All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. It is an accounting method that allows companies to show their earnings and balance sheets more favorably than they would be if they were using one of the other methods. A fiscal year is a 12-month period ending in any day throughout the year, for example, April 1 to March 31 of the following year. Because, the electricity expense was for the month of March even if the bill has been received and paid in April. The chemical manufacturing company supplies detergent and other cleaning chemicals to the cleaning services company. For instance, in the United States, many companies operate on an October 1st to September 30th fiscal year to align with the federal government’s fiscal year.

Time Period Assumption: Time Period Assumption: GAAP s Framework for Reporting Frequency

Timely information is very important when making investment decisions and predicting possible outcomes of business operations in the succeeding accounting periods. From the perspective of financial analysts, the time period assumption can introduce distortions if not carefully managed. They must consider the impact of one-off events, seasonal variations, and the timing of transactions when analyzing performance. For example, a retailer may experience the majority of its sales during the holiday season, and quarterly reports may not accurately reflect its annual performance.

Accrual Basis of Accounting

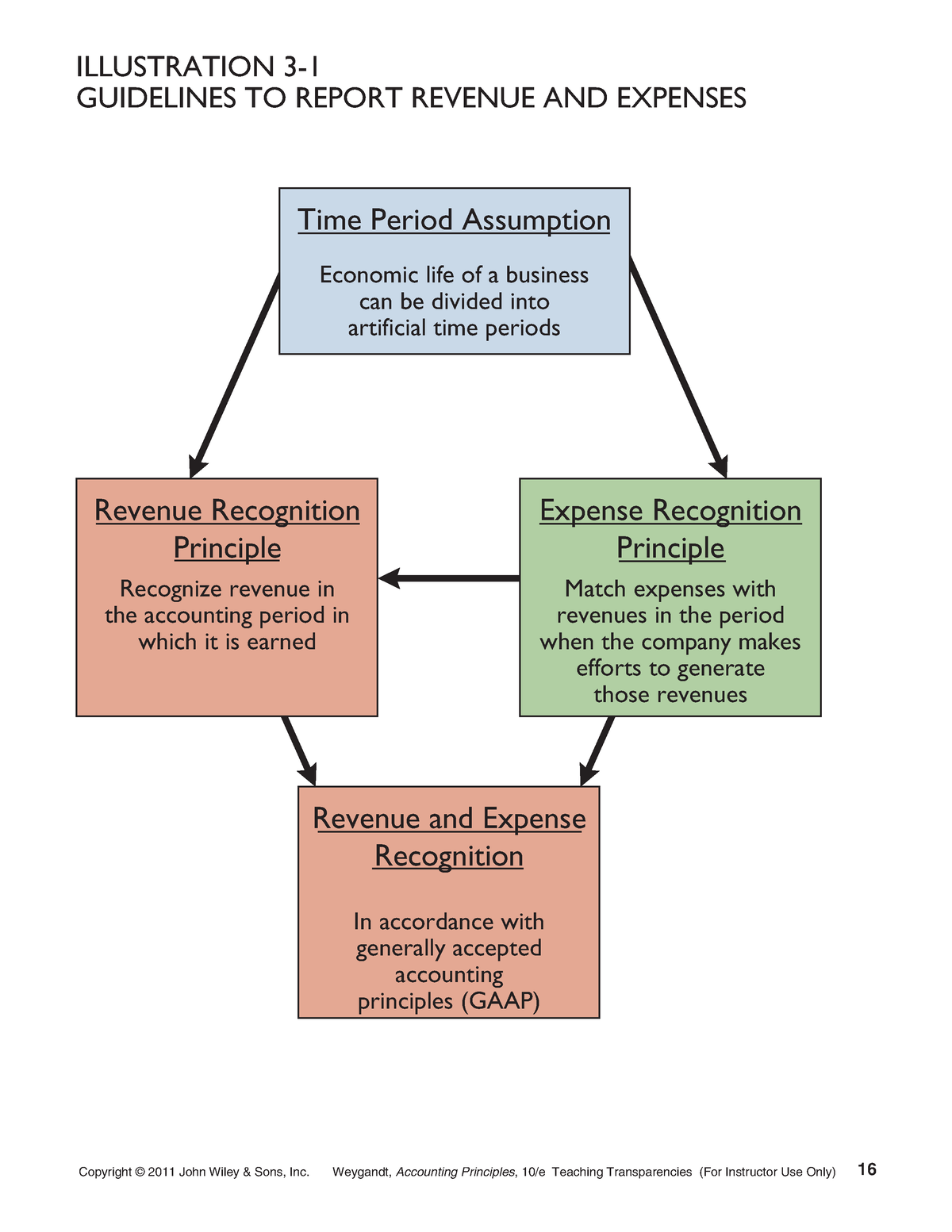

This assumption is crucial as it provides a structured framework for reporting, analyzing, and comparing financial information over specific periods. By adhering to this assumption, companies can offer stakeholders timely and relevant financial data, which is essential for informed decision-making. If you do not divide time into specific periods, it will be difficult for your accountant to separate transactions that occurred in different time periods. Furthermore, if your business transactions are not recorded in different time periods, it will not be possible to compare transactions against each other, or to measure the business position and other financial aspects. This information is very important for internal management, actual and potential investors, creditors, government agencies and other users of financial statements to decide what to do and what not to do in future. calculate the debt service coverage ratio facilitates the provision of latest, relevant and reliable financial information to the relevant parties to make reliable business decisions in a timely manner.

Which of these is most important for your financial advisor to have?

While cash accounting may be simpler, it lacks the nuance and foresight provided by accrual methods. The choice between these two approaches depends on the specific needs and regulatory requirements of the business in question. A fiscal year, often abbreviated as FY, is a one-year period that companies and governments use for accounting purposes and preparing financial statements. It’s a convention that underpins the time period assumption in accrual accounting, which states that economic activity can be divided into discrete time periods. This assumption is crucial because it enables businesses to measure performance in a consistent and comparable manner.

- It is an accounting method that allows companies to show their earnings and balance sheets more favorably than they would be if they were using one of the other methods.

- It allows for the comparison of financial results across different periods, highlighting trends and areas for improvement.

- This provides a consistent valuation method that investors can compare over time and across different companies.

- Company publishes the financial statement every year after they are audited by an independent auditor.

