Posts

Home buyers inside the New york can be qualified to receive help with off costs and you can closing costs from one from a couple statewide firms. State Earliest also provides an outlying step to possess homebuyers within the underserved parts. It includes to 8,500 in the forgivable deposit assistance close to unique repaired-price funding for both first-time and disperse-upwards individuals, with alternatives for FHA, conventional, USDA, or Virtual assistant finance. The brand new Puerto Rico Housing Financing Expert (PRHFA) program try an important financing to own low and reasonable-earnings homeowners inside Puerto Rico.

Do not faith one give prize notification which comes away from social networking platforms including Facebook or Instagram. Never post any money in order to anyone due to a money application otherwise wire otherwise any form away from money for a great give. When trying to ensure the newest legitimacy out of a give, it is vital to take on who is offering the offer. Is it a federal government give from a federal, state or local company? If the financing resource isn’t familiar, spend some time researching them to find out if the fresh entity try credible. You need to get the business on the Internal revenue service site having fun with the new ‘look from the organization name’ solution.

What number of paylines try 10, but it is as much as the fresh punter that they want to to engage. imp source Punters create winnings the overall game whenever similar icons line-up with her on the paylines. From the initiating all paylines, the new gamblers increases the probability of winning. You could potentially receive a downpayment financing as much as cuatropercent of the complete financial amount when in addition to property Virtue first mortgage. The total amount expands in order to 5percent to have a normal HFA Well-known mortgage.

That it grant can be applied in order to off costs, settlement costs, mortgage price buydowns, or pre-paid back mortgage insurance rates. A faithful system to own first-generation homeowners inside the come across metropolitan areas giving a twenty five,000 forgivable loan for use to own a deposit and you will closing costs. This is a no-desire financing without monthly obligations that is forgiven after four many years. Usage of a medication financial and you can completion away from an excellent homebuyer knowledge direction also are criteria of your own program. The new IHD Availability Forgivable program offers a good forgivable mortgage to aid on the deposit and settlement costs.

Imp source: Report Authorities Give Cons

Gives try 100 percent free and granted to you or your online business centered to the quality and you may qualification. When someone tells you to pay a little commission to have a great protected large grant size (award), that is never a legit offer. Do not mistake which with purchasing a grant-list services such GrantWatch.com, for which you shell out a registration payment to gain access to an entire list.

Give Software

Their agent or mortgage manager may also have suggestions to possess regional grant programs. Start by researching some homeownership applications provided by local otherwise condition houses government. These types of programs usually are earliest-day family customer offers and you can reduced-interest financing.

- So it low-repayable grant try flexible, enabling recipients to utilize the funds beyond only down costs and you may settlement costs.

- You’ll discover qualification direction and you will assets requirements in the program’s online brochure.

- Normal criteria were becoming a first-day family consumer, a great credit history, and you can lowest so you can modest earnings, even when particular laws are very different.

This choice provides the advantage of enabling you to be an excellent homeowner with minimal initial will set you back. You can repay the mortgage at the an afterwards phase if the financial predicament might possibly be more comfortable. The new DHCD also offers first-time home buyers that have low to help you modest revenues assistance with its advance payment and you will settlement costs with their Family Pick Guidance System, labeled as HPAP. The newest Tx Property and you can Finance Authority will bring worthwhile help basic-go out homebuyers in the form of deposit assistance has and you may next mortgages. This type of apps allow it to be easier for Tx properties which have modest and you can low revenues to buy a house. Whether or not you might have fun with the finest game from the developers for free or not, would depend mainly for the incentives available with the internet gambling enterprises your have fun with.

When you’re a recently available graduate, OHFA also offers a good dos.5percent or 5percent assistance mortgage to afford down payment and settlement costs. That it mortgage are forgiven once five years if you do not refinance, disperse, otherwise promote your home. The program has lots of options and you may laws, therefore have a look at the facts on the internet site.

