Score timely decisioning.

- Thought how long you plan to reside in your property

- Assess your tolerance getting you can easily rates increases

- Decide to reason for closing costs

- Just remember that , a larger deposit get indicate quicker monthly obligations later

Well-known Reasonable Home loan

Simple and available choice with minimal upfront will set you back. Generate a down payment as low as step three% and prevent individual home loan insurance costs. 3

Mortgage listing.

To keep date in your application, you could begin assembling your documents and pointers in advance. Access our helpful printable record to acquire become.

Find my personal nearest department or Atm

step one Every money is actually susceptible to borrowing feedback and acceptance. Pricing, system fine print differ from the county and therefore are susceptible to alter with no warning.

2 The latest HomeReady Program is actually a subscribed signature off Federal national mortgage association. Federal national mortgage association isnt associated with Well-known Financial. Most system facts arrive towards the Fannie mae website. Consumers need certainly to see HomeReady qualifications and you will qualification standards, and you can discover mortgage recognition. Debtor income should be less than 80% regarding area meridian earnings (AMI) as laid out of the Federal national mortgage association. A good step three% downpayment and you will home loan insurance are expected. First-big date homeowners will need to over a beneficial homebuyer education movement. The latest HomeReady Program is additionally designed for refinances.

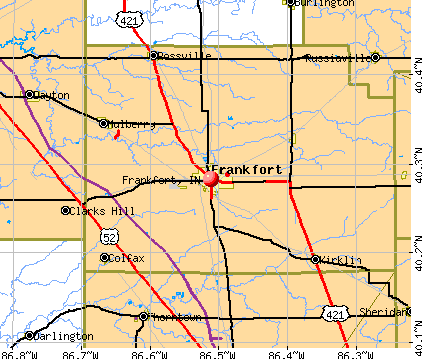

3 The favorite Sensible Home loan is designed for the purchase out-of a first house possessions discovered inside the Well-known Lender review urban area. Earnings restrictions apply and you may an excellent homebuyer education way needs. Most of the home financial loans are at the mercy of borrowing and property recognition. Pricing, system fine print try subject to changes with no warning. Never assume all items are found in all of the claims or even for all quantity. Most other restrictions and you can limits incorporate.

cuatro Consumers need to meet Government Financial Lender Homebuyer Fantasy and you will/otherwise Homebuyer Dream Also eligibility and you will certification criteria. Subject assets must be inside a famous Lender discussed testing city. Your family need meet up with the money assistance established in the Homebuyer Fantasy recommendations having an entire domestic money out-of 80% or less than of your own city median money on the county for the which the household becoming bought is positioned, adjusted having house proportions.

5 The HomeFirst Down payment Recommendations System information arrive within New york Institution out-of Property Conservation and you can Invention site. Consumers have to see HomeFirst qualification and you can certification conditions. Individuals need to be a first-date homebuyer and done good homebuyer knowledge path. Borrower income must be lower than 80% off city median money (AMI) while the determined by the new You.S. Company off Construction and Metropolitan Innovation (HUD). Good step three% advance payment is required. Area Houses Features of new York Urban area, Inc. (NHSNYC) administers the York Town Department of Houses Preservation and you will Development’s HomeFirst Down payment Advice Program.

6 The borrowed funds Origination Commission Waiver was a beneficial waiver of one’s Bank’s if you don’t simple origination payment and that’s only available to your agency products and portfolio things so you can agencies limits to own residential mortgages (purchases and you will refinances) where home is a holder-filled priily, a condominium, otherwise a cooperative assets types of), situated in Common Bank’s assessment area, and discovered within this a majority fraction census system (MMCT) Other limitations and you online loans Blue Springs, AL will limitations could possibly get use.

For new York Borrowers: Prominent Financial is managed of the Ny Service off Financial Qualities (NYDFS). So you can document an issue get in touch with Nyc State department away from Monetary Characteristics Consumer Guidance Product at 1-800-342-3736 otherwise when you go to the Department’s site in the dfs.ny.gov. Popular Lender will get make use of 3rd party companies to help you solution your own financing however, stays responsible for the actions drawn by third people.

To find out more out of charge to own mortgages and household equities serviced from the Prominent Bank, excite discover the Residential Financial and you may Home Security Tool Maintenance Charge right here. Doesn’t connect with mortgages maintained because of the Common Home loan Services. For information about charges for Common Mortgage Qualities accounts, please sign in to your account.

New york Customers: Common Bank provides code supply attributes in Foreign language. Please note you to Well-known Bank enjoys customer care options to cam that have a realtor when you look at the Foreign-language. Preferred Bank’s code accessibility attributes is restricted to spoken correspondence that have a realtor inside the Foreign-language. Prominent Lender cannot offer all other language accessibility attributes from inside the Foreign language (and other language) and you can, specifically, will not bring translations of every documents inside Language (or any other language).

A translation and you may description away from aren’t-utilized debt collection terms and conditions is available in several dialects with the New york Agencies off Consumer Affair’s web site,

Delight never show your Well-known account details which have anyone. Popular will never cost you their code as a consequence of email, social networking otherwise a third-team website. Get the full story.