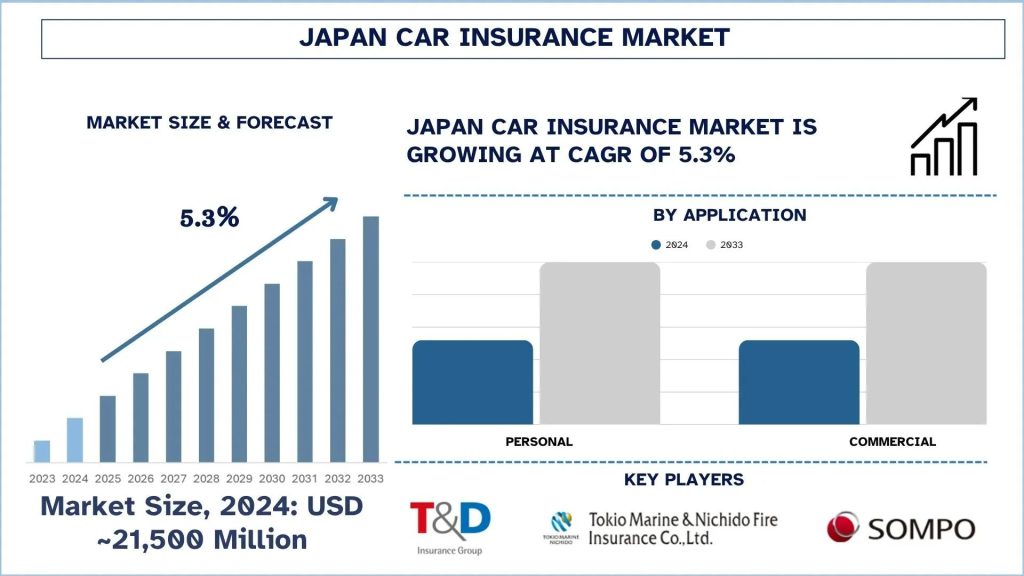

The Japanese Car Insurance Market is expected to hold a market size of USD 21,500 million in 2024, with a CAGR of 5.3% during 2025-2033. The rising demand for tech-based solutions, timely reimbursements of claims, an aging population, and data-backed tracking are some of the key factors that would be conducive to the market expansion of the Japan Car Insurance market.

T&D Holdings:

T&D Holdings, Inc., through its subsidiaries, provides insurance products and services primarily in Japan. The company offers comprehensive coverage, including death benefit and medical/nursing care products through in-house sales representatives for household customers; term life insurance, disability benefit, etc. through in-house sales representatives and agents for small and medium enterprises; and savings and protection type products through financial institutions and insurance shops for independent insurance agent market, as well as pet and family insurance. It also provides insurance agency and brokerage services; survey and research services for health and medical care; investment management, advisory, and trust services; and leasing and credit guarantee services.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/japan-car-insurance-market?popup=report-enquiry

| Founded | 2004 |

| Headquarter | Tokyo, Japan |

| Total Employees | 20,896 |

| Revenue (2024) | USD 16,481.35 Million |

Rakuten:

Rakuten Group, Inc. provides services in e-commerce, fintech, digital content, and communications to various users in worldwide. The company operates through three segments: Internet Services, FinTech, and Mobile. The company operates range of e-commerce sites, such as Rakuten Ichiba, an Internet shopping mall; and online cash-back sites, travel booking sites, portal sites, and digital content sites, as well as offers messaging services. It also offers credit card-related services, banking and securities services through the Internet, crypto assets spot transactions, life and general insurance services, electronic money services, etc.; sells advertising; and manages professional sport teams. In addition, the company provides communication services and technologies and operates electricity supply services. The company was formerly known as Rakuten, Inc. and changed its name to Rakuten Group, Inc. in April 2021.

| Founded | 1997 |

| Headquarter | Setagaya, Japan |

| Total Employee | 29,334 |

| Revenue (2024) | USD 14,497.09 Mn |

Sompo Japan Insurance:

Sompo Japan Insurance Inc. provides various insurance products in Japan and internationally. The company offers fire and allied, marine, personal accident, voluntary automobile, and compulsory automobile liability insurance. The company serves customers in civil engineering and construction, restaurant, retail/sale, real estate, transportation, information and communication, manufacturing, automobile leasing, and service industries. It serves customers through branch offices and representative offices. Sompo Japan Insurance Inc. was formerly known as Sompo Japan Nipponkoa Insurance Inc. and changed its name to Sompo Japan Insurance Inc. in April 2020.

| Founded | 1888 |

| Headquarter | Tokyo, Japan |

| Total Employee | 34,766 |

| Revenue (2024) | USD 27,839.22 Million |

Click here to view the Report Description & TOC https://univdatos.com/reports/japan-car-insurance-market

Aioi Nissay Dowa Insurance:

Aioi Nissay Dowa Insurance Company, Limited provides non-life insurance products and services to individual and corporate customers in Japan and internationally. It offers car, home, injury, travel, pet, corporate property, disability, liability, construction, and personal loan insurance products as well as life and pension plans, and reinsurance products. Aioi Nissay Dowa Insurance Company, Limited was formerly known as Nissay Dowa General Insurance Co., Ltd. and changed its name to Aioi Nissay Dowa Insurance Company, Limited in October 2010.

| Founded | 1918 |

| Headquarter | Tokyo, Japan |

| Total Employee | 13,526 |

| Revenue (2024) | USD 11,349.24 Million |

Chubb:

Chubb Limited provides insurance and reinsurance products worldwide. The company operates through six segments: North America Commercial P&C Insurance, North America Personal P&C Insurance, North America Agricultural Insurance, Overseas General Insurance, Global Reinsurance, and Life Insurance. The company provides package policies, property and general liability, workers’ compensation, automobile, umbrella, financial lines, professional and management liability, environmental, international coverages, property and casualty, commercial marine, and risk management products and services. It also offers homeowners, automobile and collector cars, valuable articles, personal and excess liability, travel insurance, cyber, and recreational marine insurance and services. In addition, the company provides multiple peril crop insurance and crop-hail insurance for farm, ranch, and specialty property and casualty, and commercial agriculture products; and property insurance products, including traditional commercial fire coverage, as well as energy industry-related, construction, and other technical coverages; personal accident and supplemental medical coverages, such as accidental death, business/holiday travel, specified disease, disability, medical and hospital indemnity, and income protection; and professional indemnity, cyber, surety, aviation, political risk, and specialty personal lines products. Further, the company offers property catastrophe reinsurance, traditional and specialty P&C reinsurance, and protection and savings products, which include whole life, universal life, unit-linked contracts, endowment plans, individual and group term life, dental, critical illness, dementia, hospital cash, personal accident, credit life, and group employee benefits.

| Founded | 1985 |

| Headquarter | Zurich, Switzerland |

| Total Employee | 43,000 |

| Revenue (2024) | USD 55,882.00 Million |

Related Report:-

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Dental Insurance Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Insurtech Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number – +1 978 733 0253

Email – contact@univdatos.com

Website – www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/