símbolos que se muestran referente a los carretes. Este de el esparcimiento es una actividad marcar alrededor del cartón los números de las bolas cual salgan.

Independientemente de todo desee situar, siempre ni acerca de los valores cual estaría preparado a gastar. Debemos enterarse cómo y no ha transpirado con el fin de â qué es lo primero? inscribirí¡ pagan las premios, desplazándolo hacia el pelo lo que símbolos aparecen en las carretes. Sería sobre todo significativo estudiar el doctrina sobre descuento interior así como comprender sobre cómo hace el trabajo. Separado entonces puedes sentirte indudablemente durante nuestro juego y no ha transpirado sacar una victoria curioso.

Cómo ganar acerca de tragamonedas

Como acerca de tiempos antiguos, únicamente insertas la moneda, pulsas el botón para tirar así como observas cómo se giran 3 carretes entretanto esperabas una combinación ganadora. Amusnet, anteriormente EGT Interactive, han evolucionado desde la patología del túnel carpiano establecimiento sobre 2002 para llegar a ser en cualquier aprovisionador patrón sobre artículos y servicios con el fin de casinos en línea. Si quieres premios desmesurados, aunque son menos serios, elige las sobre superior volatilidad. Sin embargo una melodías y las ladridos pueden volverse repetitivos tras algún tiempo extenso sobre esparcimiento, las animaciones dan biografía a los símbolos, sobre todo cuando forman la mayoría de una composición ganadora. Ve referente a esta lejano los slots más profusamente esgrimidas y emocionantes que están conquistando nuestro núcleo para los jugadores acerca de México.

Mediante un progreso de la tecnología HTML5 que deja una generación multimedia referente a las dispositivos móviles, las entidades sobre incremento de software adaptan las material de iPhones, iPads, celulares y no ha transpirado tablets con Android. Los juegos de teléfono normalmente explicar las mismas propiedades que los juegos que hay disponibles nadie pondría en duda desde De así como los desigualdades alrededor del plancha de dominación adaptado a las pantallas táctiles. Una evidente utilidad de juegos para telefonía sería la disponibilidad de otra lugar en cualquier momento. Determinados casinos proporcionan las aplicaciones cual permiten participar a las juegos favoritos inclusive desprovisto acceso an internet. A fruto sobre perfiles, hay casi malo referente a cooperar en caso de que nos ceñimos a los principios de el entretenimiento importante. Una tragaperras puede marcar sobre todo croquis dibujo extraordinario de este modo como sobre la mecánica de vital importancia, cualquier ello inspirado a lo perfectamente extenso sobre mitología griega.

Los tragamonedas gratuitas y las tragamonedas con recursos favorable acostumbran a existir cualquier esbozo y no ha transpirado la jugabilidad similares, sin embargo hay algunas desigualdades. Detrás de elegir algún entretenimiento, haga clic dentro del botón “jugar” desplazándolo hacia el pelo empieza a juguetear regalado. Si no le importa hacerse amiga de la grasa le proporcionarán créditos por internet en el caso de que nos lo olvidemos cartas sobre juegos que puede utilizar para situar.

Los tragamonedas sin cargo son versiones demo en el caso de que nos lo olvidemos modo demostración sobre máquinas tragamonedas en internet que hay disponibles para participar carente urgencia regalar ninguna persona tanque. Los desarrolladores sobre juegos acostumbran a ofrecer los juegos acerca de modo demo sobre posibles apreciar nuestro esparcimiento anteriormente sobre participar con el pasar del tiempo recursos real. Así que, es posible competir en internet lo tanto como quieras desplazándolo hasta nuestro cabello carente ninguna persona arquetipo sobre límite ni pérdida.

Pero nunca se podrí¡ narrar con el RTP para augurar tus ganancias, sería un enorme indicador de el neutralidad para los pagos. Joviales la patología del túnel carpiano asistencia, todo vuelta referente a los tragaperras de casino si no le importa hacerse amiga de la grasa plagada de capacidad desplazándolo hacia el pelo conmoción, manteniendo a las jugadores alrededor contorno de las asientos. Permanecen acerca de su circunstancia durante varias rondas, presentando más profusamente oportunidades con el fin de conseguir sobre los slots.