Global Commercial Greenhouse Market Size, Share, Trends, and Forecast 2025–2033

Market Overview

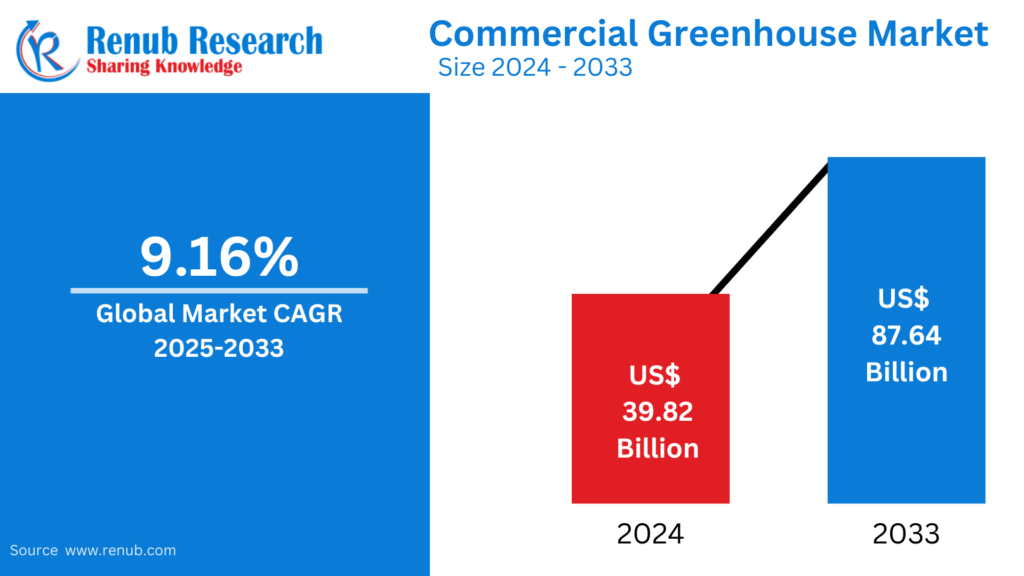

The Global Commercial Greenhouse Market was valued at USD 39.82 billion in 2024, grew to USD 43.47 billion in 2025, and is projected to reach USD 87.64 billion by 2033, exhibiting a strong CAGR of 9.16% between 2025 and 2033. This growth is largely fueled by increasing food security concerns, climate change challenges, and rising demand for sustainable, high-yield crop production systems.

The expansion of year-round farming, integration of advanced technologies like IoT, AI, hydroponics, and smart climate control systems are transforming the traditional agricultural landscape. Governments globally are endorsing this transformation through policy support, subsidies, and green incentives, contributing to the overall boom in the commercial greenhouse sector.

Market Segmentation

By Type

- Plastic Greenhouses

- Glass Greenhouses

By Product Type

- Fruits and Vegetables

- Flowers and Ornamentals

- Nursery Crops

- Others

By Equipment

- Cooling Systems

- Heating Systems

- Others (Irrigation, Lighting, Ventilation)

By Greenhouse Type

- Tunnel

- Gutter Connected

- Hybrid

- Lean-To

- Roof-Type

By Region/Country

- North America (United States, Canada)

- Europe (Germany, Netherlands, France, Others)

- Asia-Pacific (China, India, Japan, Others)

- Latin America

- Middle East & Africa

Key Market Drivers

1. Year-Round Fresh Produce Demand

With rising consumer preference for organic, pesticide-free, and locally-grown produce, greenhouses allow consistent cultivation across all seasons. The convenience and quality associated with these crops are driving retail, export, and foodservice industries alike.

🟢 Example: In April 2024, Fresh Del Monte partnered with a vertical farming firm to set up urban indoor greenhouses to meet local fresh produce needs while reducing logistics costs.

2. Integration of Smart Technologies

Advancements in automated irrigation, LED grow lighting, AI-based climate control, and hydroponics are maximizing yields and reducing operational inputs like water and energy.

🟢 Example: In December 2024, Topian launched a high-tech smart greenhouse in NEOM, Saudi Arabia, leveraging real-time climate optimization tools for advanced farming.

