Buying property in Spain as an American is absolutely possible—but getting a mortgage for Americans in Spain comes with extra layers most other nationalities never see. FATCA, IRS reporting rules, U.S. compliance checks, and bank risk policies all play a role.

If you’re a U.S. citizen asking “Can Americans get a mortgage in Spain?”, the answer is yes—but only if you understand how Spanish banks view American clients and prepare correctly.

This guide explains Spain mortgages for U.S. citizens in full detail: eligibility, FATCA impact, documentation, banks that accept Americans, interest rates, LTV limits, timelines, and how to avoid delays.

Can Americans Get a Mortgage in Spain?

Yes. U.S. citizens can legally get a mortgage in Spain, whether resident or non-resident.

However, Americans are considered “high-compliance clients” by Spanish banks due to:

- FATCA obligations

- IRS reporting requirements

- Additional AML / KYC checks

This doesn’t block mortgages—but it reduces the number of banks willing to lend and increases documentation requirements.

Why Are Mortgages for Americans in Spain More Complicated?

The main reason is FATCA (Foreign Account Tax Compliance Act).

FATCA forces non-U.S. banks to:

- Identify American clients

- Report account details to the IRS

- Apply enhanced compliance checks

- Accept legal and operational risk

Some Spanish banks simply choose not to deal with this complexity.

FATCA Explained for U.S. Buyers in Spain

What Is FATCA?

FATCA is a U.S. law requiring foreign banks to report:

- Accounts held by U.S. persons

- Balances, income, and ownership details

- Identifying data (SSN, address, etc.)

How FATCA Affects a Spain Mortgage

- Fewer banks accept U.S. clients

- Slower onboarding and approval

- Extra declarations and forms

- Ongoing reporting after approval

This applies whether you’re buying property or just opening a bank account.

Do All Spanish Banks Accept American Clients?

No.

Spanish Banks Accepting U.S. Citizens

Some major banks do work with Americans, including:

- Santander

- BBVA

- CaixaBank (select branches)

- International or private banking divisions

Others avoid U.S. clients entirely due to FATCA risk.

Choosing the right bank is one of the most important steps Americans make.

Spain Mortgage for U.S. Citizens: Resident vs Non-Resident

Non-Resident Americans

Most U.S. buyers fall into this category.

Typical conditions:

- 60–70% LTV

- Higher deposit

- Fixed-rate preference

- Strong foreign income checks

Resident Americans

If you live and pay taxes in Spain:

- Slightly higher LTV possible

- Easier affordability assessment

- Still subject to FATCA

Residency helps—but does not remove FATCA compliance.

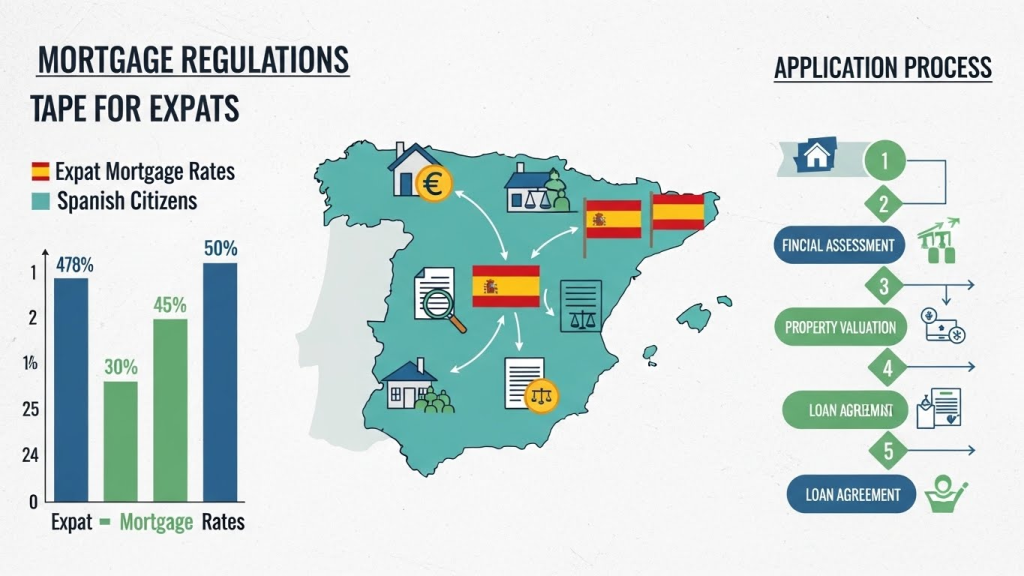

LTV for Americans in Spain (How Much Can You Borrow?)

LTV for U.S. Citizens Spain

- Non-residents: 60–70%

- Residents: up to 80% (case-by-case)

LTV is based on the lower of purchase price or tasación (valuation).

What Deposit Do Americans Need?

Plan for:

- 30–40% deposit

- 10–14% taxes and fees

Total cash: 40–50% of purchase price

Mortgage Interest Rates for Americans in Spain

Do Americans Pay Higher Rates?

Sometimes—but not always.

Rates depend on:

- Risk profile

- Income stability

- LTV

- Mortgage type (fixed vs variable)

Spanish mortgage rates for Americans are usually slightly higher than for EU residents but still competitive globally.

