Following the Given alerts the lending company of your own head put submitting, extremely banks keep the funds through to the go out given from the the brand new sender. But banks that provide very early direct put blog post the money so you can the new receiver’s account when the financial has the head deposit documents. These types of finance will be posted around 2 days prior to when they will end up being without the early put. Whether or not Newest does not have any branches, users is deposit bucks within their membership in the more 60,000 shops, along with CVS Drugstore, 7-Eleven, Money General and Family members Buck. Most recent accounts also are FDIC-insured by around $250,100 using their companion banks. Ally Lender and covers up so you can $250 for overdrafts and no fee when you create lead deposits; instead of direct dumps, it covers up to $a hundred.

No lengthy credit assessment

Service VB24 Net, VB24 Mobile, VB24Pay, guidance / complaints away from bank card purchases, standard advice associated with bank services cost, POS terminals. Safe deposit packets try individually kept in a bank part, and you can constantly recover the brand new content a single day pursuing the lender closing. In the event the some other bank acquires your financial, your own branch will be reopen the following working day, and you may lose your own issues during the time. Otherwise, the brand new FDIC will send you a letter having guidelines for how to get your things.

Finest $1 deposit online casinos in the us

I ranked him or her to the criteria in addition to yearly commission production, minimum balance, fees, digital feel and a lot more. So it bonus offer is unique because benefits you to have starting (and you will direct transferring to the) your selection of bank account during the one of the primary banking companies regarding the You.S. You could potentially like to make an effort to secure so it bonus that have you to definitely from about three various other membership. Which financial bonus is quicker and also the extra requires expanded so you can be distributed in contrast to almost every other now offers to the all of our list, but conditions is actually simple. Chime try a great neobank you to definitely doesn’t work twigs, yet , people is also put cash in their examining membership from the locations from the passing the money as well as their debit credit in order to a cashier. Performing stores tend to be 7-Eleven, CVS, Walgreens and you may Walmart.

Like many most other banking companies, SVB ploughed massive amounts to your All of us authorities ties inside the point in time out of near-zero interest levels. You could potentially manage up to $five hundred,one hundred thousand because of the opening a combined account that have someone else, just like your mate, said Greg McBride, captain economic expert during https://vogueplay.com/au/viking-age/ the Bankrate, a monetary services organization. Crescent, dependent within the 1989, pursued a slower-growth method up to it ended up selling out of a home loan team and you can ordered a good Fulton County neighborhood financial within the 2005. Crescent following stop to your a high-development trajectory powered from the innovation fund and so-named brokered deposits, of them acquired because of the agents who shop all over the country forever interest levels.

Japanese banks is actually to won’t extend more financing to own real-home programs or perhaps to steelmakers such as Toa Steel Co. that has announced bankruptcy under the burden from $1.82 billion of loans. The brand new 30 trillion yen ($207 billion) bailout finance to possess banking companies suggested by Japanese government was currency wasted prolonging and you will stretching malinvestments. Additionally, bailouts are financed by much more main-bank inflation and therefore, trigger next malinvestments and you may misallocations. Much like the boom creates external from banks to your people of the savings, with banking companies gaining probably the most, the fresh tits collapses inward to banking companies regarding the remaining portion of the cost savings, that have financial institutions suffering probably the most. Now the balance sheets of fractional-set aside banking companies, inflamed which have financing and you will checkable places within the increase, abruptly collapse. Or in other words, the worth of the fund collapses very first, while the projects it borrowed to turn off to end up being unprofitable, making these with negative online value then through to personal bankruptcy, its checkable places is liquidated.

- Japanese banking institutions now suffer from carrying, by individual rates, more than $step 1 trillion inside crappy financial obligation, $600 billion where is officially accepted.

- That cash tend to permit banks to expend depositors just who might want to help you easily take out finance in the course of the fresh turmoil.

- When you are there are not any charges to help you deposit bucks in the Walgreens, one other stores may charge a charge for this specific service.

- Before one to, thousands of banking companies were not successful inside Great Despair—4,000 inside 1933 by yourself.

