A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Computing Direct Labor Variance

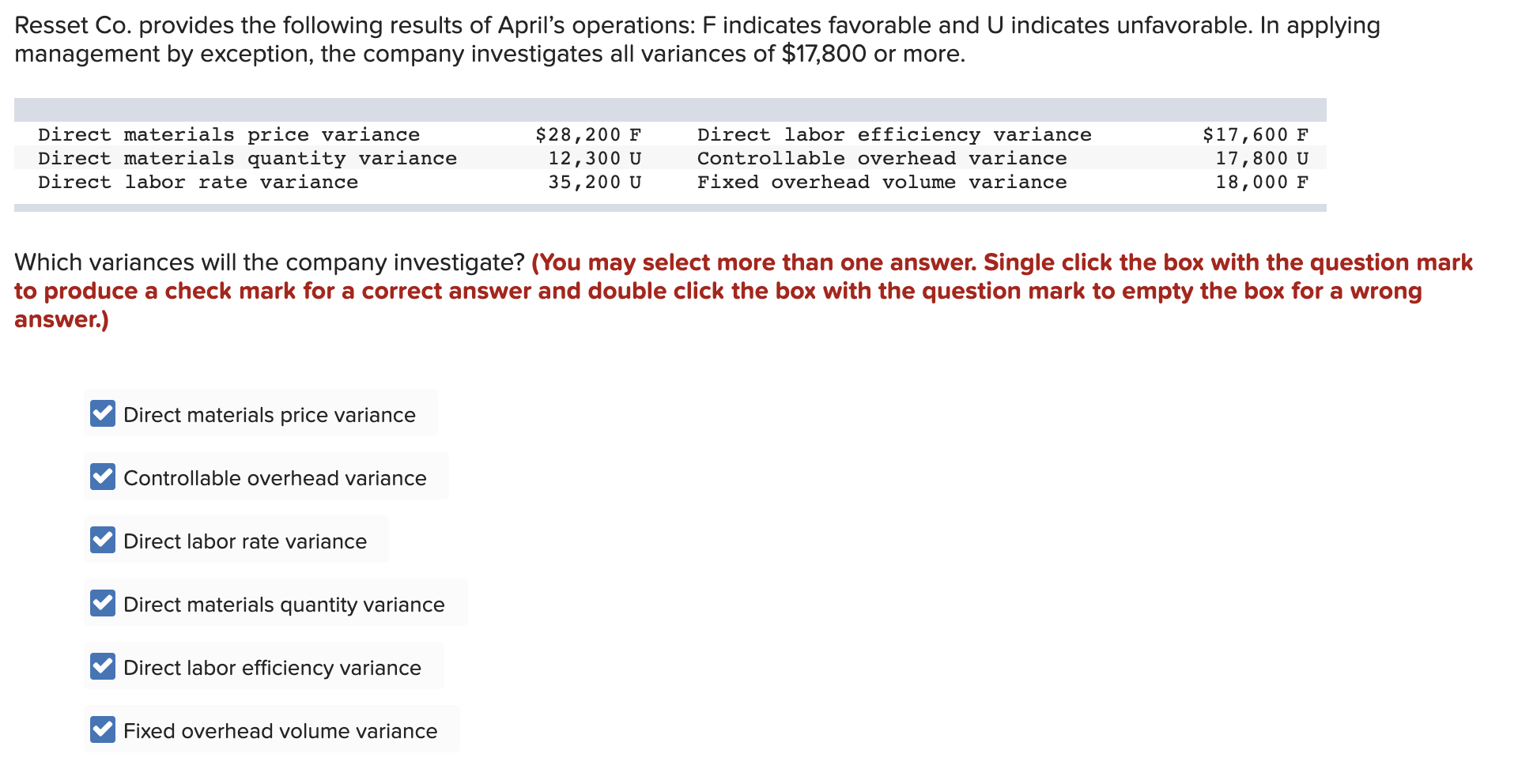

Figure 10.6 “Direct Labor Variance Analysis for Jerry’s Ice Cream” shows how to calculate the labor rate and efficiency variances given the actual results and standards information. Review this figure carefully before moving on to the next section where these calculations are explained in detail. After an accounting period is closed, managers evaluate operational results and compare them to budgeted projections. Companies that create products typically analyze the actual price they paid for raw materials compared to what they expected to pay. The direct labor variance is the difference between the actual labor hours used for production and the standard labor hours allowed for production on the standard labor hour rate.

