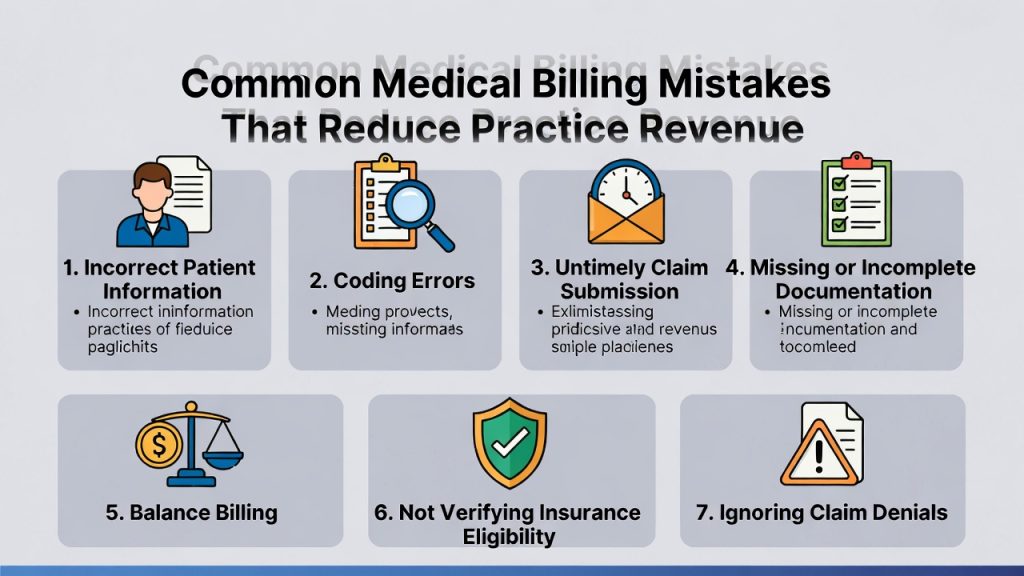

Medical practices often focus their energy on patient care, clinical accuracy, and regulatory compliance. While these areas are essential, billing operations play an equally critical role in keeping a practice financially stable. Even small billing mistakes can lead to denied claims, delayed payments, and revenue leakage that adds up over time. Understanding the most common medical billing errors is the first step toward protecting practice income and maintaining consistent cash flow.

Inaccurate Patient Information

One of the most frequent billing issues begins before a patient even sees the provider. Incorrect demographic details, outdated insurance information, or spelling errors in names can cause claims to be rejected automatically. Insurance companies rely on exact data matching. When front-desk staff do not verify insurance eligibility or patient details at every visit, it creates unnecessary payment delays and rework for billing teams.

Coding Errors and Mismatched Documentation

Medical coding requires precision. Using incorrect CPT, ICD-10, or HCPCS codes can result in underpayment, overpayment, or claim denial. Coding errors often happen when documentation does not fully support the services billed. For example, missing modifiers or incomplete procedure notes can trigger payer audits or rejections. Over time, these errors weaken a practice’s revenue cycle and increase administrative burden.

Failure to Meet Timely Filing Deadlines

Every insurance payer has strict claim submission deadlines. Missing these timelines means the claim may never be paid, regardless of how valid it is. Practices that rely on manual processes or understaffed billing departments are especially vulnerable to timely filing issues. Even a short delay in claim submission can lead to permanent revenue loss.

Not Following Payer-Specific Rules

Each insurance company has its own billing guidelines, authorization requirements, and coverage limitations. Submitting claims without prior authorization or ignoring payer-specific rules often leads to denials. When billing teams are not up to date with policy changes, errors increase, and appeal rates rise, slowing down cash flow.

Ignoring Claim Denials and Appeals

Denied claims are not always lost revenue, but ignoring them turns them into losses. Some practices lack a structured denial management process, allowing denied claims to sit unresolved. Without timely follow-up, the appeal window closes, and revenue is forfeited. Effective denial tracking and follow-up are essential for long-term financial health.

Inconsistent Charge Entry

Errors during charge entry can result in missed billable services or incorrect pricing. When procedures are not captured accurately, practices may underbill and lose income without realizing it. Inconsistent charge entry is especially common in busy clinics where documentation is rushed or workflows are unclear.

Lack of Regular Billing Audits

Many practices do not review their billing performance regularly. Without audits, errors go unnoticed, trends are missed, and inefficiencies remain uncorrected. Routine internal reviews help identify recurring mistakes, training gaps, and opportunities for improvement before they impact revenue significantly.

How Professional Billing Support Helps

To avoid these costly mistakes, many practices rely on experienced medical billing partners who understand payer requirements, coding standards, and compliance rules. Companies like Right On Time Billing provide structured billing workflows, accurate claim submission, and proactive follow-up that reduce errors and protect revenue.

Conclusion

Medical billing mistakes rarely happen all at once, but their financial impact accumulates quietly over time. By improving front-end processes, ensuring accurate coding, monitoring denials, and staying current with payer rules, practices can significantly reduce revenue loss. A reliable billing strategy is not just an administrative task—it is a core part of a successful medical practice.