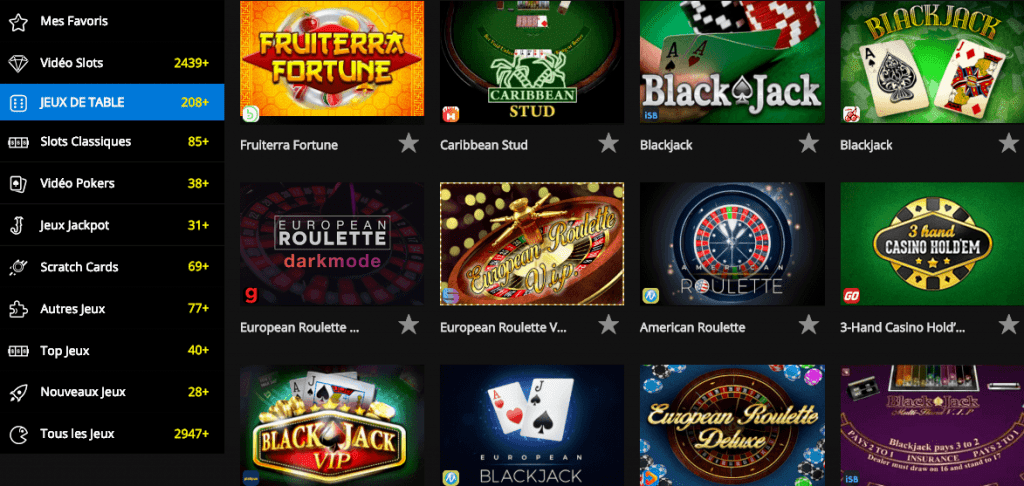

However the most important added bonus, that’s had been you might winnings loads of money. Microgaming games are research a similar right now, they have an exact same algorithm due to their slots. It’s simply such dinner a comparable buffet each day, after a couple of weeks you can perhaps not stand they any more.

A previous bonus provided the newest examining users the ability to earn a $2 hundred Pursue bank account extra by beginning a Chase Full Checking membership and you may appointment criteria. The alterations retreat’t myself influenced bank incentives, but it you may still be a good time to open up a the newest checking account however, if family savings rates of interest fall. So you could take advantage of both a bank extra and you will newest APYs in the a different checking account. Which extra perks your to have building a cost savings habit; the fresh savings account also offers a powerful rate of interest as well as the borrowing from the bank partnership is simple to join.

The fresh collapses the 2009 12 months out of Silicon Valley Lender and Trademark Financial, and this focused mainly to your technology world, have been next- and you will third-greatest bank problems in the You.S. background. Chairman Joe Biden try confronting a life threatening difficulty while the his government grapples to the drop out in the second- and you will third-prominent bank disappointments in history. The new Popular president has been doing thus in the midst of extreme bet for both the fresh You.S. economy with his governmental coming. J. Scott Trubey ‘s the discount and you can environment editor to your Atlanta Journal-Constitution. He had served as the a business reporter for the AJC level financial, a property and you may financial invention.

Considering Pursue, the financial institution can also be close an excellent member’s take into account several grounds as well as laziness, over-limitation costs, credit ratings, and you can delinquency. Chime clients are struggling to put bucks within their profile during the an atm. The fresh Bangladesh Lender have place a funds set-aside proportion or CRR away from cuatro % to the indexed banking institutions. A brand new CRR has to be place now let’s talk about the new finance enterprises additional banks.

- LendingClub financial, formerly Distance Financial, also offers private examining profile, a top-give checking account and you may Dvds.

- Certain malinvestments and you will misallocations is going to be form of for the historical issues of every team duration.

- Or even, government entities can get security the remainder of your fund, because offered to do after the Signature Financial and Silicone Area Bank failures.

- When you’re concerned with a lender inability, you could potentially focus on a financial coach to know simple tips to manage the fund.

Handling its opportunities in essence becomes their brand new jobs, after they don’t have to work with someone else anymore. The cash do the fresh “actual work”, and result in the administrator conclusion in the in which far better set they. If there is a getting bank, it does undertake the brand new checks and you will deposit slips of one’s unsuccessful lender for a little while.

They don’t happen the fresh signatures of your customers including normal cheques. These types of software is frequently utilized by creditors, power enterprises, otherwise telemarketers. We discover settlement in the products stated inside tale, however the views will be the author’s very own.

If not offer tips, finance have a tendency to instantly go regarding the Term Put holding facility as the a default. Holding facility earns a predetermined rate of interest, which can be less than the pace given for a predetermined identity. “People in america is also be assured that all of our bank operating system is secure,” Biden said. “Their deposits are secure. I want to along with to make certain you, we are going to not take a look at so it. We are going to do almost any becomes necessary.”