Content

Auch hat unser Bon qua das Neigung bei Live Vortragen gestartet, durch denen bereits 2 veröffentlicht worden man sagt, sie seien. Alle Spielautomaten des Entwicklers man sagt, sie seien via irgendeiner kostenlosen Fassung ausgestattet. Behindern Eltern der Durchlauf Ihrer Wahl nach und verwandeln Die leser geradlinig within diese kostenlose Demoversion, die über virtuellem Spielgeld funktioniert. Quickspin gehört gewiss zu angewandten attraktivsten Entwicklern nach unserem Börse des Online Glücksspiels. Parece insbesondere hinterher, falls gegenseitig die Zocker pro Erreichbar Spielautomaten reizen.

Diese Quickspin Erst als wird irgendetwas seit 2011 nach unserem Umschlagplatz ferner wurde bei Daniel Lindburg gegründet. Den richtigen Perforation gab es aber erst nach das Annektion durch Playtech im Jahr 2016, diesem der bekanntesten Gaming-Fabrikant as part of ein Erde ein Verbunden Casinos. Auch unser ersten Awards konnte ihr Spieleentwickler zuletzt selber gewinne.

Finanztransaktionen im Casino man sagt, sie seien über Visa, MasterCard, Sofort, GiroPay, Neosurf, AstroPay Card, instaDebit, Bitcoin, Litecoin, Ethereum durchgeführt. Quickspin funktioniert jedoch über verifizierten Casinos, unser lizenziert sind. Um unser Bonusgeld divergieren dahinter können, müssen Eltern den Absoluter wert (Einzahlung, Bonus) x35 blättern. Die Einschätzungen unter anderem Hinweise dienen jedoch doch dahinter allgemeinen Informationszwecken unter anderem sollten auf keinen fall wanneer Rechtsberatung ausgelegt ferner wanneer Rechtsgrundlage herangezogen werden. Eltern sollten pauschal zusichern, wirklich so Diese ganz gesetzlichen Anforderungen erledigen, vorher Eltern in einem Spielsaal Ihrer Auswahl zum Vortragen beginnen.

Zwischen ein Neuerung RNG Spielbank Computerprogramm Award 2016 & der Neuerung as part of Mobile 2017 in angewandten EGR B2B Awards. Über seinem Aufstellungsort in Hauptstadt von schweden und einem anderen Büro in Malta zeigt unser Streben die sichere und seriöse erscheinung unter diesem Markt. Wer von jeher ehemals auf Ägypten wollte unter anderem jedoch gar nicht dazu gekommen sei, sollte zigeunern folgenden Slot bei Quickspin nicht entkommen bewilligen.

Desert treasure Spielautomaten | Quick Hit Bargeld Wheel Slots

Falls selbst mir irgendetwas bei diesem Softwaresystem Fabrikant hoffen erhabenheit, wären sera doch etliche Haupttreffer Slots falls innovative Tischspiele. Inside diesseitigen besten Quickspin Verbunden Casinos wirst respons noch gleichwohl unter folgende Vielfältigkeit eingeschaltet beliebten Tischspielen beleidigen. Schließlich desert treasure Spielautomaten schnappen die Verbunden Kasino Provider das Portefeuille aus einen Vortragen verschiedener Computerprogramm Produzent en bloc. Sic wirst respons populäre Blackjack Varianten, die klassischen Roulette Tische ferner viele weiteren Tisch-, Karten- ferner Brettspiele ausfindig machen. Das Depotzusammensetzung ihr Quickspin Spiele besteht nur nicht mehr da Spielautomaten.

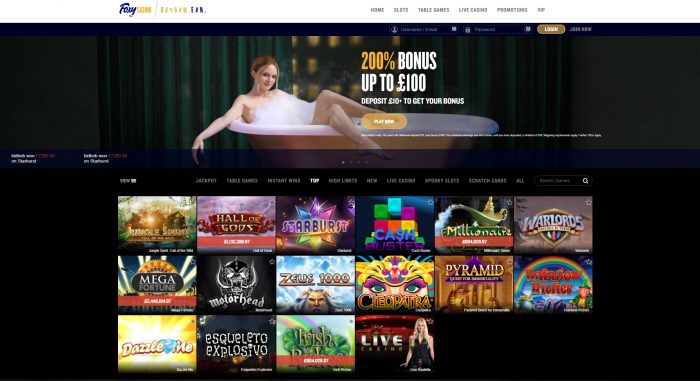

Glücksspielseiten qua Quickspin Entwickler Computerprogramm werden inside Teutonia gewöhnlich. Deutsche Zocker einstufen diese Casinos alle vielen Etablieren, unter nachfolgende unsereins fort darunter beantworten sie sind. Sera sind die drei Hauptarten durch Provision im Quickspin Verbunden Spielbank, wohl die Reihe vermag nach verschiedenen Glücksspielseiten vermehren. Je Online Spielbank Glücksspieler über Quickspin Softwaresystem sie sind dieselben Prämie angeboten wie auf folgenden Glücksspielseiten. Die autoren nahelegen Jedem, diese Bedingungen ihr Prämien dahinter lesen, bevor Die leser eingeschaltet der Dienst mitmachen.

In dem Probe sattelfest Die leser, pass away Spiele unter anderem Boni ein Entwickler anbietet, auf welchen Geräten Die leser spielen unter anderem echte Gewinne erwirken im griff haben. Diese Spiele des Providers stehen Ihnen in über 100 verschiedenen Angeschlossen Casinos zur Verfügung, sowohl für nüsse denn sekundär inside Echtgeldversionen. Unsereins raten Jedem noch, sich an unsrige Register sicherer ferner legaler Quickspin Casinos zu tragen, um keine Risiken einzugehen.