Always compare using TAE (Spanish APR), not just the headline rate.

Fixed vs Variable Mortgages for Americans

Fixed Rate Mortgages (Most Common)

- Stable payments

- No Euribor risk

- Preferred by banks for Americans

- Easier approval

Variable Rate Mortgages

- Euribor-linked

- Higher long-term risk

- Harder for U.S. citizens to obtain

- Less common for non-residents

Most Spanish banks strongly prefer fixed rates for Americans.

How Spanish Banks Verify U.S. Income

Spanish banks scrutinize U.S. income carefully.

Accepted Income Types

- W-2 salaried income

- 1099 contractor income

- Self-employed / business income

- Pension income

What Banks Check

- Income stability (2+ years)

- Consistency

- Currency risk (USD vs EUR)

- Tax compliance

Income may be discounted to account for exchange rate risk.

Documents Needed for Americans’ Mortgage in Spain

Expect more paperwork than EU buyers.

Core Documents

- U.S. passport

- NIE number (mandatory)

- Proof of address (U.S.)

- Bank statements (6–12 months)

- Tax returns (2–3 years)

- W-2 or 1099 forms

- Credit report (U.S.)

- Property details

- Signed purchase contract

Many documents must be:

- Translated into Spanish

- Apostilled (legalized)

Do Spanish Banks Check U.S. Credit Scores?

Yes—but not the same way U.S. banks do.

Spanish banks may:

- Review U.S. credit reports

- Request bank reference letters

- Assess overall financial behavior

They do not use FICO scores directly—but bad credit still matters.

Opening a Spanish Bank Account as an American

This step often causes delays.

FATCA Bank Account Requirements

- FATCA self-certification

- SSN disclosure

- IRS reporting consent

- Enhanced AML/KYC checks

Not all branches handle this smoothly—experience matters.

Do Americans Need a Spanish Bank Account for a Mortgage?

Yes—practically and legally.

A Spanish account is required to:

- Pay mortgage installments

- Pay taxes

- Cover notary and registry fees

- Manage utilities and community costs

Mortgage Approval Timeline for U.S. Buyers

How Long Does It Take?

Typical timeline:

- Bank onboarding + FATCA checks: 1–2 weeks

- Valuation (tasación): 1 week

- Mortgage approval: 3–5 weeks

Total: 5–8 weeks, sometimes longer for first-time U.S. clients.

Taxes Americans Pay When Buying Property in Spain

Upfront Taxes

- Transfer tax (resale) or

- VAT (new build)

- AJD tax (mainly new builds/mortgages)

- Notary + registry fees

Ongoing Taxes

- IBI (local property tax)

- Non-resident income tax

- Possible wealth tax (region-specific)

U.S. Tax Reporting: FATCA, FBAR & IRS Rules

Owning property in Spain does not eliminate U.S. reporting.

Americans may need to report:

- Spanish bank accounts (FBAR – FinCEN 114)

- Foreign financial assets (FATCA Form 8938)

- Rental income

- Capital gains on sale

This is separate from Spanish tax obligations.

Double Taxation: Spain vs USA

Spain and the U.S. have a double taxation treaty, but:

- Reporting is still required

- Credits must be claimed properly

- Mistakes are common without advice

Tax planning matters.

Why Spanish Banks Sometimes Reject U.S. Citizens

Common reasons:

- FATCA compliance cost

- Incomplete documentation

- Unstable 1099 income

- High DTI ratio

- Low deposit

- Branch inexperience with Americans

Rejection is often procedural, not financial.

How Americans Can Improve Mortgage Approval Chances

- Choose banks that accept U.S. clients

- Prepare FATCA documents early

- Use fixed-rate mortgages

- Keep LTV conservative

- Provide clean, well-organized income proof

- Work with professionals experienced with U.S. buyers

Preparation saves months.

Can Americans Buy Property in Spain Without Residency?

Yes.

Property ownership:

- Does not require residency

- Does not grant residency automatically

- Does create Spanish tax obligations

Mortgage eligibility is unrelated to residency status.

Need clarity on your mortgage options? Speak with a Tharros Brokers expert and get personalised guidance for your situation.

Conclusion

Getting a mortgage for Americans in Spain is not impossible—but it is different.

FATCA, IRS reporting, and compliance rules mean:

- Fewer banks

- More documents

- Longer timelines

But with the right preparation, bank selection, and expectations, U.S. citizens regularly and successfully obtain Spanish mortgages.

The key is understanding the system before you enter it—not learning the hard way after delays or rejections.

FAQs: Mortgages for Americans in Spain

Can a U.S. citizen get a mortgage in Spain?

Yes. Both resident and non-resident Americans can.

Which Spanish banks offer mortgages to Americans?

Major banks like Santander and BBVA, plus select private banking divisions.

How does FATCA affect mortgages in Spain?

It increases compliance checks and reduces the number of willing banks.

What LTV do Americans get in Spain?

Typically 60–70% for non-residents.

Do Americans pay higher mortgage rates in Spain?

Sometimes slightly higher, reflecting compliance and currency risk.