Revolutionizing Healthcare Management Through Advanced Third-Party Administration

The healthcare landscape in the United Arab Emirates has undergone remarkable transformation over the past decade, establishing new benchmarks for insurance administration and medical service delivery. As individuals and organizations seek reliable healthcare coverage solutions, the demand for professional third-party administrators who can efficiently manage complex insurance operations has grown exponentially. These specialized entities serve as vital intermediaries, connecting policyholders with healthcare providers while ensuring smooth claims processing and comprehensive customer support throughout every stage of the healthcare journey.

Comprehensive Coverage Solutions for Modern Healthcare Needs

Choosing the right lifeline insurance solution requires careful consideration of coverage scope, provider accessibility, and administrative efficiency. Modern health insurance extends far beyond basic hospitalization coverage to encompass preventive care, wellness programs, chronic disease management, and emergency medical services. The complexity of contemporary healthcare demands administrators who possess deep industry knowledge, technological sophistication, and unwavering commitment to customer satisfaction. Quality insurance administration ensures that policyholders receive timely approvals for medical procedures, transparent explanations of coverage benefits, and consistent support when navigating the healthcare system. This comprehensive approach transforms insurance from a financial product into a genuine healthcare partnership.

Extensive Provider Networks Ensuring Accessible Healthcare

A robust lifeline network list forms the foundation of effective health insurance administration, connecting members with carefully vetted healthcare facilities across multiple jurisdictions. These networks encompass multi-specialty hospitals, outpatient clinics, diagnostic laboratories, dental centers, optical services, and pharmacy chains throughout the Gulf region. Strategic provider partnerships enable cashless treatment options, eliminating the financial burden of upfront payments and lengthy reimbursement cycles. Network administrators continuously evaluate facility credentials, monitor service quality, and negotiate favorable rates that benefit both policyholders and insurance companies. The geographical distribution of network providers ensures that members can access quality medical care whether they reside in metropolitan centers or smaller communities across the emirates.

Leading Insurance Administration Services in the Emirates

Professional TPA insurance Dubai services have become instrumental in supporting the emirate’s vision of world-class healthcare accessibility. Dubai’s cosmopolitan environment demands insurance solutions that accommodate diverse cultural backgrounds, multiple languages, and varying healthcare expectations. Third-party administrators operating in Dubai leverage cutting-edge technology platforms that integrate artificial intelligence, machine learning, and data analytics to streamline operations and enhance decision-making accuracy. These technological capabilities enable real-time eligibility verification, instant pre-authorization approvals, and digital claims submission through mobile applications. The regulatory environment in Dubai requires administrators to maintain strict compliance with Dubai Health Authority guidelines while implementing international best practices in healthcare management and data security.

Strategic Collaborations with Insurance Industry Leaders

Successful third-party administration relies on strong collaborative relationships with insurance carriers who recognize the value of specialized operational expertise. Haya insurance collaborations demonstrate how administrators and insurers create synergistic partnerships that optimize resource allocation and improve service delivery. Insurance companies entrust administrators with critical functions including member enrollment, provider credentialing, claims adjudication, and fraud detection, allowing insurers to concentrate on underwriting, product innovation, and risk management. These partnerships leverage the administrator’s established infrastructure, experienced workforce, and proven processes to achieve operational excellence. The shared commitment to member satisfaction and cost containment creates alignment between administrators and insurers, resulting in sustainable business models that benefit all stakeholders in the healthcare value chain.

Advanced Technology Driving Operational Excellence

Modern claims management systems process thousands of transactions daily with remarkable speed and precision, utilizing sophisticated rule engines that automatically evaluate claims against policy provisions and medical necessity criteria. These intelligent systems flag potential fraud patterns, identify duplicate claims, and ensure accurate payment calculations while maintaining detailed audit trails for regulatory compliance. Customer engagement platforms provide policyholders with unprecedented transparency through online portals where members can view coverage details, track claim status, locate network providers, and access digital insurance cards. Mobile applications extend these capabilities to smartphones, enabling members to submit claims by photographing receipts, consult telemedicine providers, and receive push notifications regarding authorization approvals. This digital transformation enhances convenience while reducing administrative costs and processing timeframes.