3. Government Support and Policy Incentives

Governments are endorsing greenhouse farming through subsidies, training, low-interest loans, and infrastructure development to meet food security targets.

🟢 Example: The U.S. Department of Agriculture (USDA) invested $90 million in innovation grants to promote conservation technologies in greenhouses (July 2024).

Related Reports

Ireland Organic Fertilizer Market

Netherlands Organic Fertilizer Market

Market Challenges

1. High Initial Setup Costs

Constructing and equipping greenhouses with modern technology involves significant capital investment, often a barrier for small and medium-scale farmers.

2. Shortage of Skilled Workforce

Operating high-tech greenhouses requires a technically skilled workforce, and lack of training and awareness limits adoption in emerging regions.

Key Segment Analysis

Plastic Commercial Greenhouses

- Widely adopted due to low cost, durability, and ease of installation.

- High demand in emerging markets where cost sensitivity is high.

- Polyethylene and polycarbonate materials offer insulation and UV resistance.

Fruits and Vegetables Greenhouses

- Largest revenue-generating segment.

- Focus crops include tomatoes, lettuce, cucumbers, bell peppers, and leafy greens.

- Integration with hydroponics and vertical farming further boosts productivity.

Cooling Systems in Greenhouses

- Essential in hot climates to maintain crop-friendly conditions.

- Use of evaporative cooling, shade nets, and ventilation fans enhances yields and water-use efficiency.

Tunnel Greenhouses

- Low-cost solution for SMEs and smallholder farmers.

- Ideal for regions with moderate climate and limited infrastructure.

- Easy to set up and manage for seasonal and perennial crops.

Hybrid Greenhouses

- Mix of natural ventilation and smart technologies.

- Cost-effective alternative to fully automated systems.

- Offers flexibility for diverse crop production with better energy efficiency.

Smart Greenhouses

- Employ IoT devices, AI, and robotics to monitor environmental parameters.

- Enable remote management, reduce labor costs, and improve yield prediction.

- Rapid adoption in North America, Europe, and Asia-Pacific.

🟢 Example: February 2025, MAPNA Electric Co. launched Iran’s first smart greenhouse using IoT to monitor irrigation and environmental variables.

Hydroponic Greenhouse Systems

- Soil-less farming method that uses nutrient-rich water in a closed loop.

- Saves 90% more water compared to conventional farming.

- Systems like NFT, DWC, aeroponics are increasingly popular among commercial growers.

🟢 Example: In September 2024, Magic Sun launched premium Roma tomatoes in Mexico using hydroponic greenhouse cultivation for better flavor and sustainability.

Regional Analysis

United States

- Leading market due to strong tech adoption and organic food demand.

- States like California, Texas, and Florida are hubs for greenhouse-based farming.

- Government-backed R&D, tax credits, and infrastructure grants are spurring growth.

Germany

- Emphasizing renewable energy integration and energy-efficient designs.

- Growing urban farming trend and strong public-private R&D initiatives.

- €3 billion financing package announced in December 2024 for green and bioeconomy development.

India

- Rapid market expansion driven by population growth and climate variability.

- Focus on horticulture productivity, export-driven crops, and government subsidy schemes.

- ₹1,765 crore allocated for planting material improvement in 2024 under horticulture mission.

Market Outlook: 2025–2033

The commercial greenhouse market is set to more than double in value over the next decade, with Asia-Pacific and Latin America expected to be the fastest-growing regions due to urbanization, rising food security needs, and favorable climates. Innovations in vertical farming, bio-climate designs, and renewable energy integration will define the next phase of sustainable agricultural growth.

Key Questions Answered in the Report

- What is the global commercial greenhouse market size and projected growth through 2033?

- What are the key factors driving growth in the greenhouse farming industry?

- What are the main types and equipment used in commercial greenhouses?

- Which product types are most commonly grown in commercial greenhouses?

- How do smart and hydroponic greenhouses impact productivity and sustainability?

- What role do government initiatives play in market expansion?

- What are the major technological advancements shaping the market?

- Which countries are leading in the adoption of commercial greenhouse systems?

- What challenges do commercial greenhouse operators face?

- How will regional dynamics shape the future of the commercial greenhouse industry?