- For example, managers may be tempted to defer expenses or accelerate revenue recognition to meet short-term financial targets, potentially leading to ‘earnings management’ or even fraudulent reporting.

Although, a single month financial statement shows a far less accurate picture of the business compared to an annual financial statement. You may want to try using one method for all of your financial reporting or only change the time frame when it makes sense, like if there is a significant difference between revenues and expenses during certain months. It’s best to try different methods to see your company’s information when making financial reporting decisions. The general concept of the time period principle assumes that all businesses can divide their financial activities into artificial time periods.

Great! The Financial Professional Will Get Back To You Soon.

According to the time period assumption, the company would recognize revenue each month as the service is provided, not just when the contract is signed or when payment is received. This method ensures that the revenue is matched with the period in which the service was actually performed, providing a clearer picture of the company’s financial activities during that time. Auditors face the challenge of verifying that the time period assumption has been consistently applied. They must ensure that the financial statements provide a true and fair view of the company’s financial performance and position for the specified period. This can be particularly challenging in industries where long-term contracts are common, such as construction or research and development.

For example, managers may be tempted to defer expenses or accelerate revenue recognition to meet short-term financial targets, potentially leading to ‘earnings management’ or even fraudulent reporting. From the perspective of financial analysts, the Time Period Assumption is crucial for trend analysis and forecasting. It allows them to compare performance across similar periods, identifying patterns and anomalies that may indicate opportunities or risks. Auditors, on the other hand, rely on this assumption to perform timely and relevant checks on financial statements, ensuring that they reflect the company’s financial status within a specific timeframe. Businesses and other economic entities record transactions and compile them using different accounting bases that best suit their preferences and needs.

Understanding the nuances of fiscal years is essential for interpreting financial statements, making informed business decisions, and ensuring compliance with regulatory requirements. The fiscal year is more than just a period on the calendar; it’s a strategic tool that can influence a company’s financial narrative and operational tactics. By breaking down the fiscal year and grasping its implications from various perspectives, stakeholders can gain deeper insights into a company’s financial health and prospects. It is one of the fundamental accounting principles that apply to both cash-basis and accrual-basis accounting, as well as its variants.

The time period assumption in GAAP ensures that information is presented in a consistent and comparable manner, facilitating better decision-making for all stakeholders involved. Accounting rules and principles were created over time as the practice of accounting matured and developed through usage. They exist both to promote the accuracy and faithfulness of financial statements and to create a common basis of understanding that facilitates communication between accountants and end users. What accounting rules and principles are being used in the accounting basis has enormous implications for financial statements, though some rules are so common as to be universal or almost universal. According to the time period assumption, the company should recognize revenue evenly over the subscription period.