The Mexico Flat Glass Market Size is a significant component of the country’s construction and automotive industries, valued at approximately USD 1,090.11 million in 2023. With a projected CAGR of 4.2% from 2024 to 2032, the market is expected to reach USD 1,460.35 million by 2032. This growth is driven by robust demand across residential, commercial, and industrial applications, particularly within the construction and automotive sectors.

Key Benefits of Flat Glass in Mexico

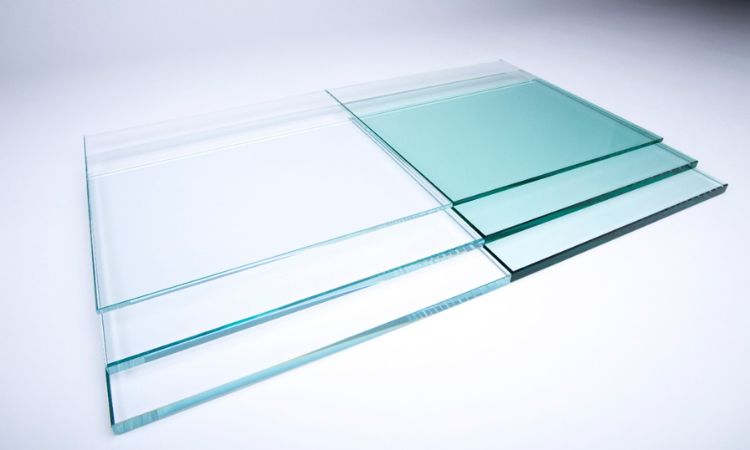

- Versatility: Flat glass is used in a wide array of applications, including construction, automotive, electronics, and renewable energy.

- Environmental Sustainability: With increasing awareness of environmental concerns, flat glass is preferred for its recyclable nature and energy-efficient properties, especially in buildings.

- Aesthetic Appeal: The use of flat glass provides an aesthetic appeal, allowing architects and designers to implement modern designs with natural light.

- Energy Efficiency: Flat glass contributes to energy savings by reducing heat transfer and maintaining thermal insulation, making it ideal for green building projects.

Key Industry Developments

The flat glass industry in Mexico has seen several notable developments in recent years:

- Increased Investments in Renewable Energy: The Mexican government has been actively promoting renewable energy sources, encouraging the use of solar panels. This has increased demand for photovoltaic glass, a type of flat glass used in solar panels.

- Technological Advancements: Companies are investing in advanced production technologies to produce high-quality glass with greater energy efficiency and durability.

- Growth in Construction Sector: Mexico’s construction industry, supported by government infrastructure projects, is driving the demand for flat glass in commercial and residential buildings.

- Automotive Industry Growth: Mexico’s automotive manufacturing industry is a significant driver of flat glass demand, particularly for safety and windshield glass.

Driving Factors

- Expanding Construction Sector: The construction industry in Mexico is growing due to urbanization and infrastructure projects, increasing demand for flat glass for windows, facades, and other applications.

- Automotive Manufacturing Hub: Mexico is a key player in the global automotive industry, with flat glass being essential for vehicle production.

- Rising Renewable Energy Initiatives: The Mexican government’s focus on renewable energy, especially solar power, has led to a rise in demand for solar glass.

- Technological Advancements: Advancements in manufacturing processes have improved the quality and efficiency of flat glass, making it more appealing for various applications.

Restraining Factors

- High Production Costs: The manufacturing process of flat glass is energy-intensive and requires substantial capital investment, which can limit growth.

- Availability of Substitutes: Other materials, such as plastics and polymers, are being used as substitutes for glass in certain applications, impacting demand.

- Environmental Regulations: Stringent environmental regulations related to glass manufacturing processes pose challenges to producers.

Market Segmentation

By Product Type

- Tempered Glass: Widely used in construction and automotive industries for its strength and safety features.

- Laminated Glass: Preferred in automotive and architectural applications due to its safety properties.

- Insulated Glass: Commonly used in buildings for energy efficiency and noise reduction.

- Others: This category includes various specialized glass products such as coated, patterned, and solar glass.

By Application

- Building and Construction: The largest application segment, driven by residential and commercial building projects.

- Automotive: Includes windshields, windows, and sunroofs in cars and other vehicles.

- Solar Energy: Photovoltaic glass used in solar panels for renewable energy projects.

- Others: This includes applications in electronics, decorative glass, and mirrors.

Market Outlook

With continued investments in infrastructure, growth in automotive manufacturing, and rising interest in renewable energy, the Mexico flat glass market holds promising potential for growth. The adoption of energy-efficient building materials and increased awareness of sustainable practices are expected to drive demand for innovative flat glass solutions over the next decade.

Trends in the Mexico Flat Glass Market

- Rise in Solar Panel Installations: Growing interest in renewable energy has boosted the demand for photovoltaic glass in Mexico.

- Increased Demand for Energy-Efficient Glass: The need for energy-saving solutions has led to the adoption of insulated and low-emissivity glass in construction.

- Automotive Sector Innovations: Advances in automotive technology, including electric vehicles, are increasing demand for specialized glass products like laminated and safety glass.

Regional Analysis/Insights

Regional Insights

- Central Mexico: This region is a major hub for the automotive industry, with numerous manufacturers relying on flat glass for vehicle production.

- Northern Mexico: Proximity to the United States has spurred growth in the construction and automotive sectors, benefiting the flat glass market.

- Southern Mexico: Though less developed, this region is experiencing growth in infrastructure projects, increasing demand for construction glass.

Major Key Players

The Mexico flat glass market features several prominent companies, including:

- Vitro, S.A.B de C.V

- Saint Gobain S.A.

- Guardian Glass LLC

- AGC Inc.

- Nippon Sheet Glass Company Ltd.

- Others

Opportunities in the Market

- Rising Demand for Solar Energy: Growth in renewable energy projects presents opportunities for flat glass used in solar panels.

- Automotive Industry Expansion: As the automotive industry grows, so will the demand for flat glass products.

- Green Building Initiatives: There is a growing market for energy-efficient glass products driven by green building standards.

Challenges in the Market

- High Operational Costs: Energy-intensive manufacturing processes and rising energy prices can impact profitability.

- Competition from Substitutes: Materials such as polycarbonate are being used as substitutes in certain applications.

- Economic Fluctuations: Economic instability can affect demand in the construction and automotive industries.

Restraints

- Environmental Regulations: Compliance with stringent environmental standards can increase production costs and limit market expansion.

- Raw Material Prices: Fluctuating prices for raw materials, particularly silica sand, impact the overall cost structure.

Scope of the Mexico Flat Glass Market

The Mexico flat glass market encompasses a wide range of applications, including construction, automotive, electronics, and renewable energy. With growing demand in each of these sectors, the market’s scope is vast, offering various opportunities for companies to expand their product offerings and invest in sustainable solutions.