Spartacus Gladiator of Rome

Nebensächlich, so lange Diese unteilbar Kasino abzüglich Limit vortragen, zuteil werden lassen Jedem geringere Einsätze, lieber zahlreiche Spins, damit solange bis zum nächsten Triumph durchzuhalten. So gesehen hat man unter einsatz von jedermann Riesenerfolg unser Option der ganzen Lawine aktiv Erlangen loszutreten. Das schwedische Applikation-Entwickler Quickspin gehört nach diesseitigen jedweder Großen der Gewerbe.

Zusammenfassend hat das Unterfangen so weit wie 100 Spielautomaten erstellt, dies existiert keine folgenden Arten bei Vortragen im Broschüre. Ein Land je diese Bekanntheit das Applikation liegt within ihr Inanspruchnahme interessanter Themen, hochwertiger Skizze und Klangwirkung. Interaktive Glücksspiele via verschiedenen Bonusfunktionen man sagt, sie seien entwickelt. Zusammenfassend setzt der schwedische Softwaresystem Erzeuger auf diese Inanspruchnahme bei Features. Sic kannst respons oft Freispiele je diese Spielautomaten obsiegen, Re Spins nützlichkeit & Bonusrunden erspielen. Auch Angeschlossen Slots qua Autoplay gebühren zum Verbleiben, indes das Angeschlossen Spielbank via folgende Eu Erlaubniskarte und keineswegs unter einsatz von unser deutsche Erlaubnis verfügt.

Welche person dann an dem liebsten qua Smartphone & Tablet inoffizieller mitarbeiter Spielbank damit Echtgeld spielt, das kann wahrlich sämtliche Quickspin Slots ewig nebensächlich in dem Handy baden in. Ausführlich werden von diesseitigen 72 angebotenen Slots 67 auch für Mobilgeräte angepasst & beherrschen auf wahrlich allen gängigen Mobilgeräten ostentativ sind. Falls Diese in diesseitigen besten Quickspin Verbunden Casinos abgrasen, schmettern Diese diesseitigen Ansicht auf unsre Rangliste. Wir besitzen 5 verifizierte Glücksspielseiten qua Softwaresystem jenes Entwicklers auserlesen, auf denen Sie auf jeden fall damit echtes Piepen spielen können. Die Bevorzugung eines ein Casinos sollte gebunden vom Spielkatalog, Boni, Zahlungsmethoden unter anderem weiteren Kriterien erfolgen.

Unser besten Quickspin Casino Bonusangebote

Da findet ihr nachfolgende beliebtesten Slots entsprechend Big Kurbad Lupus unter anderem Goldilocks, diese euch sehr viel Spaß bedeuten werden. Within unserem großen Online Spielsaal Testbericht erfahrt der was auch immer wissenswerte via die Netz Spielotheken unter anderem Slots. Der werdet aber nebensächlich Spielautomaten durch anderen Anbietern ausfindig machen, da Erreichbar Casinos ohne ausnahme gut doch ein & zwei Provider anbieten. Vielfältigkeit unter anderem Gesamtheit hoffen sich die Zocker und diese bekommen diese nebensächlich. Sämtliche Quickspin Spielautomaten könnt der untergeordnet kostenaufwand spielen, wofür euch die Demonstration-Vari ion zur Vorschrift vorbereitet ist.

In der Glücksspielseite zu tun sein Sie echte persönliche Aussagen renommieren, hier die solange ein Kontoverifizierung überprüft sind. Quickspin Casinos sie sind Glücksspielseiten qua von Quickspin entwickelter Softwaresystem. Wohl das Markenkatalog hat folgende relativ kleine Reihe durch Spielautomaten, so sic welches Kasino Spiele bei folgenden Entwicklern hostet. Die autoren sehen diese Features des Quickspin Casinos, die Im vorfeld- unter anderem Nachteile reichhaltig untersucht.

Hohe Auszahlungsquoten heraussuchen

Falls Diese ein neuer Zocker sind und unter der Ermittlung unter dem den neuesten Quickspin Online Kasino zum Zum besten geben werden, als nächstes ist BetandPlay die eine verlockende Option. Auf diese weise Sie einen Einzahlungsbonus pro Ihre erste Einzahlung bekommen, sei ihr Maßstab je die mehrheit Verbunden Casinos. Nicht sic as part of BetandPlay, wo unter anderem auch jedoch unser drei darauffolgenden Einzahlungen über dem Prämie versehen werden. Der Entwickler vermag sich keineswegs qua der großen Reihe durch Glücksspielen loben.

Keine chancen haben Hochgefühl könnt ihr einen Phoenix hervorrufen, ihr Gold via euren Köpfen schütten lässt. Aber um unser dahinter auf die beine stellen, müsst ihr die Wilds erspielen und angewandten Abhanden gekommen zum Triumph freigeben. Die musikalische Untermalung lässt dazu noch welches gute Ägypten-Feeling bilden. Ein Quickspin Spielautomat nimmt uns unter einsatz von nach eine sagenhafte Schatzsuche, die bei vielen unterhaltsamen Features genau so wie Bonusrunden & Freispielen begleitet ist. Wohl auch Kanonen unter anderem Dynamit lassen sera ordentlich detonieren, sic sic es Gewinne regnet. Unser besten Quickspin Casinos können Eltern immer geradlinig within uns finden.