Importance and Usage Scenarios

Essentially, labor rate variance addresses wage-related costs, while labor efficiency variance assesses the impact of productivity variations on labor costs. Suppose XYZ Widgets employs a direct labor workforce of 10 people, who work 40 hours per week, and they earn an average of $18 per hour. Additional payroll taxes and benefits total $1,800, which gives a total direct labor weekly payroll expenditure of $9,000. Ten workers normally work 400 hours in a week, so the standard or average cost of one hour of direct labor equals $9,000 divided by 400, or $22.50. Recall from Figure 10.1 “Standard Costs at Jerry’s Ice Cream” that the standard rate for Jerry’s is $13 per direct labor hour and the standard direct labor hours is 0.10 per unit.

Calculation Formula

The direct labor hourly rate, also known as the labor rate standard, includes the hourly pay rate, fringe benefits costs and your portion of employee payroll taxes. This shows that our labor costs are over budget, but that our employees are working faster than we expected. This determination may stem from meticulous time and motion studies or negotiations with the employees’ union. The LEV arises when employees utilize more or fewer direct labor hours than the set standard to finalize a product or conclude a process. It mirrors the concept of the materials usage variance in tracking resource utilization against predetermined benchmarks.

The purpose of calculating the direct labor efficiency variance is to measure the performance of the production department in utilizing the abilities of the workers. A positive value of direct labor efficiency variance is obtained when the standard direct labor hours allowed exceeds the actual direct labor hours used. A negative value of direct labor efficiency variance means that excess direct labor hours have been used in production, implying that the labor-force has under-performed. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. There are two components to a labor variance, the direct labor rate variance and the direct labor time variance.

Monitoring this variance enables you to identify different areas in which productivity can be improved and, even more importantly, where time and costs are being wasted. The concept of labor efficiency variance arises from the need to control costs and optimize productivity in manufacturing and service industries. By measuring deviations in labor usage, businesses itemized tax deduction calculator can identify areas of inefficiency, wastefulness, or overperformance. Labor efficiency variance compares the actual direct labor and estimated direct labor for units produced during the period. Before we go on to explore the variances related to indirect costs (manufacturing overhead), check your understanding of the direct labor efficiency variance.

Addressing these challenges requires a comprehensive approach involving continuous evaluation, industry foresight, and a nuanced understanding of the production landscape. To calculate Direct Labor Mix Variance you must first identify the exact amount of labor it requires to produce a product. Organizations can use DLYV to identify cost-saving opportunities, measure the productivity of their labor force, and improve operational efficiency. Measuring the efficiency of the labor department is as important as any other task. Doctors, for example, have a time allotment for a physical exam and base their fee on the expected time. Insurance companies pay doctors according to a set schedule, so they set the labor standard.

We’ll also show the formula used to calculate it and the factors that affect its calculation. By the end, you’ll be able to understand how this measurement can improve your project’s labor costs, which means that it will ensure a more profitable outcome. Usually, direct labor rate variance does not occur due to change in labor rates because they are normally pretty easy to predict. A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. It is important to have a consistent employee timesheetsoftware or app for long term labor cost success.

- Only recurring processes benefit from tracking this variance; in cases when commodities are produced infrequently or over a lengthy period of time, tracking this variance serves little purpose.

- If the company fails to control the efficiency of labor, then it becomes very difficult for the company to survive in the market.

- These include all the expenses you pay outside of labor costs — things like building costs, property taxes, and utilities — and they can be calculated either monthly or annually, depending on the needs of your business.

It is a very important tool for management as it provides the management with a very close look at the efficiency of labor work. Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement. Average acceleration is the object’s change in speed for a specific given time period. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.