The parts of assets, liabilities, and equity are separated into more sub-headings for providing in-depth data to the clients. The parts of assets and liabilities are likewise named current and non-current. Large organizations use a classified balance sheet as the format that delivers in-depth data to the clients for better decision-making. The formula classified balance sheet template is used to create the financial statements, including the balance sheet and will give you an accurate snapshot of your company’s financial health. Classified balance sheets present the sub-categories or classifications of assets and liabilities. Understanding these divisions and sub-divisions is pivotal for financial analysis and business decisions.

Assets

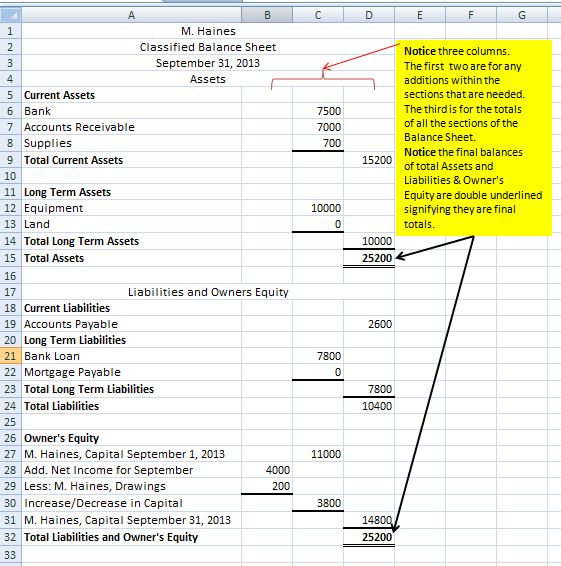

However, there is a condition of preparing and publishing financial statements in partnerships and companies to make the financial position clear. A classified balance sheet displays details about a business’s assets, liabilities, and shareholders’ equity divided into account subdivisions. Therefore, the above steps are essential to prepare a classified balance sheet complete the process so that it can be used by the management and other stakeholders for analysis and investment decisions. This include note payable, account payable, accrued expense, current portion of installment, deferred income tax and long term includes bond payable, bank loans etc. Current liabilities incorporate all debts that will become due for the current time. Basically, this is the amount of principle needed to be repaid in the following year.

- Fair disclosure is also one of the benefits offered by a classified balance sheet.

- Financial Statements of the company show its financial health, position and its operational activities.

- For example, an investor interested in the day-to-day operations and profitability of the firm would like to calculate the current ratio.

- The insights you can gain from the balance sheet—along with other financial statements—allow you to make informed financial decisions as your business grows.

Intangibles in Tech vs. Physical Assets in Manufacturing – The Strategic Role of Asset and Liability Classification

In the classified balance sheet, assets are further sub-classified into current and non-current assets. Whichever type of balance sheet is adopted by a business or individual, the usefulness of the balance sheet for financial analysis is undeniable. The classified balance sheet is the most commonly used type of balance sheet. A classified balance sheet is identical to a traditional balance sheet. However, unlike a typical balance sheet, the classified sheet bifurcates the assets, liabilities, and equity into other different sections for each type. However, even though such classification are very useful and provide more meaning to the document, the format may vary according to the company rules or the industry.

Traditional Balance Sheet Format

Use our guide to learn the importance of balance sheets for small businesses. Learn how to format your balance sheet through examples and a downloadable template. Classified balance sheets are more than just static reports—they are dynamic tools that aid many stakeholders in making vital business decisions.

Current Assets – The Classified Balance Sheet

A classified balance sheet lists the standard contents of a normal balance sheet, which include the assets, liabilities and the value of the equity but there are further classifications or categories of each. It is a more detailed approach, whereby the business will organize the data in such a manner so that more specific and detailed information is available to whoever tries to analyse or read it. A classified balance sheet is a financial document that subcategories the assets, liabilities, and shareholder equity and presents meaningful classification within these broad categories. Simply put, it presents the firm’s financial status to the user in a more readable format. It is one step ahead of the balance sheet, which is nothing but a way of representing the valuation of the assets and liabilities. When assets and liabilities are sorted into categories, it’s easier to see how a company earns and spends money.

Categorizing Liabilities into Current and Long-Term Sections

Understanding the regulatory and compliance factors that shape classified balance sheets is crucial for both preparers and users of financial statements. These standards and requirements bring uniformity, consistency, and transparency to the complex world of financial reporting. Besides, it is also hard to identify different items relating to varying classifications. For example, you can take totals of current assets and current liabilities in the classified balance sheet to calculate the current ratio.

An organization utilizes current assets for taking care of current liabilities since it might effectively access current assets. Long-term liabilities incorporate loans the organization doesn’t have to pay off within a year’s time, although the organization might have to make a few installments on the loan by the next year. Small businesses and sole proprietorship do not have a condition of publishing their financial statements.

Examples of long term liability can be corporate bonds, mortgages, pension liabilities, deferred income taxes, etc. Non-current assets are like the furniture in your house or a family car. This group has fixed assets like buildings and machines, intangible assets like patents and copyrights, and investments that take longer to pay off. It’s like dumping your books, lunch, and sports gear into one big backpack. While it still tells us what the company owns and owes, it doesn’t organize the information neatly. In short, a classified balance sheet is a useful tool for anyone trying to understand a company’s financial strength and potential for future success.

There are many benefits of using a classified balance sheet over a simple one. Retained earnings signify the leftover earnings after a company has paid its expenses and dividends to the shareholders. Those obligation which will be payable after a year is called long term liabilities. Implement our API within your platform to provide your clients with accounting services. If a company has surplus cash available and it sees a valuable investment opportunity in some other business, it can decide to buy a stake in it.

At its core, a classified balance sheet is an enhanced version of a standard balance sheet, with a deeper level of organization and clarity. It groups or ‘classifies’ assets, liabilities, and equity into several subcategories, making it easier for stakeholders to analyze and interpret the data. Current liabilities like current assets have an existence of the current financial year or the current operating cycle. These are usually short debts that are expected to be taken care of utilizing current assets or by creating a new current liability. The important part is that these need to be settled fast and not be kept pending for later installments.

It likewise educates a lot about the executives who are not only about the valuations but also how these have been calculated. The long-term section incorporates the commitments that are not due in the following year. A part of these long-term notes will be expected in the following year. Along these lines, this part is constantly reflected in the current section.