Customized Insurance Plans for Every Requirement

Healthcare needs vary significantly across different population segments, necessitating flexible plan designs that accommodate diverse budgets and coverage preferences. Corporate insurance programs serve employees ranging from entry-level staff to executive management, with tiered benefit structures reflecting organizational hierarchies and compensation philosophies. Small and medium enterprises benefit from cost-effective group plans that provide essential coverage without excessive premium burdens. Individual and family policies offer customization options allowing policyholders to select deductibles, copayment levels, and coverage extensions based on personal health profiles and financial considerations. Specialized plans address unique requirements such as maternity coverage, dental and optical benefits, mental health services, and chronic condition management programs that provide ongoing support for diabetes, hypertension, and other long-term health issues.

Commitment to Transparency and Ethical Practices

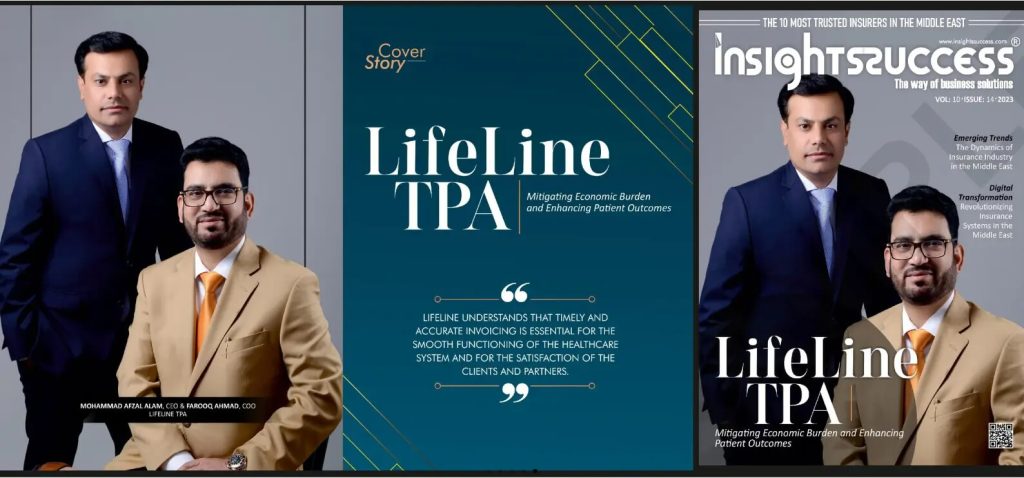

The foundation of successful insurance administration rests upon transparent communication, ethical conduct, and unwavering commitment to member welfare. Lifeline TPA operations exemplify these principles through clear policy documentation, honest disclosure of coverage limitations, and proactive member education regarding benefit utilization. Dedicated customer service teams provide multilingual support around the clock, ensuring that members receive assistance regardless of time zones or language preferences. Comprehensive fraud prevention programs protect the integrity of insurance pools through sophisticated data analytics that identify suspicious billing patterns, unnecessary treatments, and fraudulent provider behavior. Regular training programs ensure that staff members remain current with medical terminology, insurance regulations, and emerging healthcare trends. Quality assurance initiatives including member satisfaction surveys, claims audit programs, and service level monitoring drive continuous improvement across all operational areas, maintaining high performance standards that distinguish exceptional administrators from mediocre competitors.

The healthcare industry continues advancing through medical innovation, digital transformation, and evolving consumer expectations. Third-party administrators who embrace change, invest in technology, and prioritize member experience will shape the future of healthcare access across the region, contributing to healthier populations and more efficient healthcare systems that deliver value to individuals, employers, and society.Retry