The newest Company from Veterans Points backs the newest Va mortgage, offered to customers as the repaired- or variable-rates mortgage loans throughout 50 claims. System qualifications means a 620 credit score, a great 50percent debt-to-income proportion, and customers need meet with the definition of a first-day house client. Conventional 97 is actually a step three-per cent off antique home loan to own homebuyers who aren’t lower- and average-earnings earners. The applying is usually called the Simple 97 LTV, which is shorthand to own a good “simple traditional 97percent loan-to-really worth financial”. Home You’ll be able to means eligible buyers for a good 660 credit score if you are making it possible for as much as fiftypercent DTI.

Extra Provides GrandX Video slot

Let a home loan business pre-accept your home loan and provide you with guidance. Home loan banks and you may agents wear’t matter mortgages with deferred mortgage payments. Where you should find an excellent deferred home loan is by using a good civil regulators otherwise regional basis, which could matter deferred mortgage loans inside the number to 25,100000. Bucks gives is actually low-repayable presents so you can earliest-day home buyers to aid pick their earliest house. HomeReady try a good step 3-per cent down payment financial that provides reduced mortgage rates and lower financing prices for reduced- and you may reasonable-money home buyers. First-day customer apps build homeownership opportunities to the fresh customers.

Pros DPA

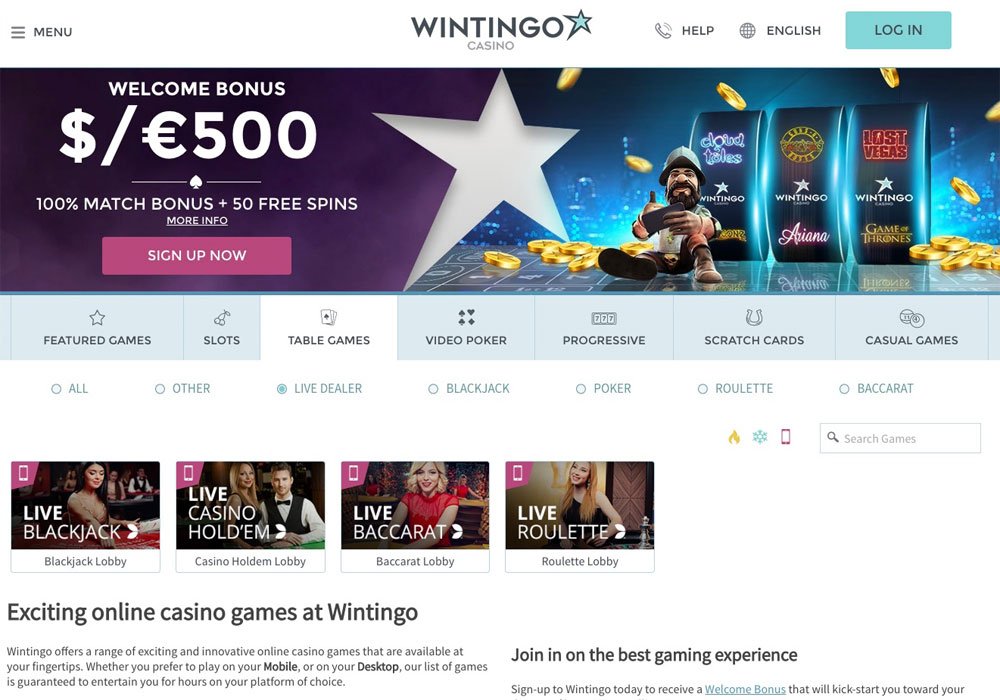

GrandX Local casino are owned by Alpache OÜ and contains projected profits surpassing step 1,one hundred thousand,100 a-year. Which sets it as a tiny in order to medium-size of internet casino in the bounds of our categorization. So far, you will find gotten just six user ratings of GrandX Gambling enterprise, that is why so it casino doesn’t have a person satisfaction get yet ,. The new rating try calculated as long as a gambling establishment features obtained 15 or even more reviews. The reviews submitted from the profiles can be found in the newest ‘User reviews’ part of the web page. A patio created to showcase our very own perform aimed at bringing the sight away from a better and more clear online gambling industry to help you reality.