Household guarantee loans is an intelligent replacement for playing cards and personal financing to have property owners. Obtaining a property equity financing from inside the Louisiana allows you to use your home security to borrow cash.

While finding tapping into your own residence’s guarantee , Griffin Funding might help. Find out about family security finance and just how you can expect competitive domestic guarantee mortgage costs for the Louisiana.

Focusing on how a home collateral mortgage performs is an essential earliest step before you apply for a financial loan. House guarantee fund enables you to use the equity in your domestic since the security to take out that loan, providing quick access to cashflow to possess emergency costs, major systems, plus.

Household guarantee and you will HELOC costs into the Louisiana are less than charge card and personal loan interest rates, and thus a property equity financing could easily become a great method for individuals who want to combine personal debt otherwise enhance their earnings from the a lower rate.

Really lenders makes it possible to borrow to 95 percent of the collateral you have got of your home, though some lenders set the newest limitation at 85 per cent. In order to sign up for that loan making use of your house’s security, your generally speaking must have at the least 15 or 20% equity. Family security mortgage symptoms essentially are priced between four so you’re able to forty years, providing more time to settle the loan. Yet not, make an effort to pay the loan in full if you thinking about selling your residence.

Usually, you will have to promote W-2s and tax statements when you’re applying for a home collateral mortgage. But not, the zero doctor house guarantee mortgage also offers an option getting worry about-working somebody.

Particular Home Collateral Financing

There are two main top form of family guarantee money, one another offering distinctive line of benefits and drawbacks. Before you apply for a financial loan, think about your financial predicament and make sure you might be opting for that loan that fits your circumstances.

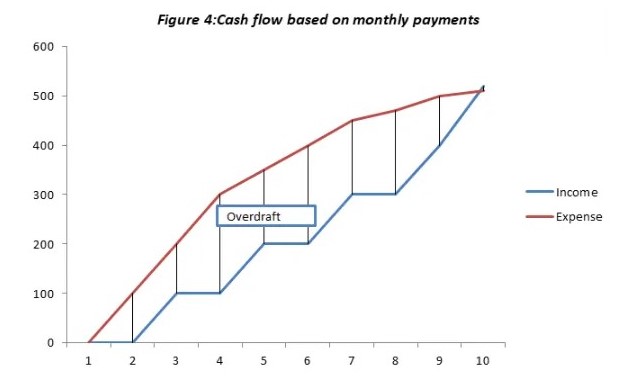

A property guarantee credit line (HELOC) enables you to unlock a personal line of credit making use of your residence’s collateral due to the fact collateral. Your own financial offers a having to pay restrict predicated on your own house’s well worth and you can equity, as well as an adjustable interest. Since the HELOC rates within the The latest Orleans changes frequently plus purchasing may vary, HELOC monthly installments commonly normally may include month to month.

As an alternative, a house security financing (HELOAN) is essentially a timeless protected financing using your residence’s guarantee while the security. You obtain a predetermined interest rate and you may a single lump sum payment payment, along with a predetermined mortgage term. Your commission may be the exact same monthly and you’re going to be protected from ascending interest levels.

You can find advantages to each other HELOCs and you can HELOANs. It depends on the financial situation and how you may be having fun with your money. If you are planning with the taking out a beneficial HELOC, you need to be aware that you will want to finances your bank account to help you end overspending.

Benefits and drawbacks of Louisiana Domestic Security Money

Before taking aside a house collateral mortgage , you should know your options and look at the advantages and you will disadvantages out-of Louisiana house guarantee fund. And factoring into the HELOAN and HELOC rates in Baton Rouge, you will find some positives and negatives to take into consideration.

- You can easily get access to money you want to own an urgent situation or unanticipated expenses

- Griffin Funding offers aggressive mortgage pricing on the top land, 2nd residential property, and you may money characteristics

- You can preserve your own low-rate first-mortgage when you’re obtaining a home security loan

- The loan can be used for one thing – and increasing your home’s well worth compliment of renovations

- You could eradicate your house if you’re unable to pay back your domestic security financing

- Taking right out a home guarantee loan increases your overall debt burden

- HELOCs can lead to overspending when the utilised without a monetary package

If you are considering using a charge card or unsecured loan to help you finance a giant enterprise otherwise pay scientific expenses, a home security mortgage could possibly get confirm a far greater solution. Domestic guarantee finance bring competitive rates and you can extended loan episodes than just extremely credit cards and private financing, causing them to a beneficial tool to possess people who wish to raise their funds move.

Louisiana Home Collateral Mortgage Qualification Conditions

Lenders have a look at particular standards to find out if you qualify for a property security mortgage in the Louisiana. Understanding what loan providers pick can help you satisfy qualification requirements to start with. Here you will find the around three most significant products:

- As a general rule, loan providers require you to keeps 20% collateral to qualify for a home collateral loan. A decreased domestic collateral requisite you can find is generally fifteen percent.

- We in addition to glance at the credit history and you can personal debt-to-money ratio each and every applicant just before granting programs. A high credit score and you will lower personal debt-to-earnings ratio makes it better to be eligible for a home equity financing.

- Just be sure to provide proof of fast home loan repayments into the during the last and additionally proof of income. For people who seem to skip mortgage repayments otherwise your income is not enough, you do not qualify for financing.

Unsure whether or not your qualify for a house security financing for the Louisiana? Get in touch with the group at the Griffin Money today to discuss your qualifications. You’ll be able to download this new Griffin Gold software to compare the financing choices, score personalized mortgage advice, and you can accessibility wise cost management equipment to evolve debt better-are.

Submit an application for a house Equity Loan from inside the Louisiana

House guarantee funds would be a useful money if you use all of them responsibly. Cannot obtain more than you can afford to settle and create a spending budget for those americash loans Nassau Village Ratliff who choose a property security distinct borrowing. If you repay the loan punctually, you may enjoy the flexibility that is included with good Louisiana home security mortgage.

From the Griffin Financial support, we understand trying to get fund should be a hassle – that is why i ensure it is simple. What you need to would are fill out an internet software or call us to apply for property security mortgage. If you would like bucks to have scientific costs otherwise family home improvements, you could potentially make an application for a home equity mortgage having Griffin Financial support today.