I dunno. Many of us create just that insurance firms a mortgage and you can expenses to possess old-age. Precisely the day level differs.

I think specific concept of concerns has to get into this IMO. For those people that cannot manage to only pay it, we must earn some possibilities – any $ spent on the latest students knowledge are $ a new comer to fund all of our retirement.

* Do we has fairly sufficient to own retirement with many unknown shield? – If yes, then it’s an optimisation problem of tips invest. – If not following how do we intend to loans retirement?

There are a good zillion mortgage alternatives for university however, except that an other financial, I don’t find loads of right up until passing financing heading? Have always been We shed anything??

Make your self the fresh recipient and you may visit to pension once the a great scholar. Frequently some around the world schools meet the criteria. Perhaps a semester during the water!

I am wondering simply when it turned a hope getting a grandfather to fund their children’s school expenses? Simply ten-15 years back whenever i is actually getting my personal training, that has been a luxurious that not absolutely all college students got readily available.

Aren’t college loans, pell offers, part-date services and you can you’ll scholarships and grants a far greater contract, total, than simply leveraging ones family security to attempt to reach for college or university costs?

Merely curious exactly how many diehards paid down her way (otherwise a majority of their individual ways) using college or university and need its people to express one character-strengthening feel.

NateH penned: I’m questioning only if it became a hope having a father to pay for the youngsters’ university expenses? Merely 10-fifteen years in the past as i are making my education, that has been a deluxe that never assume all children got readily available.

Aren’t student education loans, pell gives, part-big date operate and you can it is possible to grants a better package, overall, than leveraging ones domestic equity to try loans Hillcrest Heights and grab university expenditures?

Just thinking exactly how many diehards paid off her ways (or a majority of their own means) compliment of university and require their people to share with you you to profile-building feel.

In my opinion you could attack mothers in any event. often these include spoiling the high school students which have economic outpatient care and attention otherwise these are typically that have high school students they cannot pay for.

my personal parents was indeed underneath the poverty range and you will provided $0 on my BS and you can PhD. once they was in fact millionaires, they’d features cheerfully paid off my personal method. individuals which get fucked will be middle-income group.

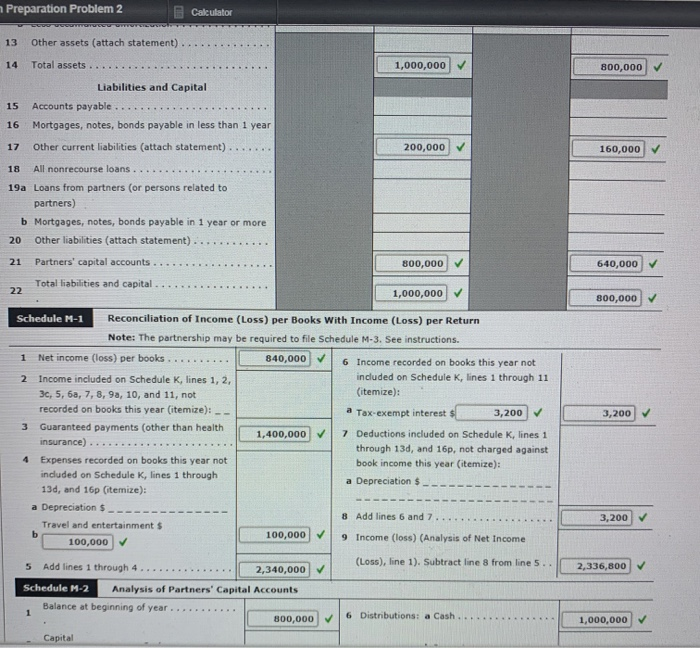

Family Equity

Helot’s got it right. This is a taxation deferred ecosystem, plus it do not need to be used getting his very own high school students studies..Provides tax-free progress now. worry about effects later. There are ways out of 529’s in the long run.

Knob Enjoying School Girls

My buddy stated he was offered bringing a property guarantee financing out of $50,000 and transferring it in the an effective 529 arrange for their young man.

I really don’t select the circumstances particularly appealing. Credit currency from the six. % and expenses it for an seven season months hoping to earn an income higher than the eye paid back looks most risky.

Just what state you? Whenever you had sufficient collateral, might you think like a financial investment plan for a baby just like the not in favor of an 8 year-old?

I would personally in the course of time do that HELOC way of maximum out ROTHs (and this we don’t have the capacity to perform today) as opposed to fund 529s for our step three and you may 6 year-old.

ROTHs very first after that 529s. It’s got drawn me a while to make to which strategy. Helot, you may want to perspective so it toward friend. Possibly, he or she is maxing his ROTHs currently, I don’t know.