But if 10,000 pages are printed, each page carries only 0.55 cents of set-up cost. The difference between fixed and variable costs is essential to know for your business’s future. After that, selling and administrative expenses are subtracted to find net income. In contrast, the variable costing statement segments costs by variable expenses and fixed expenses. The importance of absorption costing extends beyond mere compliance with accounting standards; it shapes how companies perceive their costs and profits. It also plays a critical role in inventory management, potentially affecting an organization’s financial health and operational strategies.

1: Absorption Costing

It is also known as a managerial account used to cover all expenses made on a particular product. Therefore, an absorption cost includes all direct and indirect costs, including labor, rent, insurance, etc. Absorption costing considers all fixed overhead as part of a product’s cost and assigns it to the product. ABC costing assigns a proportion of overhead costs on the basis of the activities under the presumption that the activities drive the overhead costs. Instead of focusing on the overhead costs incurred by the product unit, these methods focus on assigning the fixed overhead costs to inventory. You can calculate a cost per unit by taking the total product costs / total units PRODUCED.

Please Sign in to set this content as a favorite.

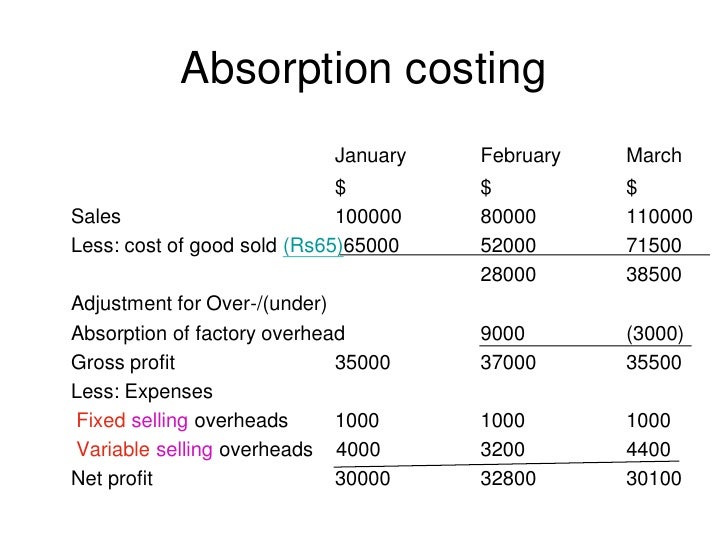

Indirect costs are typically allocated to products or services based on some measure of activity, such as the number of units produced or the number of direct labor hours required to produce the product. Once you have the cost per unit, the rest of the statement is fairly easy to complete. This includes sales, cost of goods sold, and the variable piece of selling and administrative expenses. The traditional income statement, also called absorption costing income statement, uses absorption costing to create the income statement. This income statement looks at costs by dividing costs into product and period costs.

What are the Advantages of Absorption Costing?

Consequently, Absorption Costing is alternatively called Total Cost Method and Full Costing. Production is estimated to hold steady at \(5,000\) units per year, while sales estimates are projected to be \(5,000\) units in year \(1\); \(4,000\) units in year \(2\); and \(6,000\) in year \(3\). This means that we now need to remove the effect of over-absorbing $40000, which can be done simply by subtracting it from the cost of sales. But the actual number of manufactured units is 170,000, so we simply have to multiply the manufactured units by $8 to get $1360,000 as the cost of manufactured goods. Therefore, it is necessary to analyse and evaluate the pros and cons of the process and then decide whether it is suitable for the business. The company management should use it with diligence and responsibility so as not to create any negative effect in the decision making process.

Example of Absorption Costing

In 2024, the Securities and Exchange Commission (SEC) issued its highly anticipated climate change disclosure rules. Our publication provides some key disclosure and reporting reminders for upcoming filings and summarizes the SEC’s rulemaking and other activities that affect financial reporting. Disclose expense reimbursements included in any relevant expense captions such as those reimbursed under shared research and development contracts. Any reimbursements may be presented in the tabular format as a separate line item or net within the relevant expense category with separate disclosure.

New Accounting Standards Upcoming Effective Dates for Public and Private Companies

- Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost.

- This means that every cost must be included at the end of an inventory and is usually done as an asset on the balance sheet.

- Instead of focusing on the fear and anger, she started her accounting and consulting firm.

- Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills.

If production doubles, rent is now allocated at only $0.05 per unit, leaving more room for profit on each sale. Absorption costing stands as a cornerstone in the field of accounting, pivotal for its role in financial reporting and strategic what is accounts payable definition, job description and software decision-making. This method’s significance is underscored by its widespread application across various industries and its influence on tax calculations. The question only gave us the 170,000 manufactured units and 140,000 sold units.

Let us understand the concept of absorption costing equation with the help of some suitable examples. Absorption costing results in a higher net income compared with variable costing. A relevant expense caption is one that is presented on the face of the income statement and includes any of the expenses listed above.

Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline. For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike. A business is sometimes deliberately structured to have a higher proportion of fixed costs than variable costs, so that it generates more profit per unit produced.

Tax authorities typically require that inventory costs include both fixed and variable production costs, which aligns with the principles of absorption costing. This requirement ensures that expenses are not prematurely deducted for tax purposes, thereby deferring tax liabilities to the period when the inventory is actually sold. The deferral of tax payments can be advantageous for cash flow management, allowing businesses to utilize funds that would otherwise be paid in taxes for other operational needs or investments. Generally, absorption costing has to do with situations that affect the manufacturing costs of companies. It includes all product costs, which are both fixed and manufacturing product costs.

This can complicate operational decision-making, particularly in industries where cost control and pricing flexibility are crucial for competitiveness. Absorption costing leads to more accurate product costs than variable costing, which only includes direct costs. However, absorption costing depends heavily on cost estimates and output assumptions. In summary, absorption costing provides a full assessment of production costs for inventory valuation, while variable costing aims to show contribution margin and provide internal reporting. Most companies use absorption costing for external financial reporting purposes. The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead costs).